Could Tesla Motors NASDAQ TSLA Miss This Quarter s Expectations

Tesla TSLA Misses Second Quarter 2013 Forecast On Profit But Beat

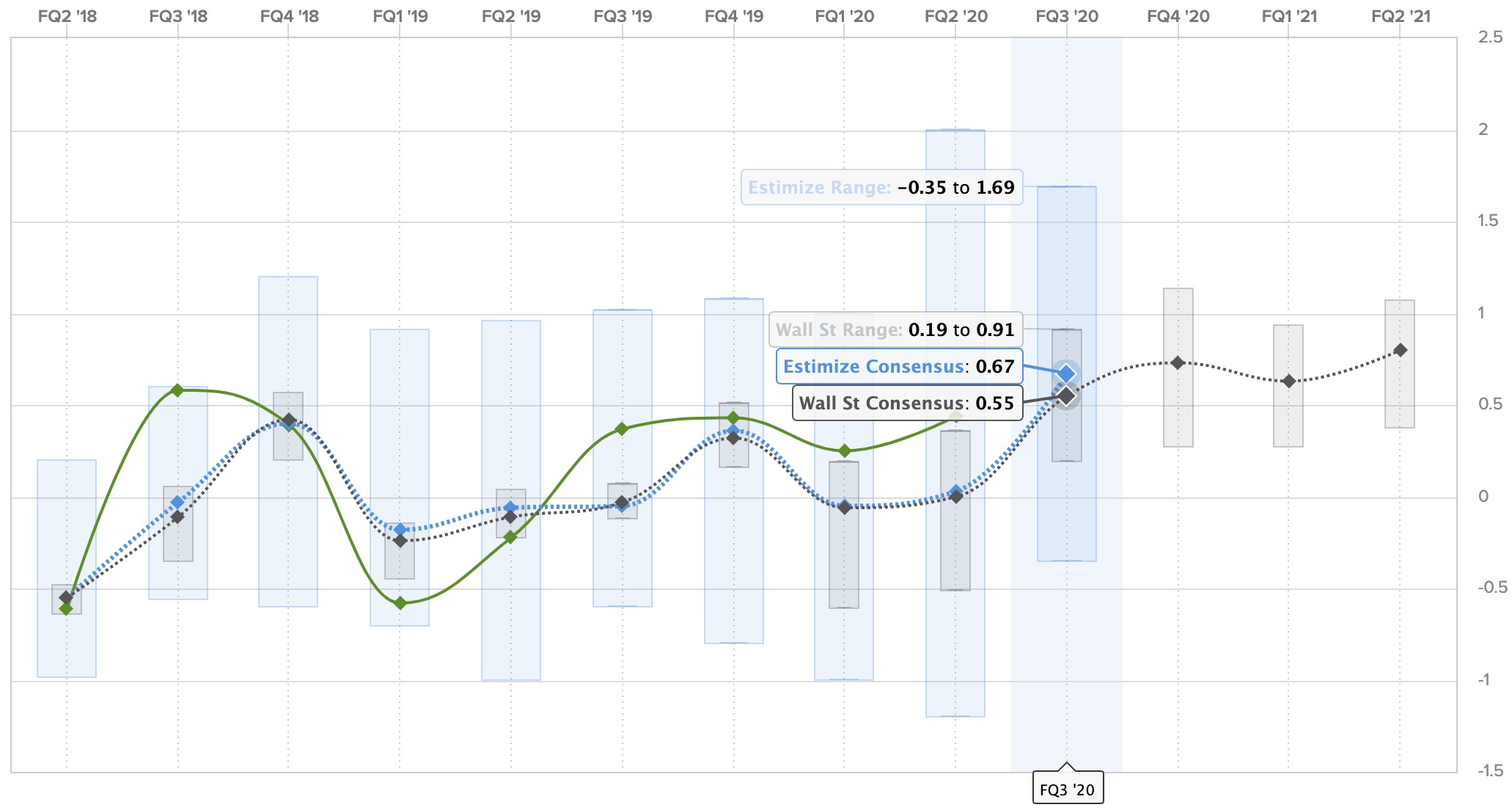

Tesla TSLA releases Q3 2020 results destroys both revenue and profit

Tesla s RECORD quarter MISSES expectations TSLA TeslaStock Tesla

