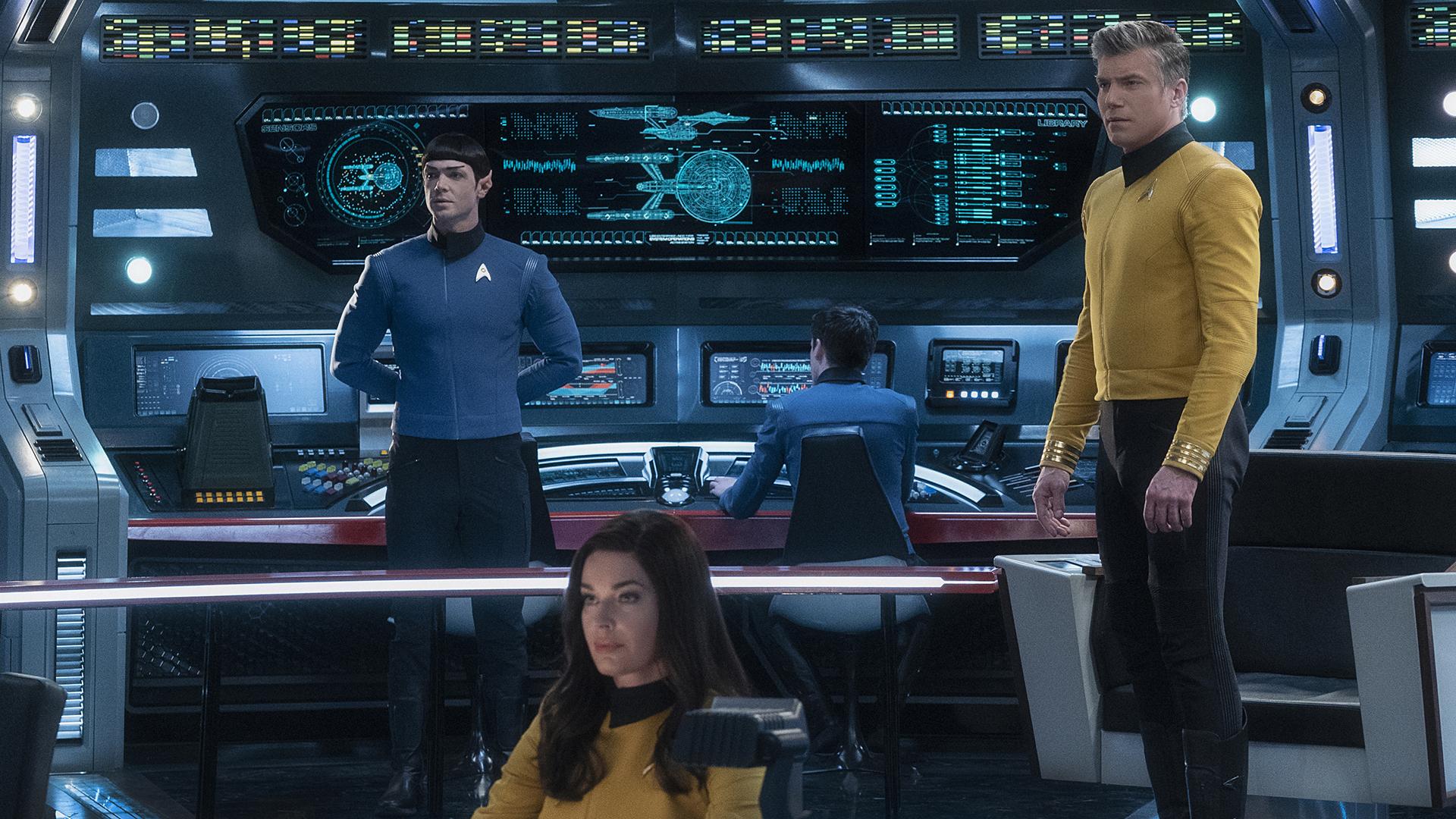

Star Trek Strange New Worlds Season 1 Coming To Blu ray DVD And

STAR TREK STRANGE NEW WORLDS Recap S01E01 Strange New Worlds

Star Trek Strange New Worlds Cast Every New amp Returning Character in

The World s Number One Flat Out All Time Great Stock Car Racing Book

The World Cup is the worlds number one sporting event in terms of

Strange New Worlds timeline leak could mean a major Star Trek retcon

Star Trek Strange New Worlds Season 2 Will Explore Number One s Backstory

Star Trek Every TOS Character In Strange New Worlds amp Who Plays Them

What s Streaming at Paramount in May 2022 Including Star Trek

world s number one No 1 concept vector Stock Vector Image amp Art Alamy

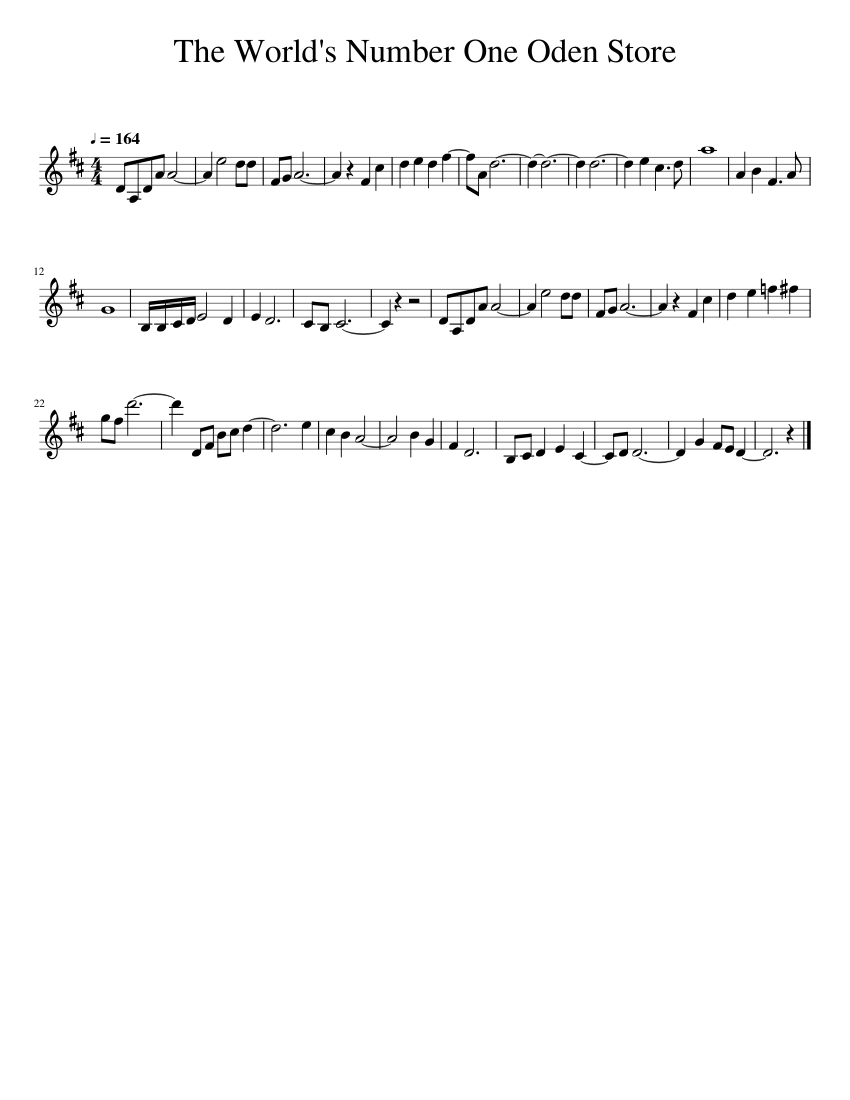

The World s Number One Oden Store Kohei Tanaka Sheet music for Piano

Worlds Number One Prick No1 Prick t shirt Nick Name funny Joke Etsy de

HAPPY BIRTHDAY MISS WORLDS NUMBER ONE CUTIE i love you so much

Star Trek Strange New Worlds 2022 Reqzone com

25 Things Movies Always Get Wrong Wtf Gallery eBaum s World

World number one 9 294 images photos et images vectorielles de stock

quot Star Trek Strange New Worlds quot Captain Pike Number One and Spock

Read Star Trek Strange New Worlds Star Explains Nurse Chapel Costume

