TSMC Sets Up for Soaring Chip Demand Semiconductor manufacturing

TSMC revenue rises but downturn begins to bite The Register

Ranking The 10 Biggest TSMC Competitors

TSMC Share Price Drops To Record Low As Rival Takes Chipmaking Lead

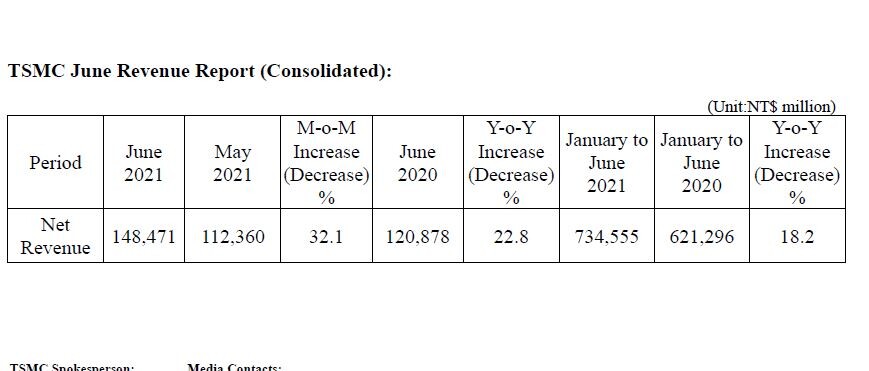

TSMC posts record revenues for September and 3Q21

TSMC 5nm Plant Production Hit By Polluted Oxygen No quot Significant

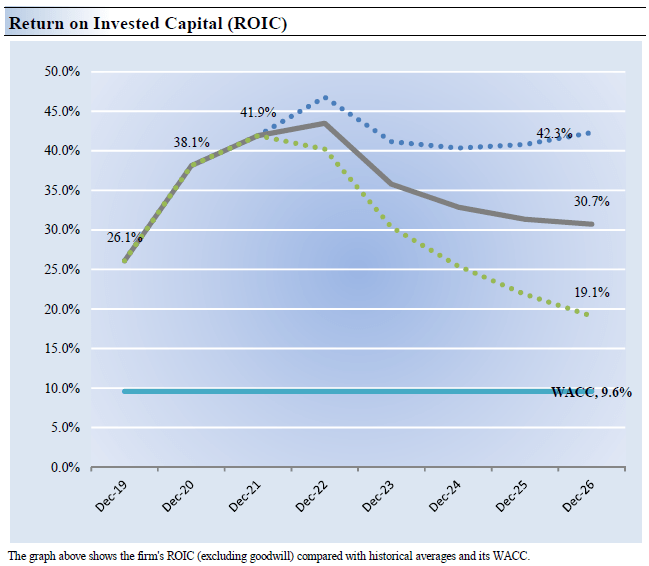

TSMC NYSE TSM Faces Uncertainty on CAPEX as the Fallout From

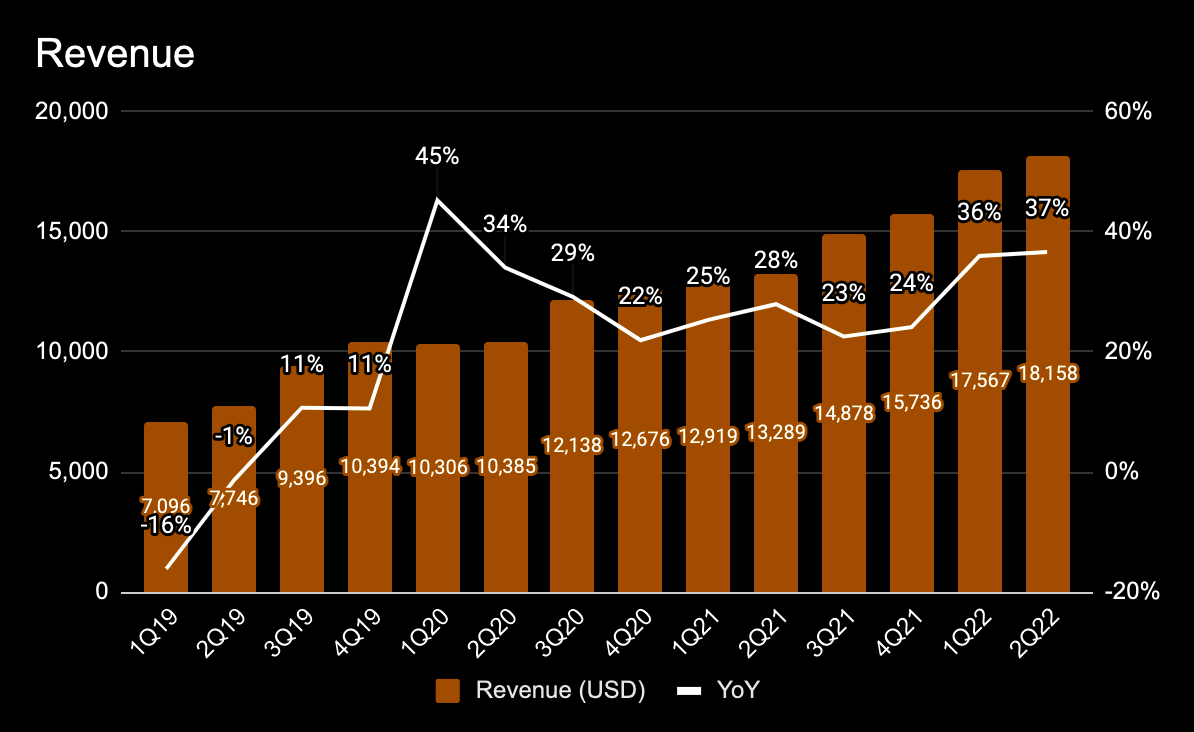

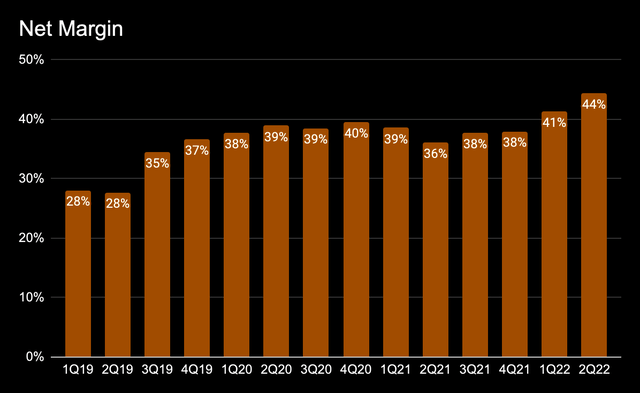

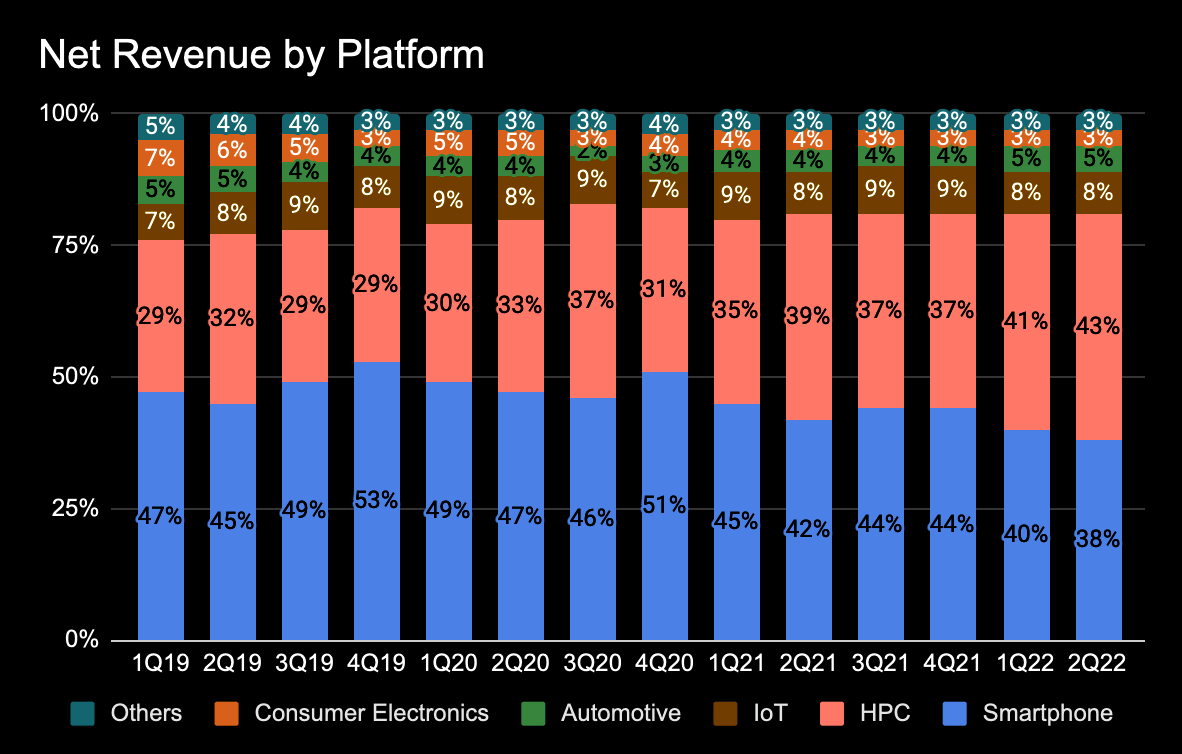

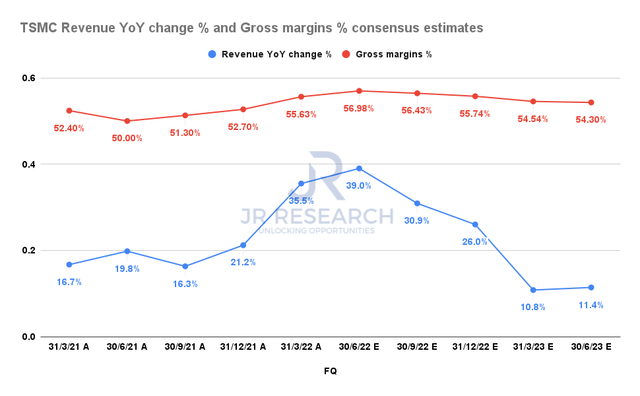

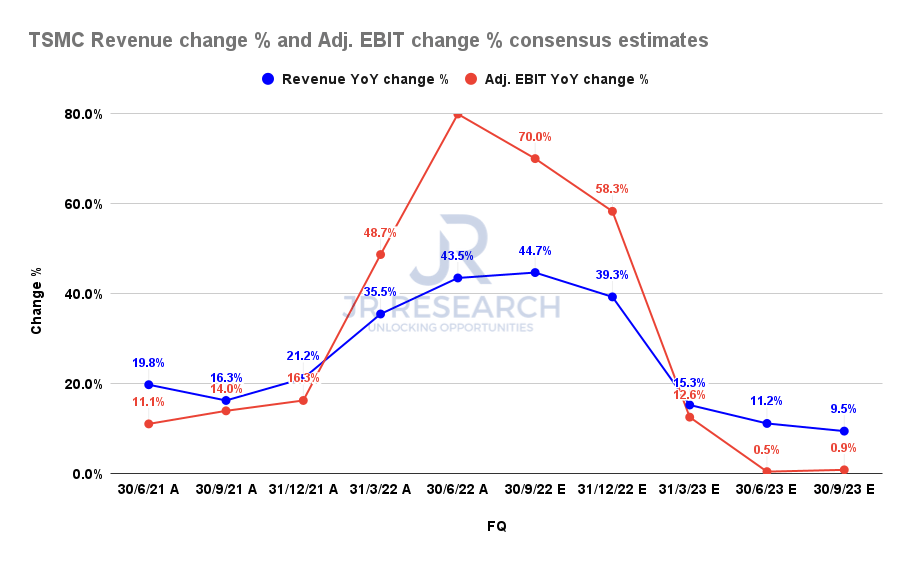

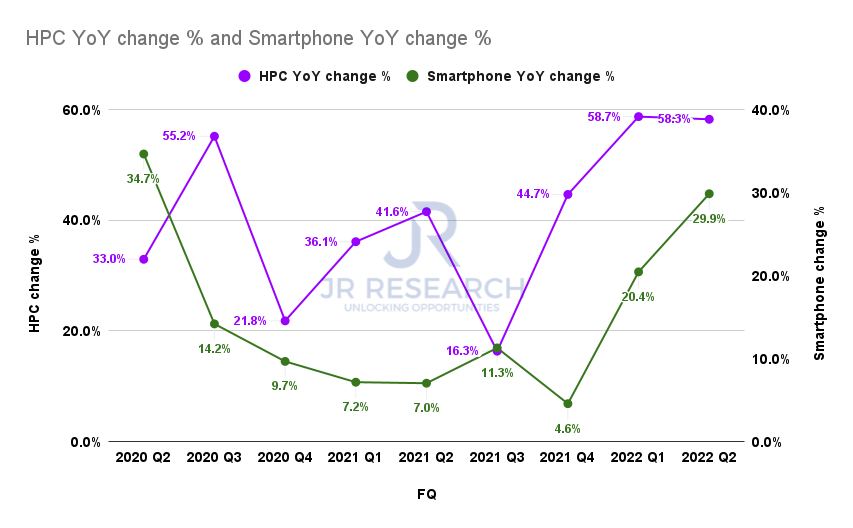

