The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors

Soudah Development (SD) is a closed joint-stock real estate development company owned by the Public Investment Fund (PIF), launched by HRH Crown Prince Mohammed bin Salman bin Abdulaziz Al Saud, Prime Minister and Chairman of PIF, on 24th February 2021, to develop a luxury mountain tourism destination set 3,015 meters above sea level on Saudi. Among the first funders was the Saudi Public Investment Fund — run by the Saudi Arabian government. "looks like Jared Kushner has to 'pay back the $2billion from Saudi Arabia In Full.

In April 2022, The New York Times reported Jared Kushner received $2 billion in Saudi-backed funds. A new Washington Post report reveals how Kushner's company concealed the source of the funds. On. 381. By David D. Kirkpatrick and Kate Kelly. April 10, 2022. Six months after leaving the White House, Jared Kushner secured a $2 billion investment from a fund led by the Saudi crown prince, a.

Related Posts of The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors :

58+ Images of The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors

The destination is owned and managed by King Abdullah Financial District Development and Management Company (KAFD DMC), which was established in 2018 and is a wholly-owned subsidiary of the Public Investment Fund (PIF), the sovereign wealth fund of the Kingdom of Saudi Arabia.

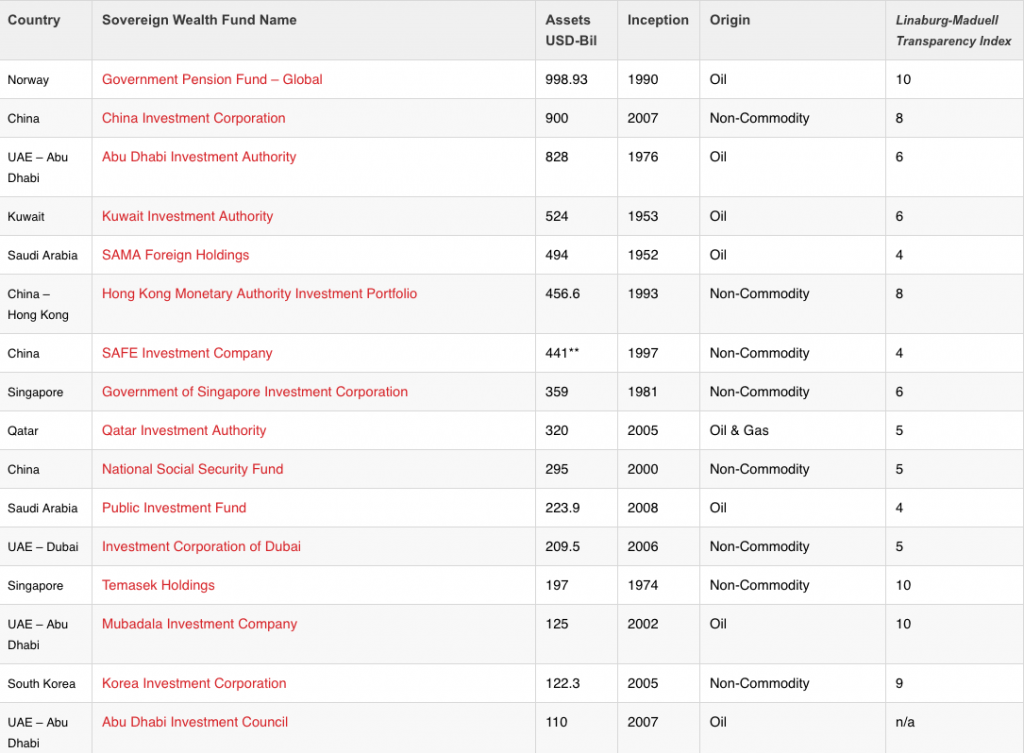

The Public Investment Fund (PIF; Arabic: صندوق الاستثمارات العامة) is the sovereign wealth fund of Saudi Arabia.It is among the largest sovereign wealth funds in the world with total estimated assets of US$925 billion (£726.3 billion). It was created in 1971 for the purpose of investing funds on behalf of the Government of Saudi Arabia.

Known as the Public Investment Fund, or P.I.F., it is an investment pool that manages more than $700 billion in Saudi government money. It invests those funds in companies, real estate and other.