world s number one No 1 concept vector Stock Vector Image amp Art Alamy

Worlds number one website How to download any English movie in Hindi

Why Strange New Worlds is the show Star Trek and the world needs

Worlds Number One Prick No1 Prick t shirt Nick Name funny Joke Etsy de

world s number one No 1 concept vector Stock Vector Image amp Art Alamy

Worlds number one website How to download any English movie in Hindi

New Character Posters Revealed For Star Trek Strange New Worlds

The World s Number One Oden Store 1 Hour version One Piece YouTube

Star Trek s Ready Room Releases Sneak Peek into Strange New Worlds

Star Trek Strange New Worlds Stars Ethan Peck and Anson Mount How

Star Trek Strange New Worlds What We Know So Far

Exclusive Star Trek Strange New Worlds Will Have A Non Binary

Star Trek Strange New Worlds Will Finally Reveal a Fan Favorite

Star Trek Characters Collage

World s Number One YouTube

One Piece The worlds number one Oden store YouTube

Star Trek Strange New Worlds TVmaze

Why Strange New Worlds is the show Star Trek and the world needs

Sally Jones TV Presenter for BBC Breakfast Time and also Worlds Number

One Piece The Worlds Number One Oden Store Piano Tutorial YouTube

Star Trek Strange New Worlds reveals the rest of the Enterprise crew