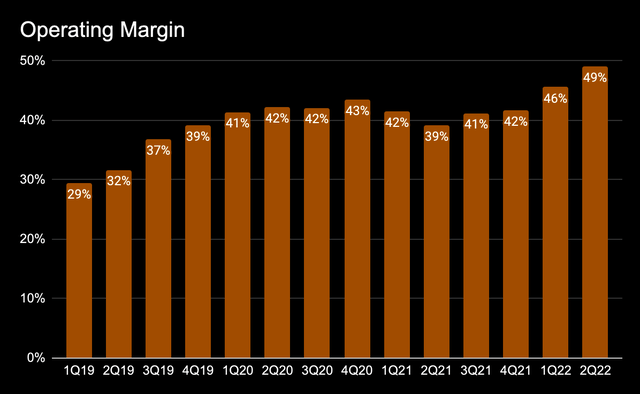

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

Tsmc Adr Stock Post Business Us Stocks Apple And Microsoft Led The

TSMC s NOV18 revenue reach NOWnews

Will TSMC Be a Semiconductor Chip Winner The Grey Rhino

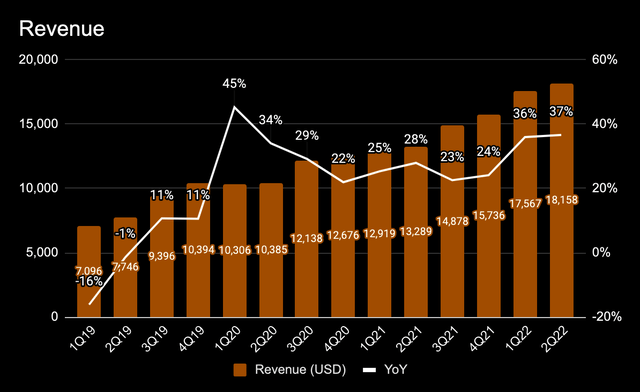

TSMC Reports 20 Growth in Revenue Year over Year TechPowerUp

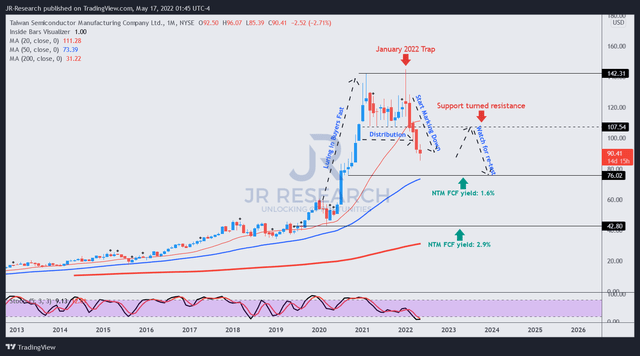

TSMC We Were Wrong More Pain Coming NYSE TSM Seeking Alpha

TSMC Posts First Revenue Drop in Nearly Four Years Trandy Newz

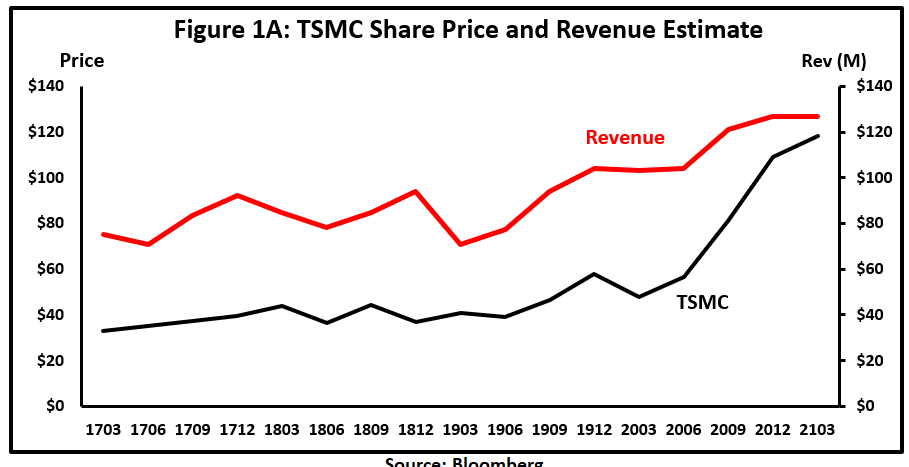

Tsmc Stock Below you will find the price predictions for 2021 2022

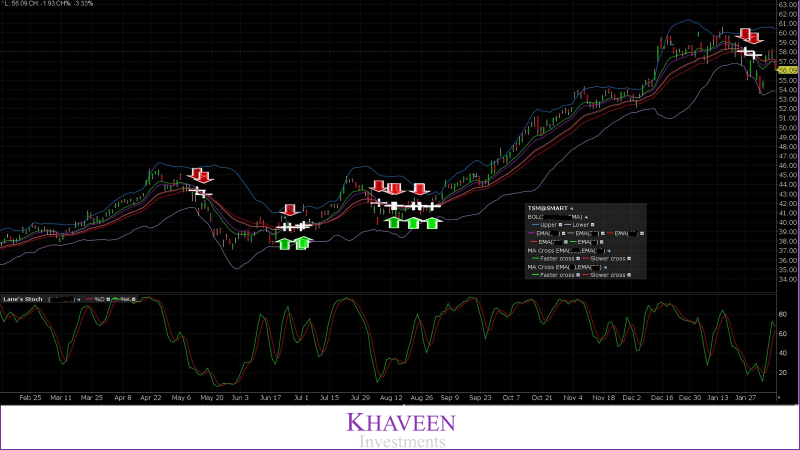

TSMC Stock Don t Worry About The Political Risk Buy This Rally NYSE

TSMC and ASML Demand for Chips Remains Strong But Getting Fab Tools