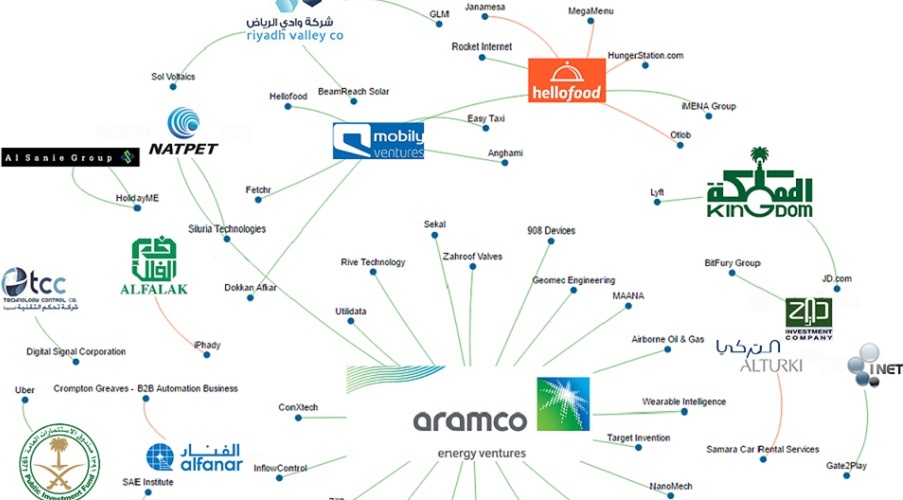

The Public Investment Fund's investments accelerate innovation, reinvent industries, create jobs, and grow Saudi Arabia's economy. Previously unimaginable opportunities in the Kingdom are now creating a bright future with huge promise and potential for all. Launched in 2017, the Program is dedicated to maximizing the impact of the Public.

