10 Tips For Successful Long Term Investment Ashika Group Blog

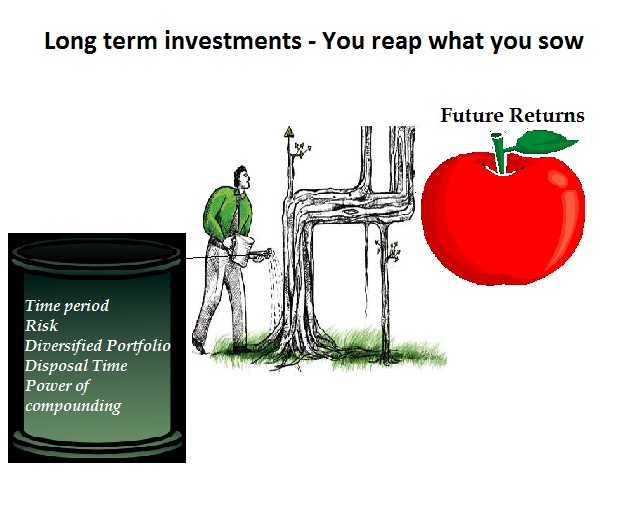

Long Term Investment Plans For Growing Your Money

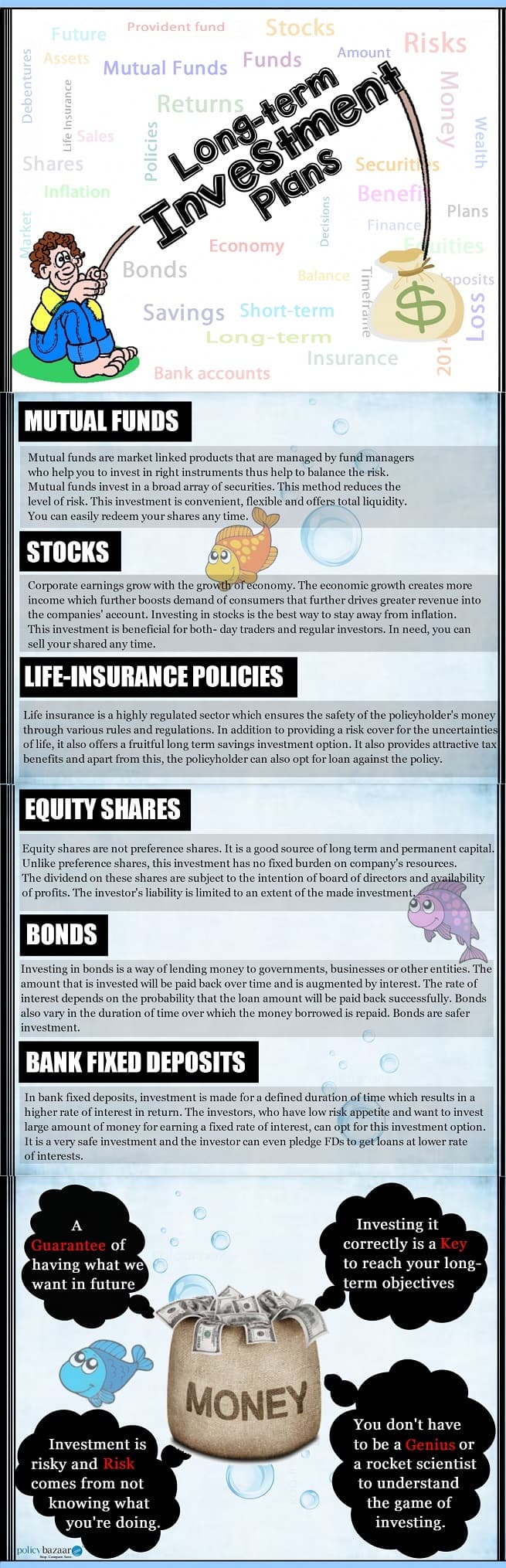

Examples of Long Term Investment to Start Your Journey

Someone making a long term investment 2416341 Vector Art at Vecteezy

Image Gallery Long term Investment

Why is long term investment important

Long Term Investment Options Finance Dais

Long Term Investment For Young Adults DG Institute

Top 6 Long Term Investment Options

Short Term and Long Term Investments Which Is Right For You LifeHack

What are the Long Term Investment Plans Offering High Returns in India

Long term investment Protective Sheild for Future Safety

Five Key Principles for Long Term Investment Strategies

Long Term Investment Definition Types amp Strategies

Long term investment vs short term investment

Best Long Term Investment Stocks to Buy in India StockBasket

Long Term Investments Factors Strategies and Options WealthDesk

Long Term vs Short Term Investment Which is Better

Short Term vs Long Term 6 Advantages and Disadvantages of Short Term

Best Long Term Investment Stocks to Buy in India StockBasket

Long Term Investments Factors Strategies and Options WealthDesk

Long Term vs Short Term Investment Which is Better

Short Term vs Long Term 6 Advantages and Disadvantages of Short Term

Infographic The Best Long Term Investment is Mortgage Blog

Long Term Investment A Listly List

Long Term Investment A Strategy to Earn Maximum Return at Minimum Risk