TSMC We Were Wrong More Pain Coming NYSE TSM Seeking Alpha

TSMC Stock Don t Worry About The Political Risk Buy This Rally NYSE

University of Minnesota eliminates four men s sports facing massive

TSMC s NOV18 revenue reach NOWnews

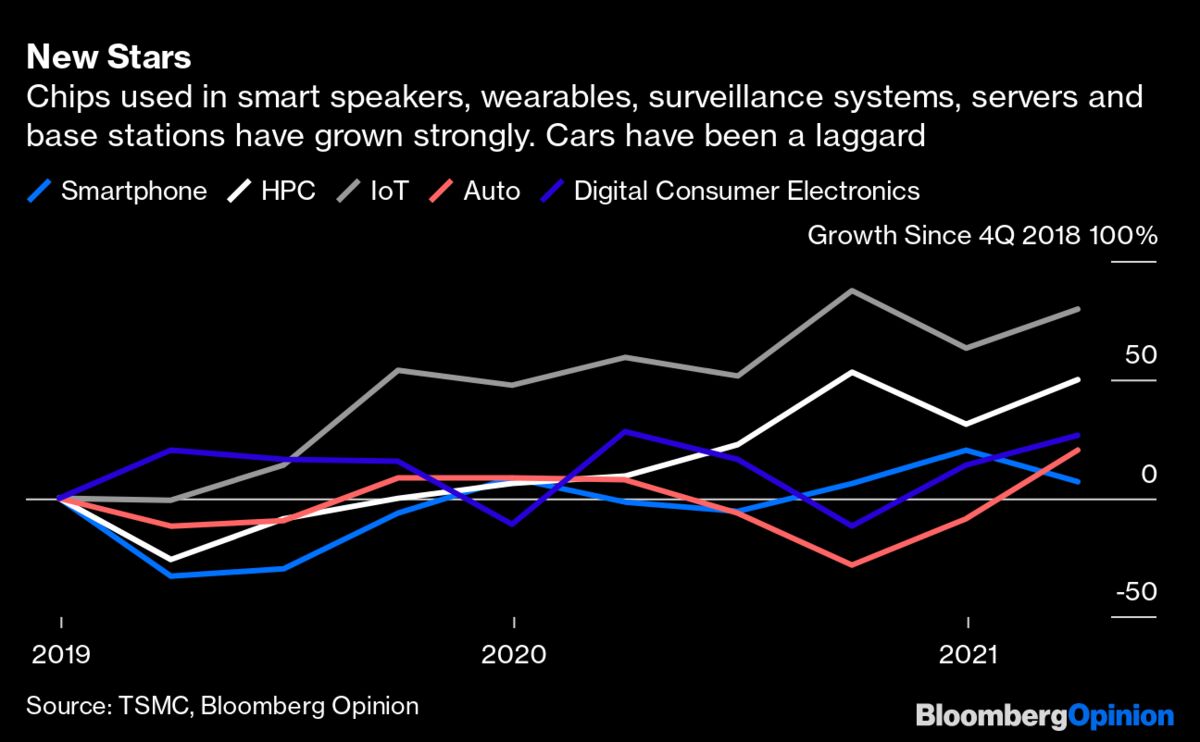

Will TSMC Be a Semiconductor Chip Winner The Grey Rhino

TSMC Reports 20 Growth in Revenue Year over Year TechPowerUp

TSMC We Were Wrong More Pain Coming NYSE TSM Seeking Alpha

TSMC Posts First Revenue Drop in Nearly Four Years Trandy Newz

Tsmc Stock Below you will find the price predictions for 2021 2022

TSMC Stock Don t Worry About The Political Risk Buy This Rally NYSE

TSMC and ASML Demand for Chips Remains Strong But Getting Fab Tools