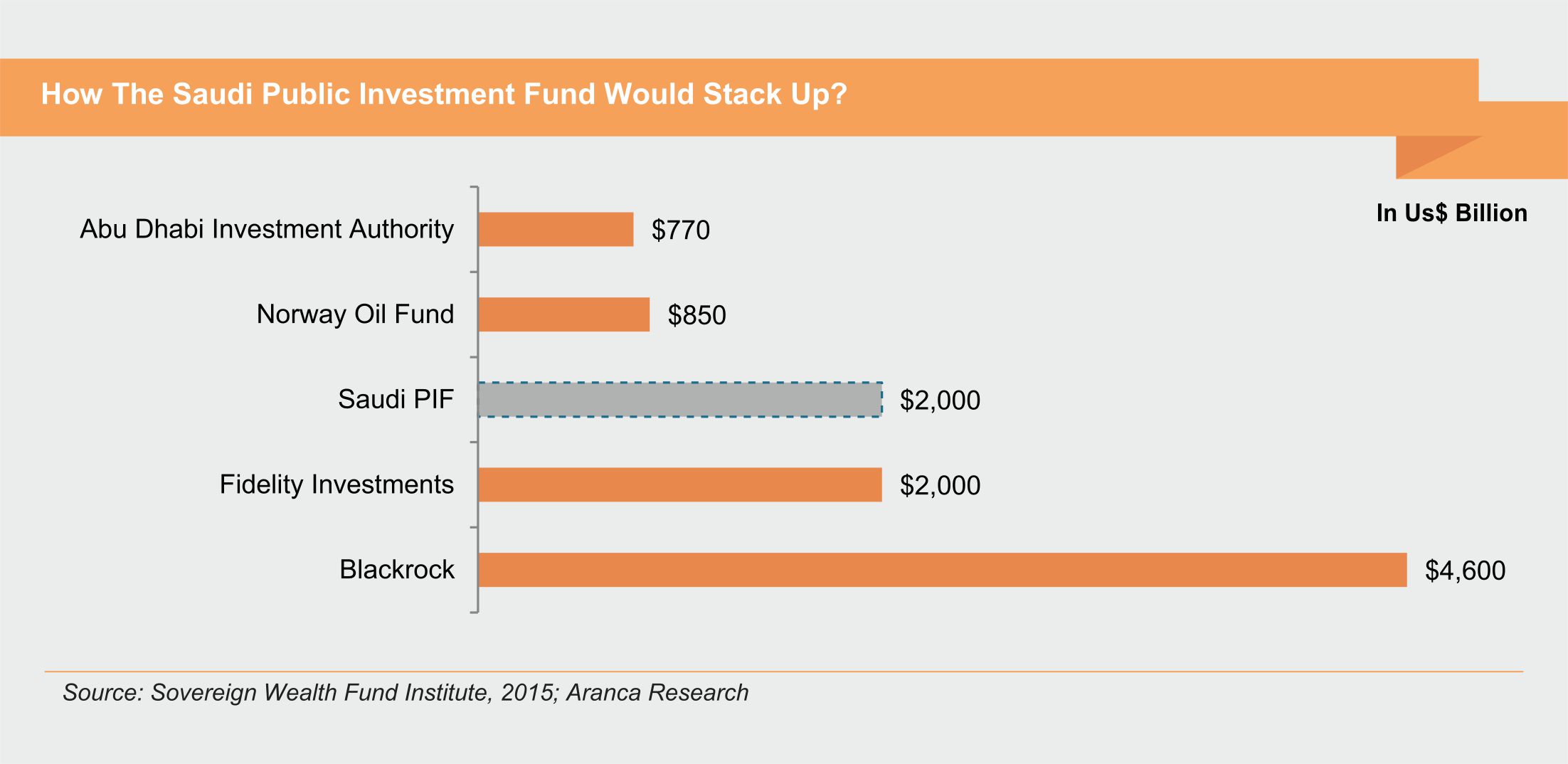

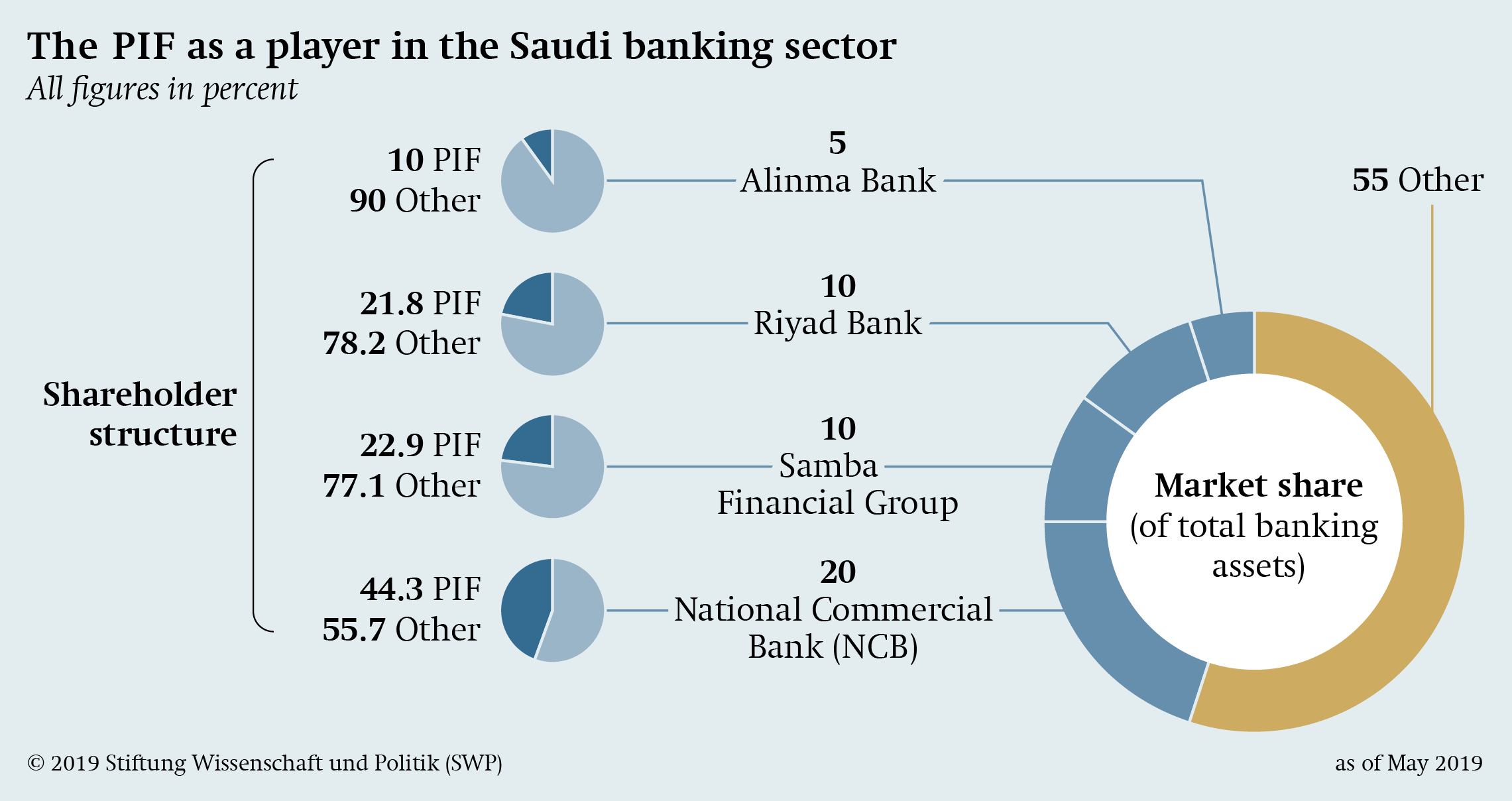

The $230 billion Public Investment Fund (PIF) is emerging as the central financial vehicle to consolidate and then exercise Saudi Arabian economic power in the service of goals outlined by the crown prince, Mohammed bin Salman (MbS).. The PIF, founded in 1971 as a relatively small investment fund to support a few Saudi companies, is quickly.

Who We Are. PIF is driving the growth of new sectors, companies and jobs, as a catalyst of Vision 2030. As a global impactful investor, the Fund has a world-class investment portfolio with a focus on sustainable investments, both domestically and internationally. "PIF is evolving into a primary driver of Saudi economic growth.

The Public Investment Fund of Saudi Arabia purchased an 80% stake in Newcastle United. The 2021 takeover of Newcastle United F.C. by a consortium of the Saudi Public Investment Fund (PIF), PCP Capital Partners, and the Reuben Brothers was a takeover proceeding that commenced in April 2020 and was successfully concluded in October 2021.. The takeover process gained notoriety for allegations of.

"The Saudi Public Investment Fund cannot have it both ways: if it wants to engage with the United States commercially, it must be subject to United States law and oversight," Blumenthal said.

That happened in early June, when PGA Tour commissioner Jay Monahan and Yasir al-Rumayyan, governor of the Saudi sovereign wealth fund — or Public Investment Fund, as it is known — put their.

Back in June, the PGA Tour, together with the DP World Tour, settled on a "framework agreement" with the Saudi Arabian Public Investment Fund (PIF)—the beneficiary of LIV Golf. That.

The governor of Saudi Arabia's sovereign wealth fund, Public Investment Fund, said on Tuesday that governments and the private sector could not sustain the same level of spending and investments.