Number One TV Movie 1984 IMDb

Star Trek Strange New Worlds TVmaze

Star Trek Strange New Worlds CBS surrenders to Pike and Spock s

Star Trek Strange New Worlds can fix Discovery canon in 5 ways

World s Number One stock image Image of business award 35043623

Star Trek s Most Underserved Characters Will Be Back in Strange New

40 Years Ago Star Trek II Brings Back Khaaaaaaaaannn

Sally Jones TV Presenter for BBC Breakfast Time and also Worlds Number

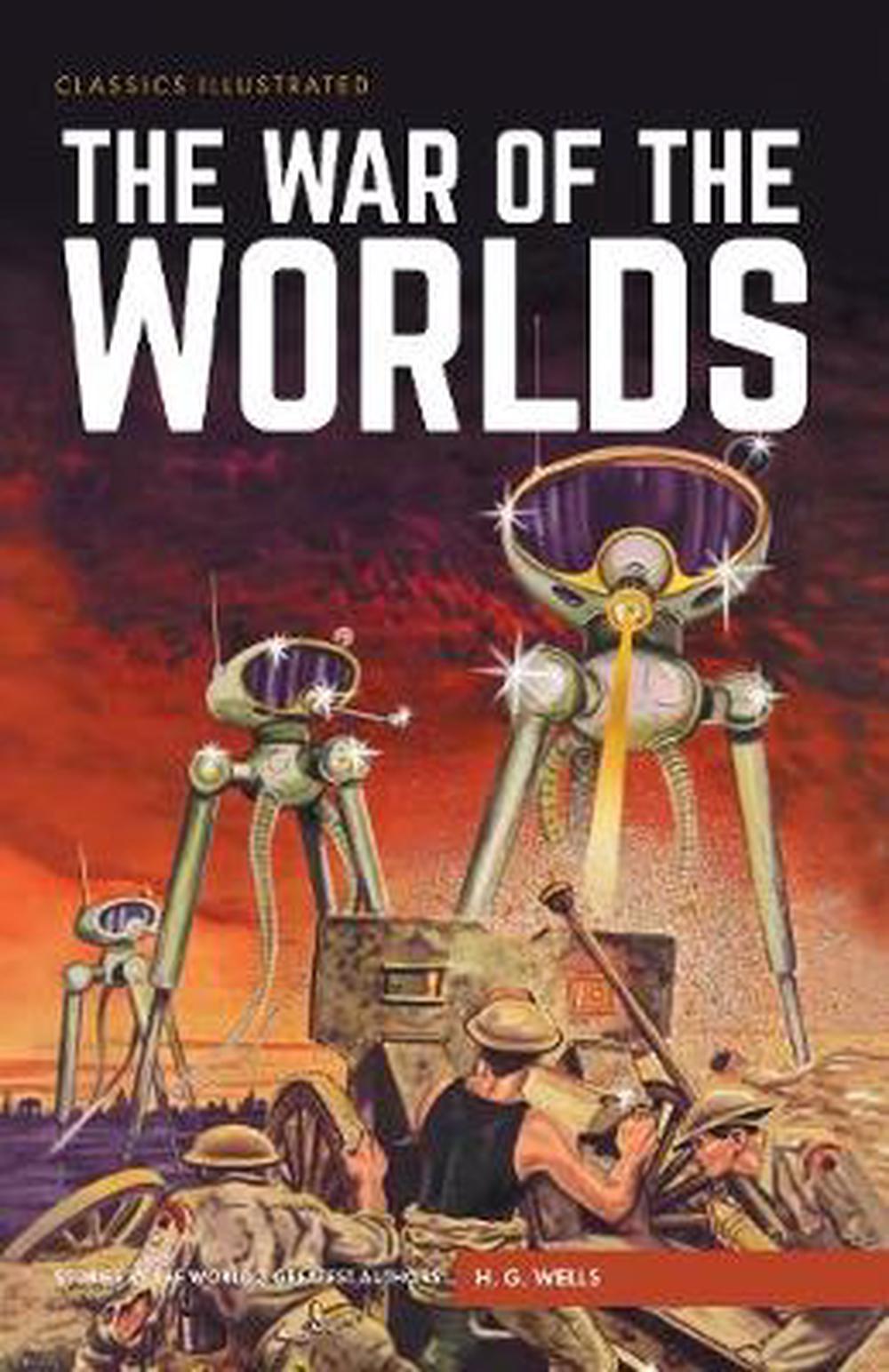

Martian Fighting Machines Robot Supremacy Wiki

Star Trek Strange New Worlds can fix Discovery canon in 5 ways

Star Trek Strange New Worlds 2022 Reqzone com

World s Number One stock image Image of business award 35043623

Star Trek s Most Underserved Characters Will Be Back in Strange New

40 Years Ago Star Trek II Brings Back Khaaaaaaaaannn

Sally Jones TV Presenter for BBC Breakfast Time and also Worlds Number

Martian Fighting Machines Robot Supremacy Wiki

Jared Martin who was the lead in the 1977 series Fantastic Journey and

Star Trek Strange New Worlds is coming to CBS All Access What to Watch

Exclusive Star Trek Strange New Worlds Will Have A Non Binary

Episode 28 The World s Number One Podcast The Host Unknown podcast