TSMC We Were Wrong More Pain Coming NYSE TSM Seeking Alpha

TSMC Stock Don t Worry About The Political Risk Buy This Rally NYSE

University of Minnesota eliminates four men s sports facing massive

TSMC posts over 10 revenue decline in March

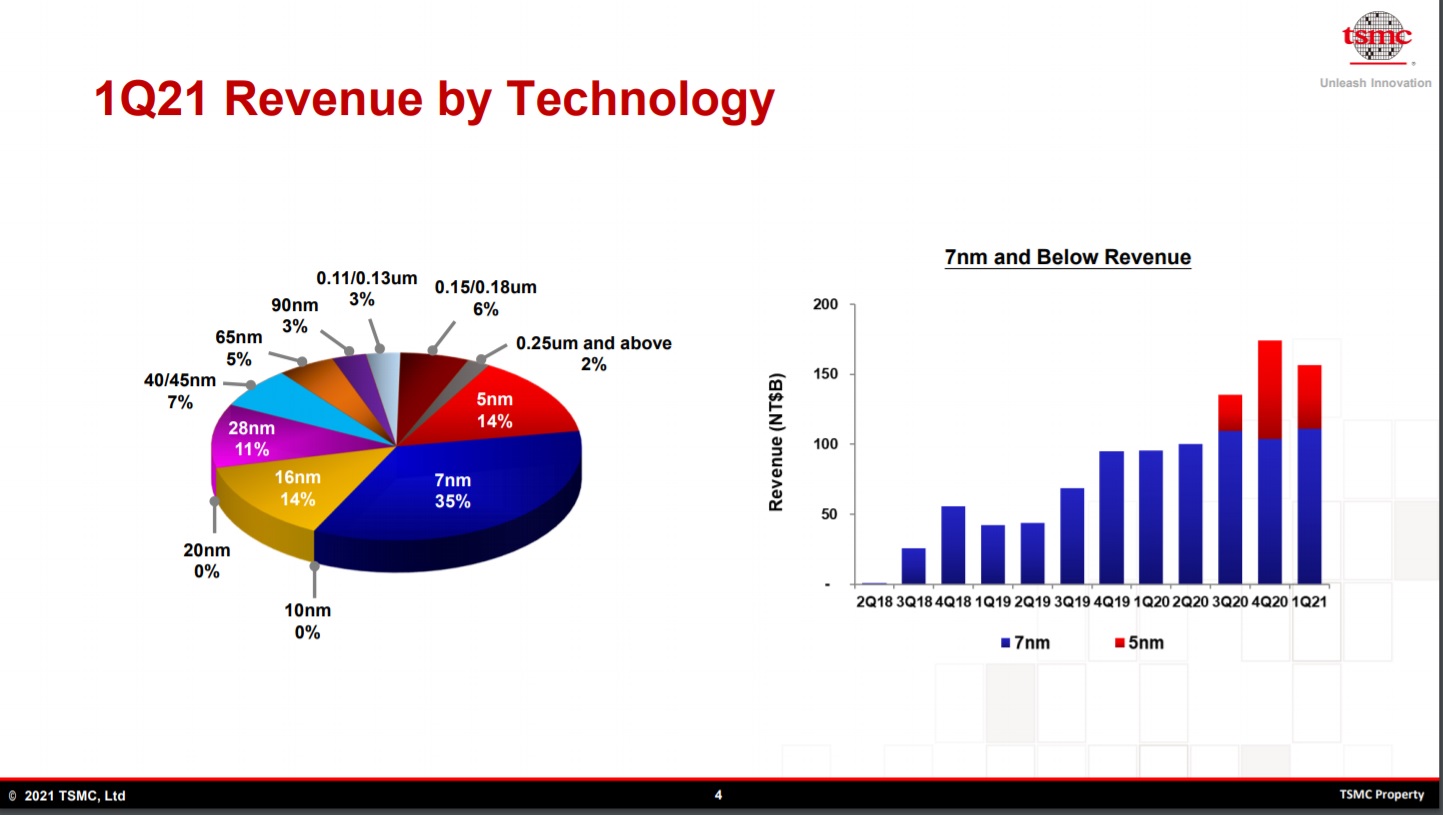

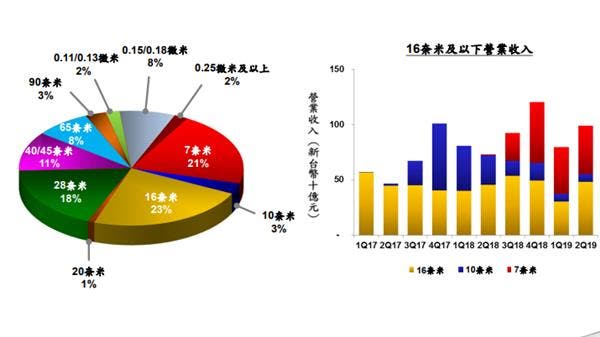

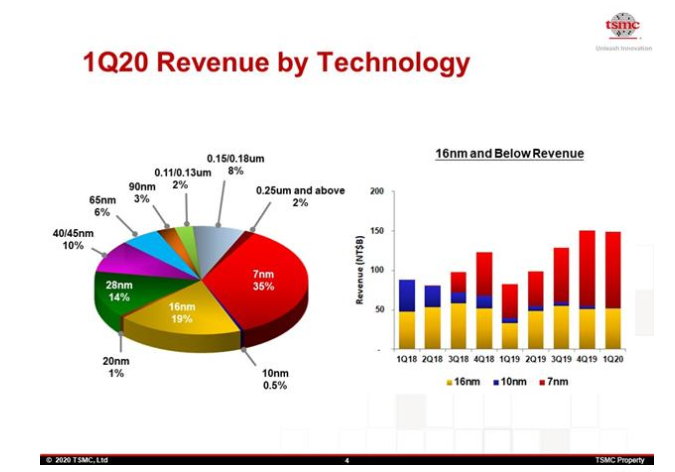

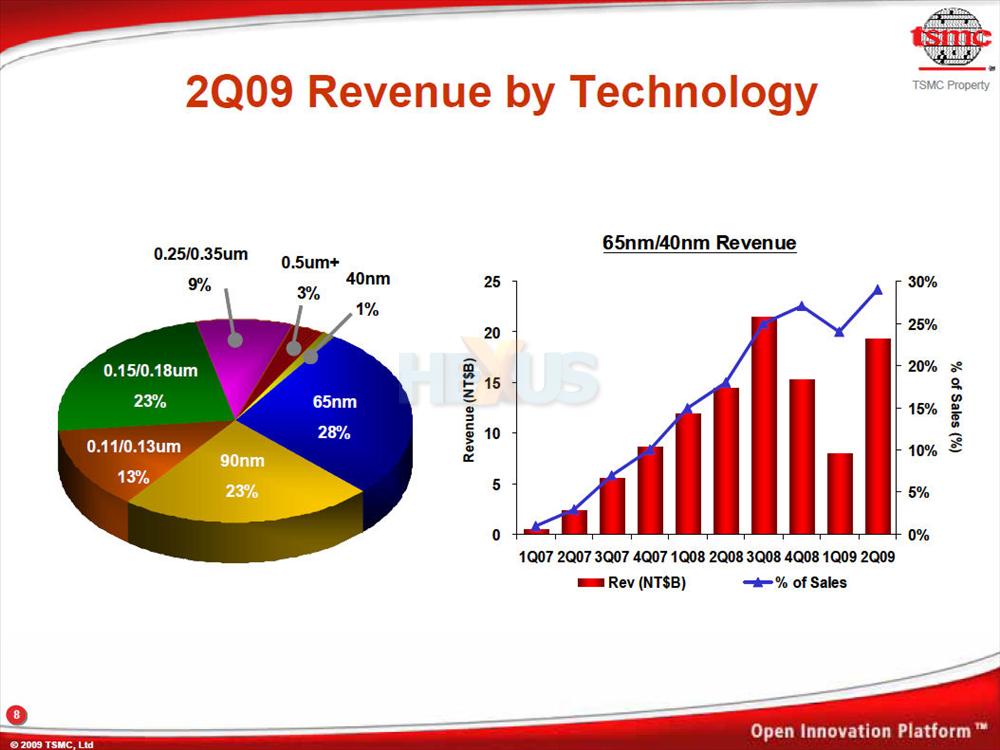

TSMC s 20nm process is performing terribly bad contributes 0

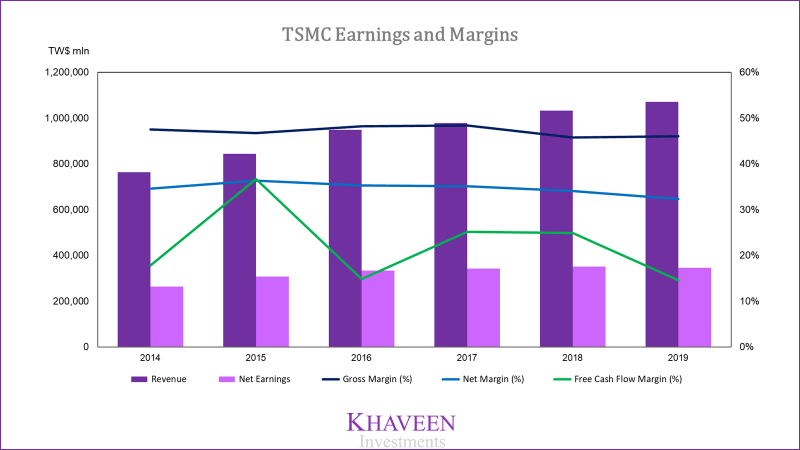

TSMC Earnings Mule s Musings

TSMC to post at least 15 revenue growth in 2020

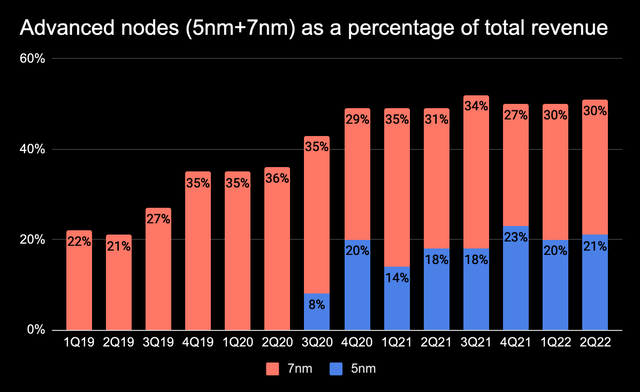

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

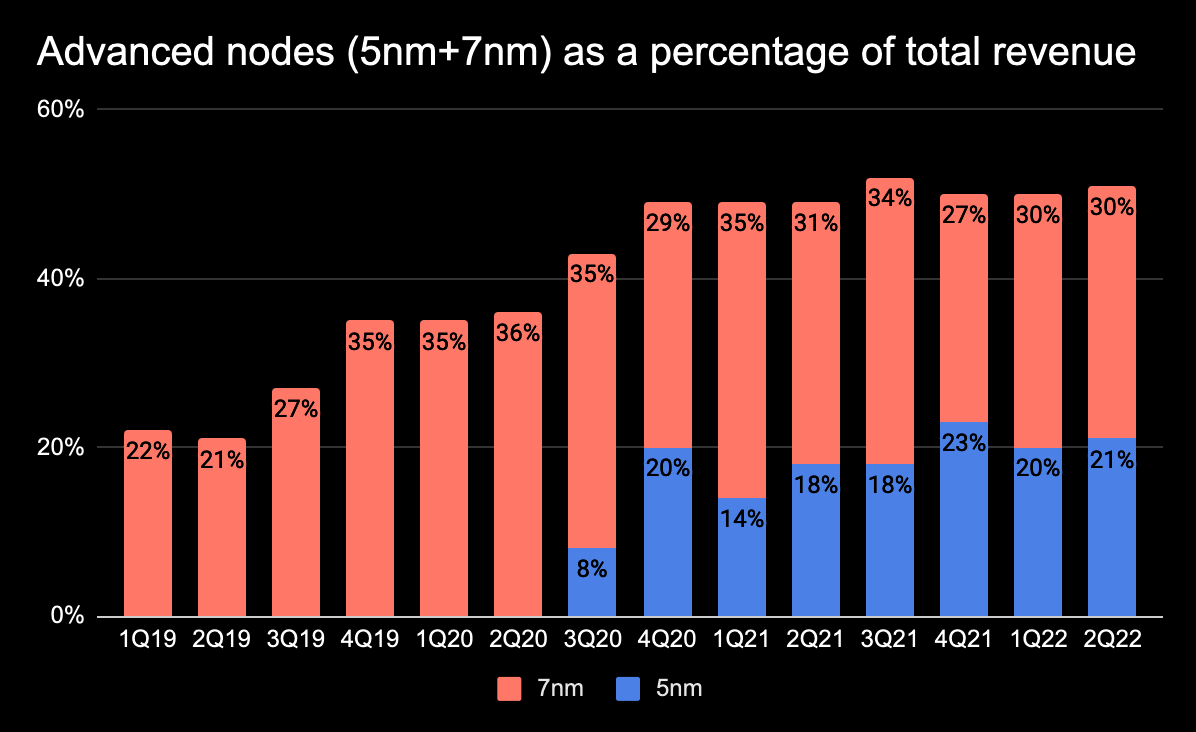

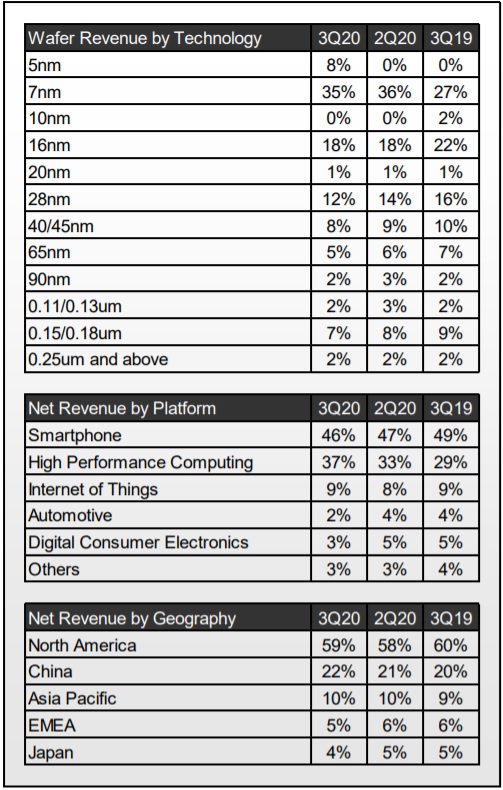