The Saudi Public Investment Fund is a government-controlled fund that has $650 billion in assets under management, according to its most recent filing. It is aiming to top $1 trillion within a few.

Listen. 1:54. A Chinese venture capital firm backed by a unit of Saudi Arabia's Public Investment Fund is planning to raise $1 billion to back technology startups in the Middle East. MSA Capital.

An investment firm owned by Saudi Arabia's Public Investment Fund (PIF) has emerged as a frontrunner to back a new cycling league, three people familiar with the matter told Reuters, the latest.

Saudi Arabia's Public Investment Fund (PIF) announced it has signed deals with Saudi Telecommunications Company (stc Group) that will see PIF acquire a majority stake in Saudi Telecom Co.'s.

The Public Investment Fund will own 54% of the new venture while STC, as Saudi Telecom is known, will hold 43%, according to a filing Bloomberg Terminal on the Saudi stock exchange.

The Public Investment Fund (PIF) supports the launch of new sectors and opportunities that helps in shaping the future of the global economy and drives economic transformation in Saudi Arabia. View Website. Location: Riyadh.

The PGA Tour, DP World Tour and Saudi Arabia's Public Investment Fund will not meet the Dec. 31 deadline to create a for-profit entity laid out in the framework agreement announced back in June, but the Tour did provide its players with an update on the status of negotiations on New Year's Eve. On Dec. 10, the Tour's policy board.

Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), will acquire a 51 percent stake in Telecommunication Towers Company Limited (Tawal) from the Saudi Telecommunications Company (STC Group). Tawal is the largest telecoms infrastructure company in Saudi Arabia and has an.