9 lo i h 236 nh u t d 224 i h n t t nh t cho th 225 ng 10 n m 2021 VTrade

7 Best Long term Investment Options in India Finance amp Taxation Tips

Long term investment icon simple element from Vector Image

What s the best long term investment strategy

WHY LONG TERM INVESTING IS THE BEST INVESTMENT STRATEGY Long term

best long term investment Fintrakk

Long term investment vs short term investment

Are Index Funds Good for Long Term Investment TradeVeda

How Do Short Term Investments and Marketable Securities Differ

best short term investments Choosing Your Gold IRA

The Significance of Long term Investment Strategies Affluence Funds

5 tips for long term investment

Tips for Long Term Investment Concept Benefits Strategies amp more

Long Term Investment YouTube

Best Long Term Investment Windermere North

How to Choose Between Long Term and Short Term Investments A Deep Dive

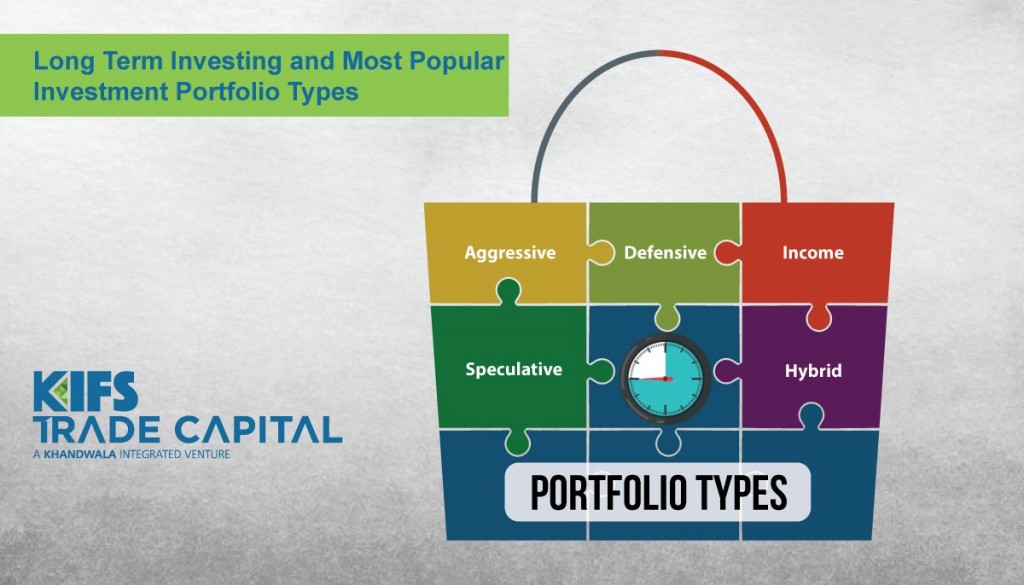

Long Term Investing and Most Popular Investment Portfolio Types KIFS

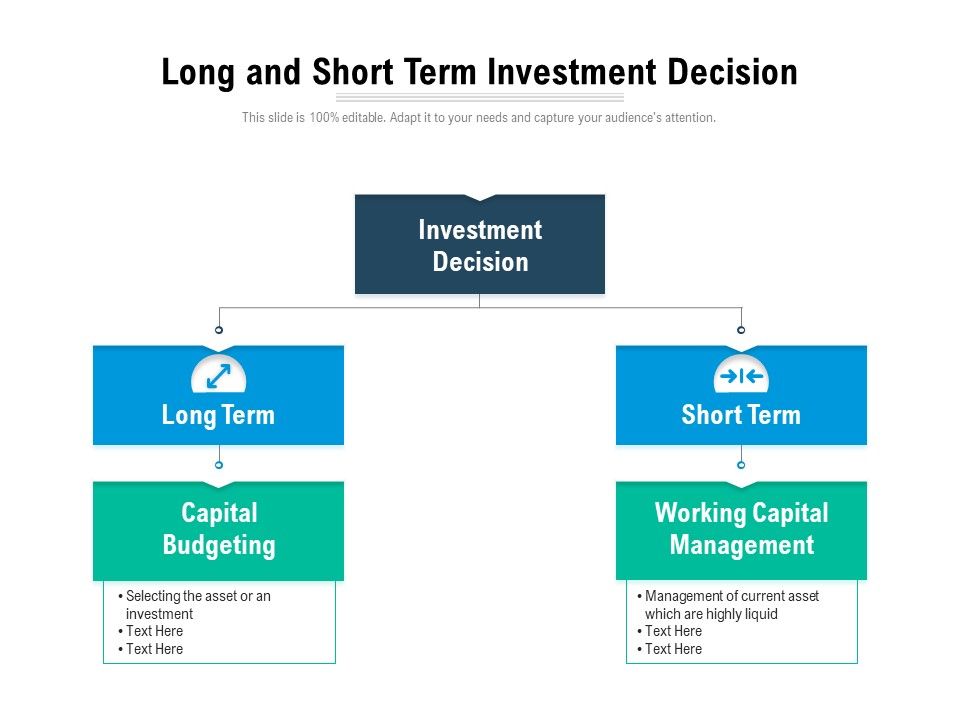

View Investment Decision Is PNG invenstmen

Understanding Long Term Investment Plans Complete Guide

How To Plan For A Long Term Property Investment

Best Long Term Investments Making the Most with Your Money

Short Term vs Long Term Investing What s the Difference TheStreet

Examples of Long Term Investment to Start Your Journey

Short Term vs Long Term Investment

What Is the Difference Between Long Term and Short Term Investments

Long term investments when are they the best choice Tendercapital