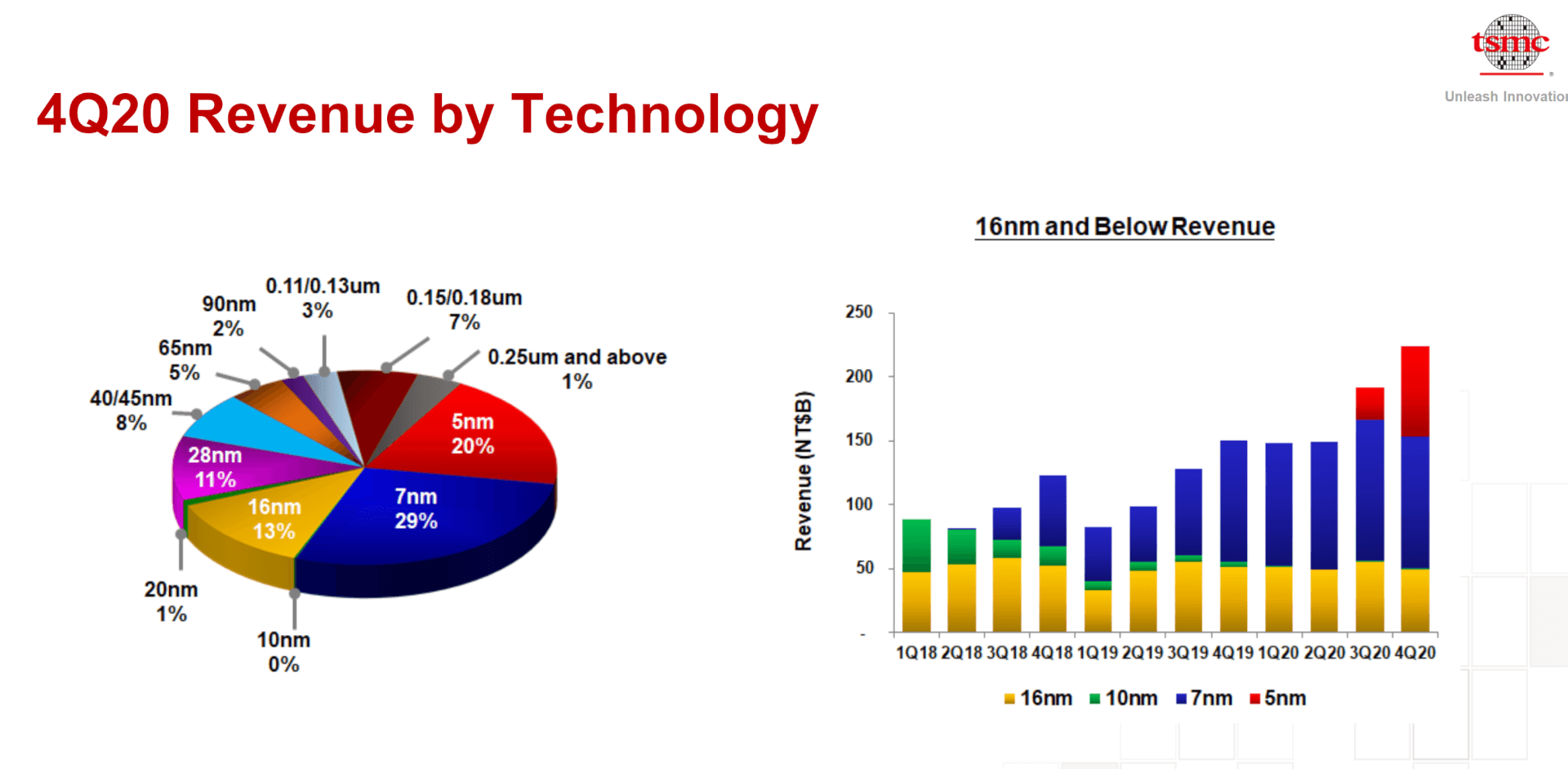

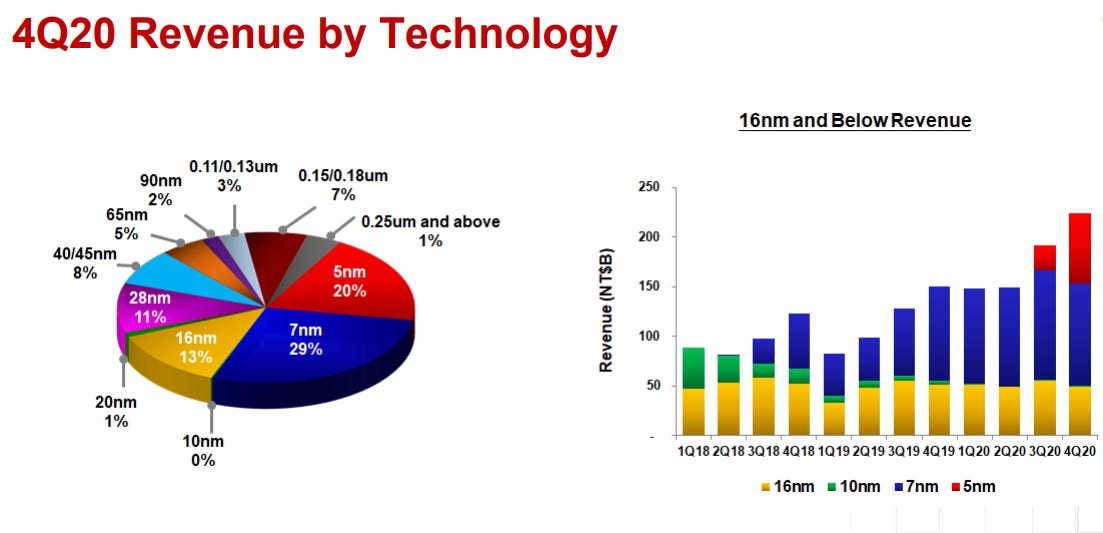

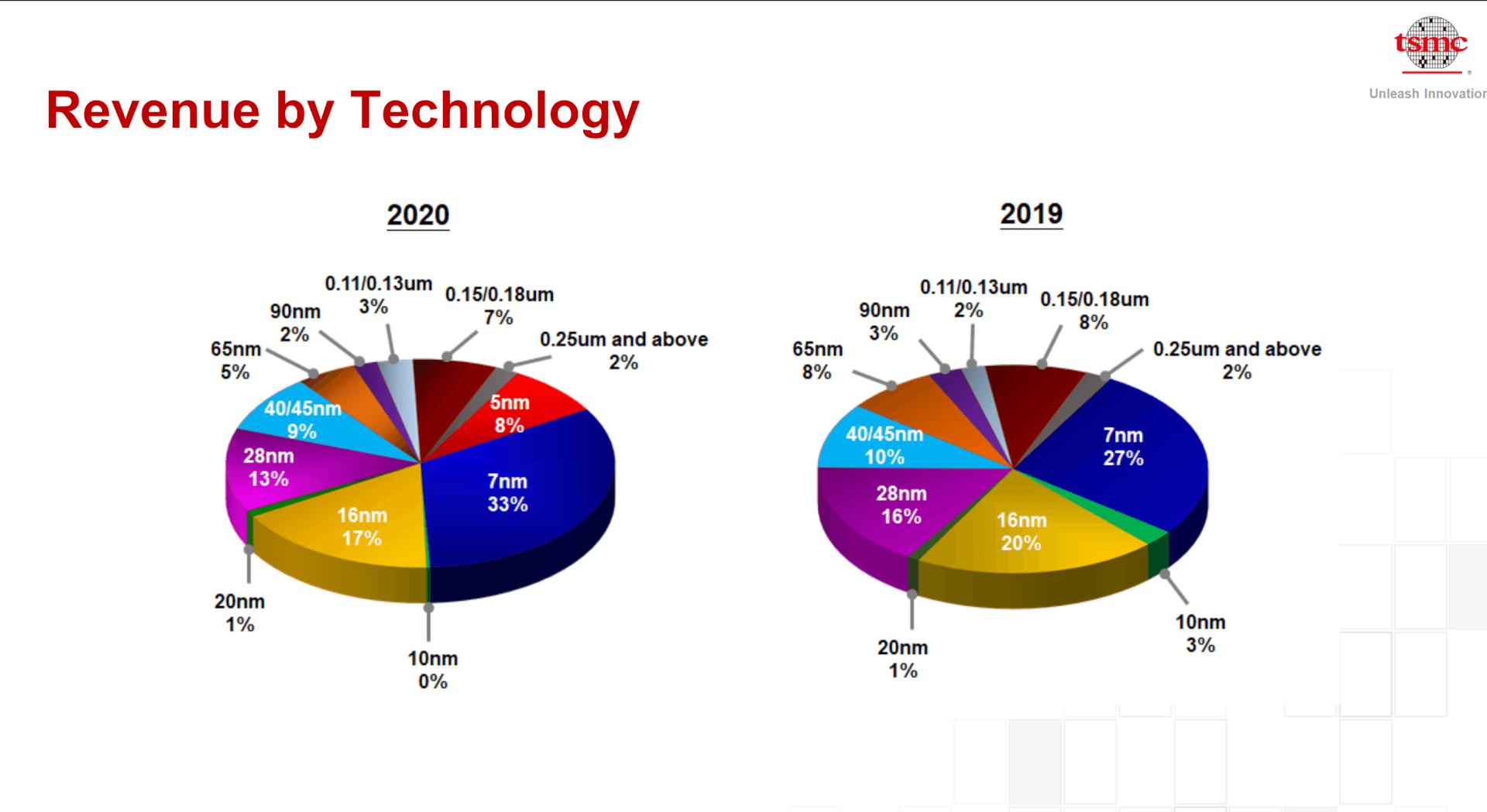

TSMC s Revenue Grew by 25 in 2020 5nm Accounted for 20 of Total

TSMC revenue rebounds strongly in Q2 Economic Indicators News

TSMC Predicted To Significantly Grow Revenue This Quarter

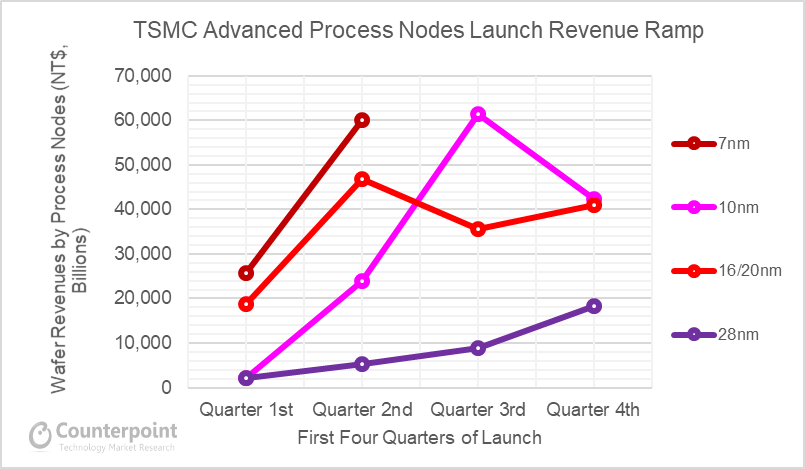

TSMC Q1 2021 Process Node Revenue More 7nm No More 20nm

News tagged TSMC at DIGITIMES

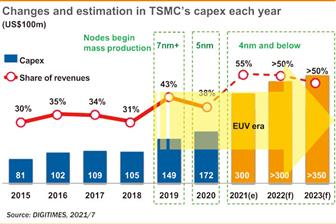

TSMC Will Spend Up to 28 Billion in 2021 to Protect Tech Lead BNN

TSMC Weak 2019 Demand but 5nm Set for 2020 Volume Manufacturing

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

TSMC receives bad chemicals stopping production for Nvidia and Huawei

TSMC logs highest quarterly profit sees record revenue and capital