War of the Worlds the by H G Wells English Hardcover Book Free

The Worlds Number One Oden Store Kohei Tanaka One Piece Sheet music

Star Trek 10 Secrets Of Strange New Worlds Enterprise You Need To Know

New Star Trek Series Focusing on Captain Pike and Spock Coming Den of

Robotics The world s number one The Dart

Star Trek Strange New Worlds Just Announced Its Bridge Crew

The War of the Worlds 1953 iTunes HD Review Not on Blu ray

Worlds Hardest Word Search New Calendar Template Site

The War of the Worlds by H G Wells English Paperback Book Free

War of the Worlds 2005 Tom Cruise Dakota Fanning Tim Robbins

CBS All Access quot Star Trek Strange New Worlds quot Pike Spock series

Earl s Top 7 Games of 2013 Nerds on the Rocks

Star Trek Strange New Worlds Next Episode Air Date amp am

Album Review Jeff Wayne s War of the Worlds Breaking it all Down

The War of the Worlds 1953 iTunes HD Review Not on Blu ray

War of the Worlds 2005 Tom Cruise Dakota Fanning Tim Robbins

War of the Worlds by H G Wells English Paperback Book Free Shipping

The Last Time The Worlds Number One Cryptocurrency Was Quiet Prices Crashed - The pictures related to be able to The Last Time The Worlds Number One Cryptocurrency Was Quiet Prices Crashed in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

.jpg)