The Long Term Investing Guide to Compounding Wealth YouTube

Best Long Term Investments for Lasting Financial Success Tasteful Space

Best Long Term Investment Plans with High Returns 2024 PolicyBachat

Investments Short vs Long Term Investing Step Up Financial

5 Benefits of Long Term Investments For Financially Sound Future

Benefits Of Staying Invested In Long Term Piggy Blog

Why Long Term Investing Isn t Always Better Than Short Term Trading

6 Best Long term Investment Options You Should Know Techolac

Are Index Funds Good for Long Term Investment TradeVeda

What Defines A Long Term Investment Check All That Apply How long

How long is long term investment

The Finance Section Helping you understand the often complicated

13 Best Long Term Investments NEW Strategies for 2022

5 tips for long term investment

Top 10 Long Term Investment Options in India

ACG Investment Management LLC Why Invest in Long Term Investment

Long Term Investments Options Strategy Plan And Examples

Long term investment strategies should be made keeping this fact in

8 Best Long Term Investment Opportunities 2021 Grow Your Wealth and

PPT Long Term Investment Decisions PowerPoint Presentation free

Long Term Investment Strategies List of Best Long Term Investment Tips

Long Term Word Vs Short Better Results Longer Later Investment M Stock

What Is Long Term Investment - The pictures related to be able to What Is Long Term Investment in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/GettyImages-1134479990-693d67f6ce7d4f619618b93b1c887fa8.jpg)