A series chip supplier TSMC working on making 5nm chips in 2020 3nm in

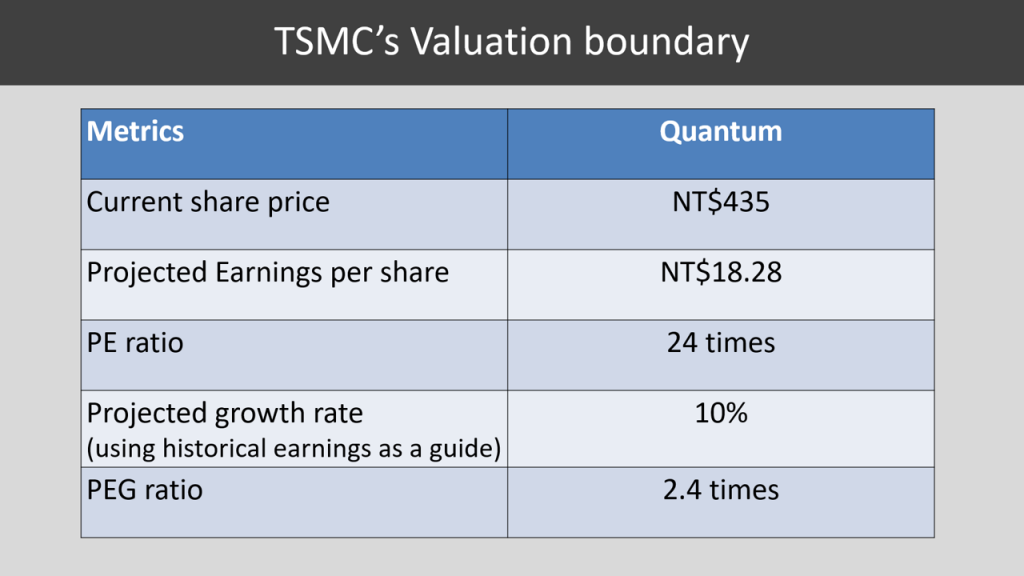

Is TSMC a good investment during this stock price jump

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

TSMC logs highest quarterly profit sees record revenue and capital

A series chip supplier TSMC working on making 5nm chips in 2020 3nm in

Is TSMC a good investment during this stock price jump

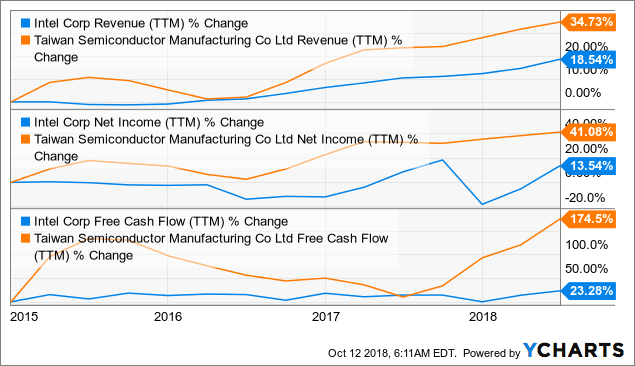

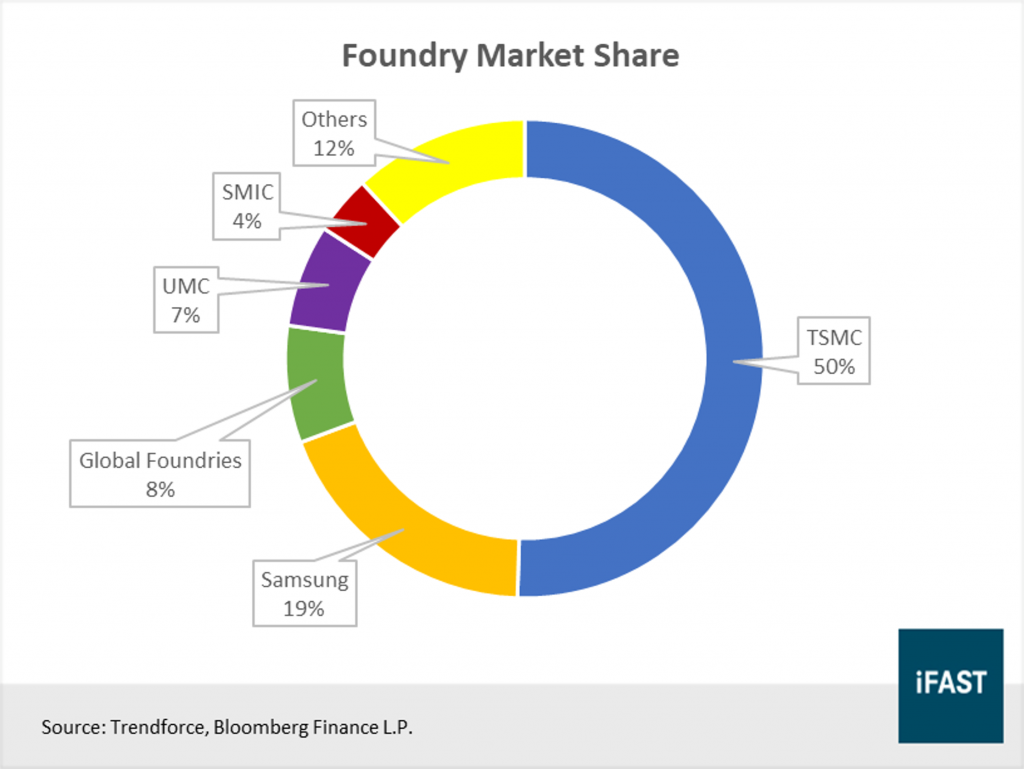

Intel Vs TSMC The Safer Pick NASDAQ INTC Seeking Alpha

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

TSMC to outgrow market in 2016 despite unfavorable market climate

TSMC earnings The heart of the chip industry Stock Market News