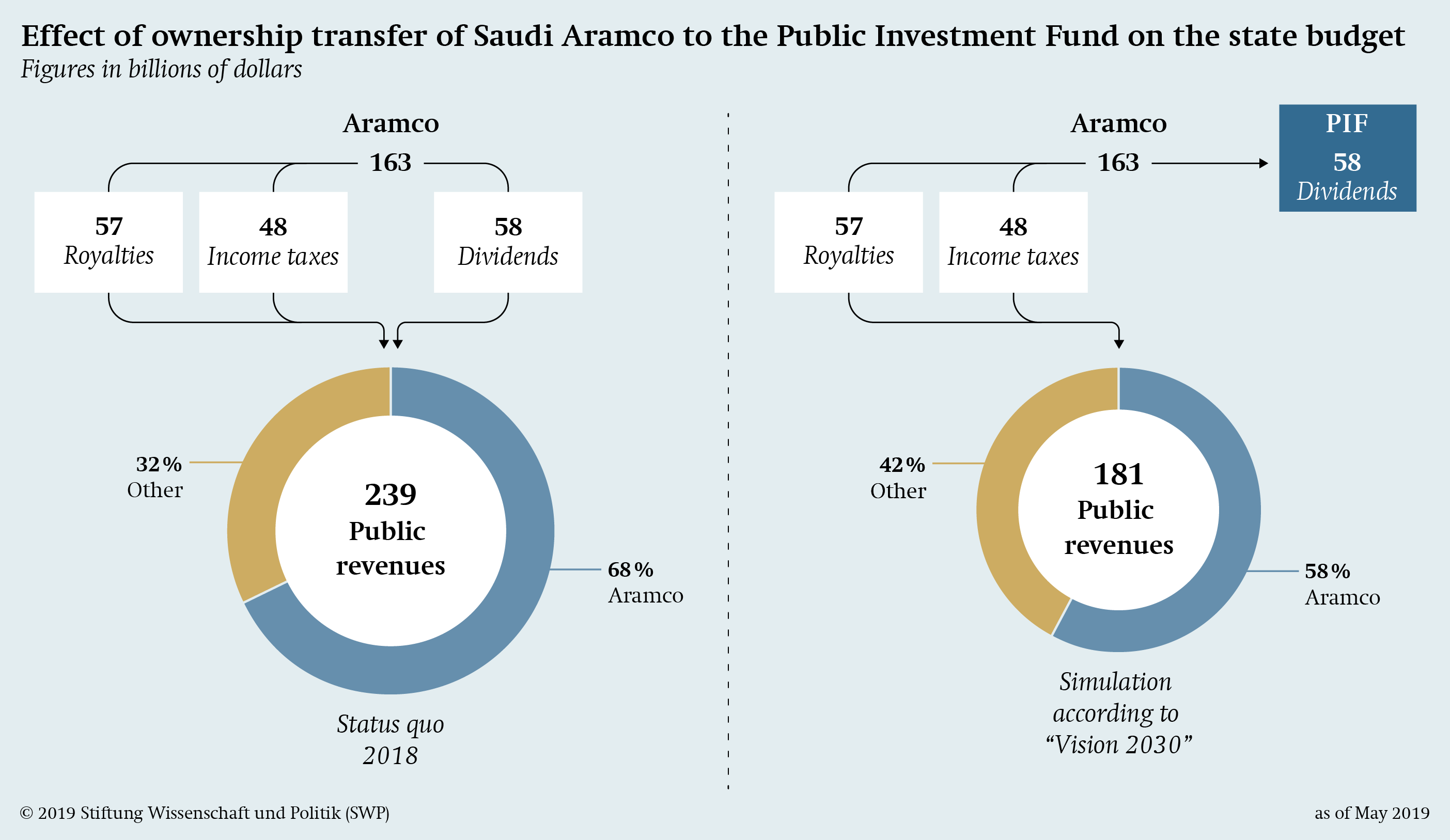

Sources of Funding. PIF is required to invest and reinvest available funds in order to achieve its objectives for the benefit of the public welfare, support economic development, and diversify sources of income for Saudi Arabia. Hence, when considering dividends declaration, the Board of Directors shall consider PIF's mission, vision, and.

The PGA Tour and Saudi Arabia Public Investment Fund (PIF) merger deadline is expected to be pushed back until April, a source close to negotiations has told the Telegraph. There was confidence.

Savvy, wholly owned by Saudia Arabia's Public Investment Fund, agreed to buy mobile game maker Scopely for $4.9 billion last April, the same month the Monopoly title was released. Since then.

Negotiations between the PGA Tour, DP World Tour and Saudi Arabia's Public Investment Fund (PIF) have been extended beyond the original deadline of 31 December.. A framework agreement between.

Saudi Arabia's sovereign wealth fund PIF has agreed to buy a 51% stake in Telecommunication Towers Company Ltd (TAWAL) from STC Group , paving the way for the creation of the region's largest.

Rory McIlroy is in line to receive about $50m as the wait for an agreement with the Saudi Public Investment Fund goes on James Corrigan, Golf Correspondent 24 April 2024 • 5:36pm Related Topics

Gallery of The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors :

The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors - The pictures related to be able to The Saudi Public Investment Fund Is Back Again To Rescue The Lucid Group Investors in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XCF4E26IUJIUDN7MMJM7L33MHE.jpg)