TSMC Q2 Earnings Inventory Correction Long Term Prospects Remain

TSMC Stock Attractive Despite Geopolitical Risks NYSE TSM Seeking

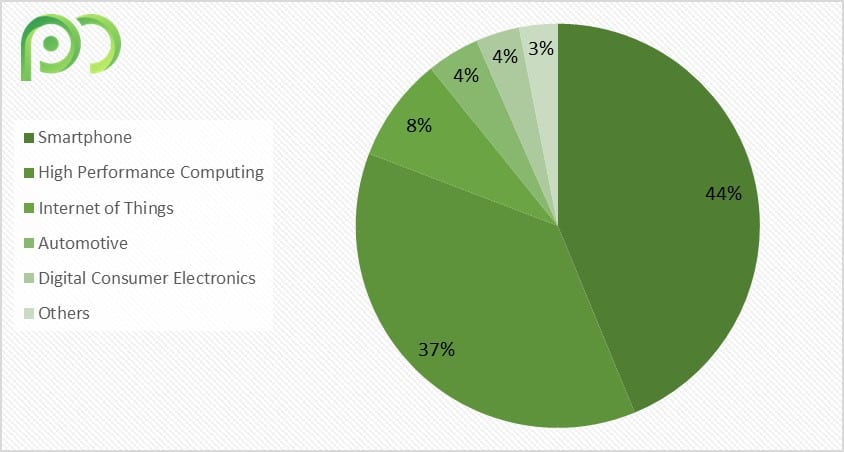

Tsmc Revenue By Customer According to tsmc s latest financial reports

TSMC s Q1 2016 revenues decline 18 percent

TSMC s 5nm Process and N5P Will Hit the Road in Automotive SoCs News

TSMC Announced strong Q4 Financials and their intent to Invest up to

TSMC and the FinFET Era Read more on SemiWiki

Tsmc Revenue By Customer According to tsmc s latest financial reports

Apple chipmaker TSMC says earthquake damage will hit production full

TSMC Poised For Revenue Growth Through 5G amp 7nm Process Nodes

TSMC Revenue Forecast Beats Analyst Expectations on Strong iPhone Demand

TSMC s Expansion Challenge Told in 10 Timely Charts

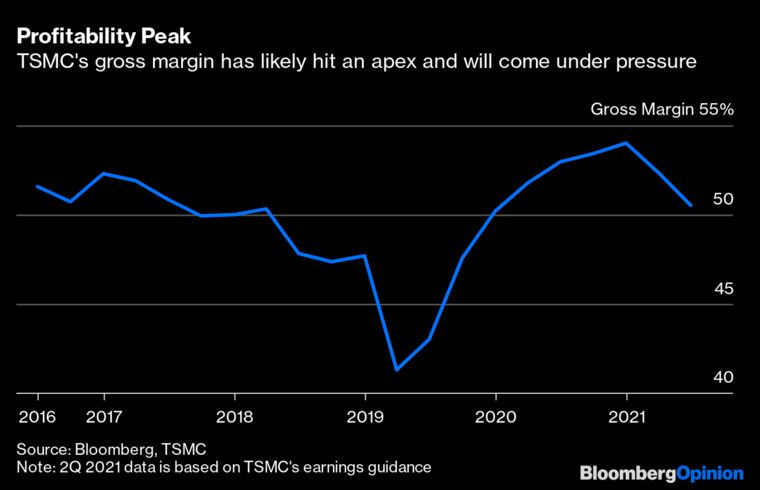

TSMC s Outlook and Rising Inventories Are a Bad Sign for Tech Bloomberg

Is TSMC a good investment during this stock price jump The Grey Rhino

TSMC Sets the Stage for a Great 2021 SemiWiki

TSMC Too Big To Beat NYSE TSM Seeking Alpha

Is TSMC a good investment during this stock price jump YouTube

TSMC Too Big To Beat NYSE TSM Seeking Alpha

TSMC s Revenue Grew by 25 in 2020 5nm Accounted for 20 of Total

TSMC s Expansion Challenge Told in 10 Timely Charts

Tsmc Is Facing A 15 Revenue Hit From Slowing Demand - The pictures related to be able to Tsmc Is Facing A 15 Revenue Hit From Slowing Demand in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XEKJAUTRGNOQRJGKE4G7YYGV7U.jpg)