Cracks Appear In Tesla s Growth Story NASDAQ TSLA Seeking Alpha

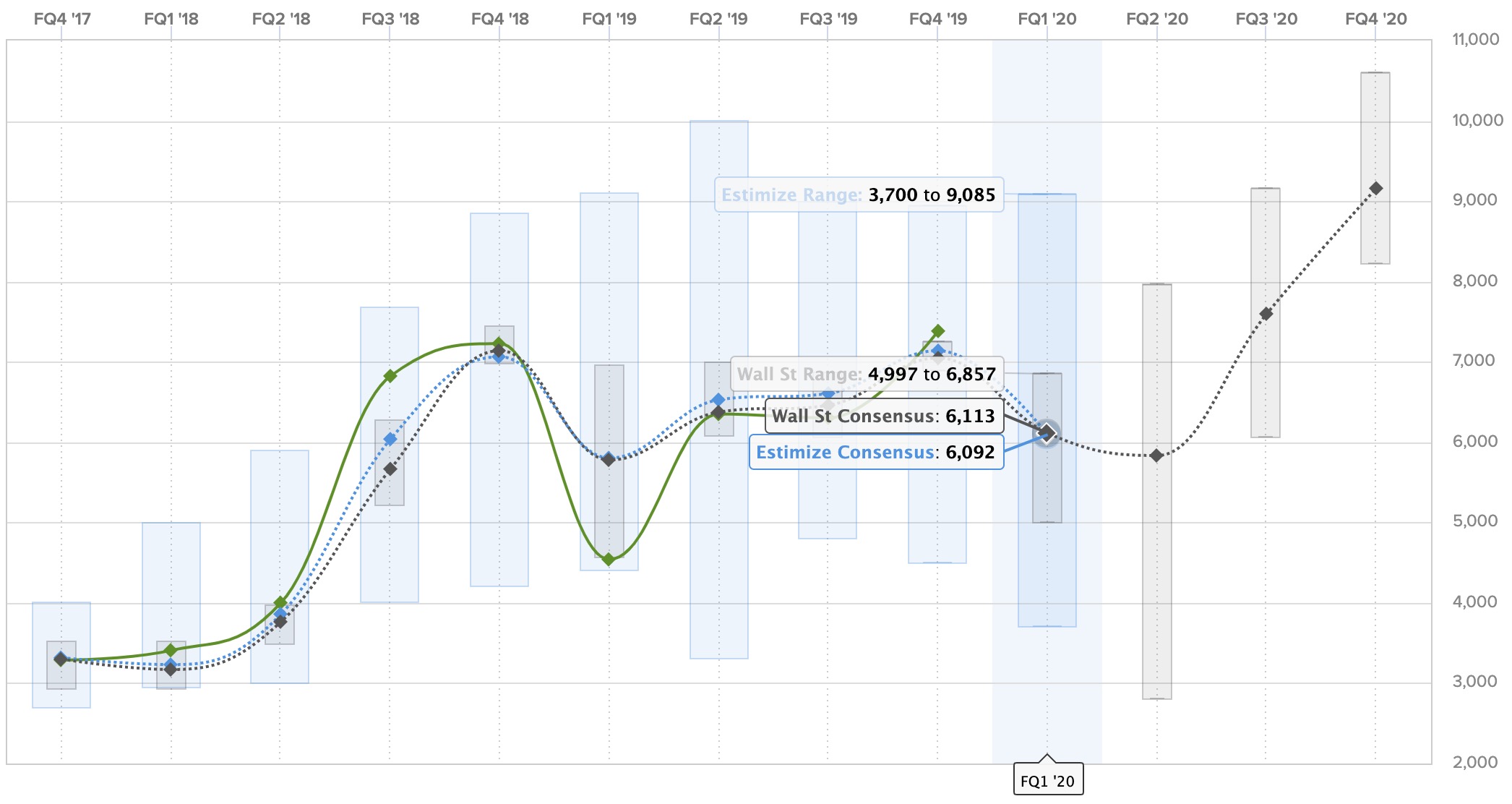

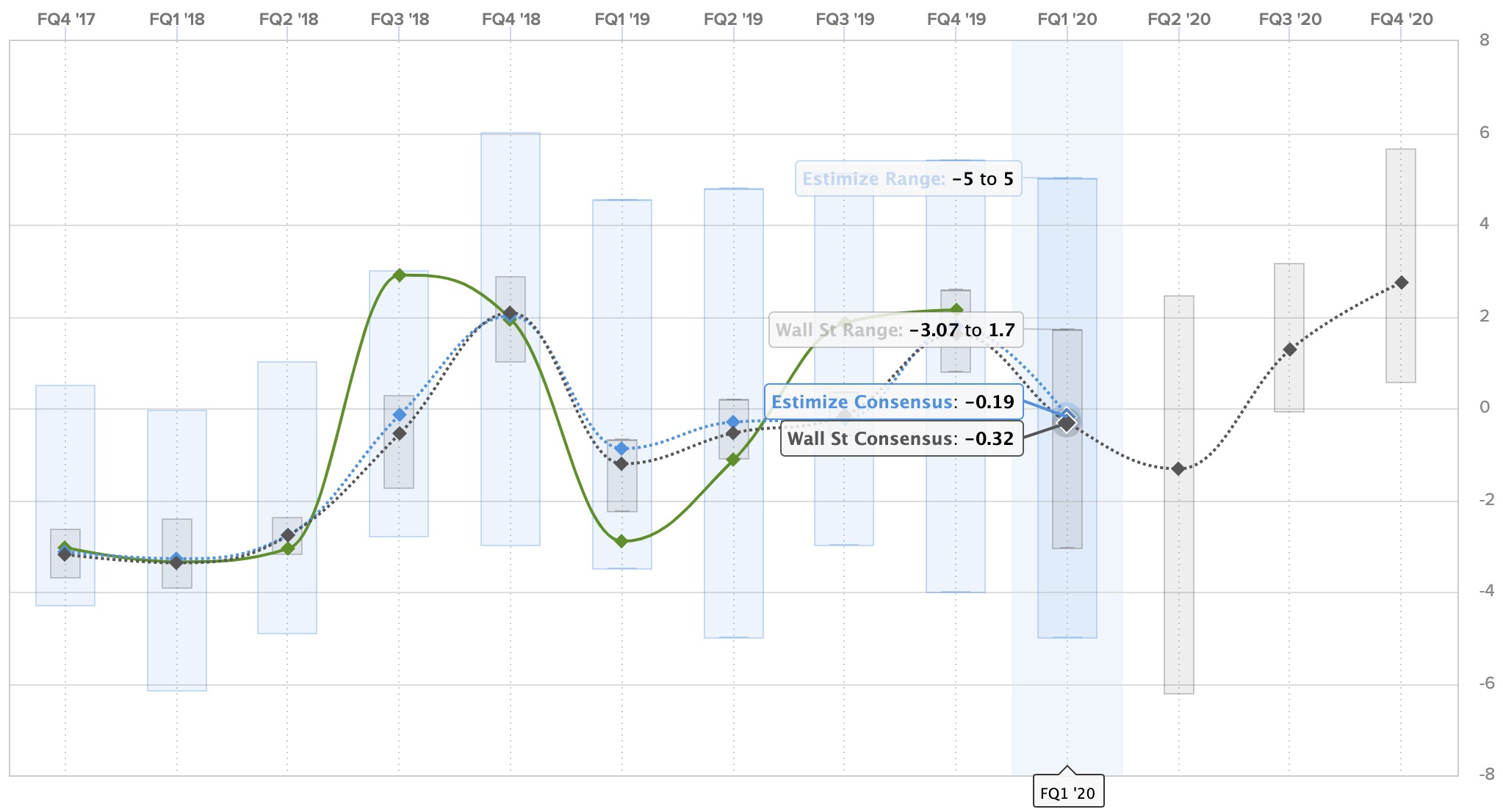

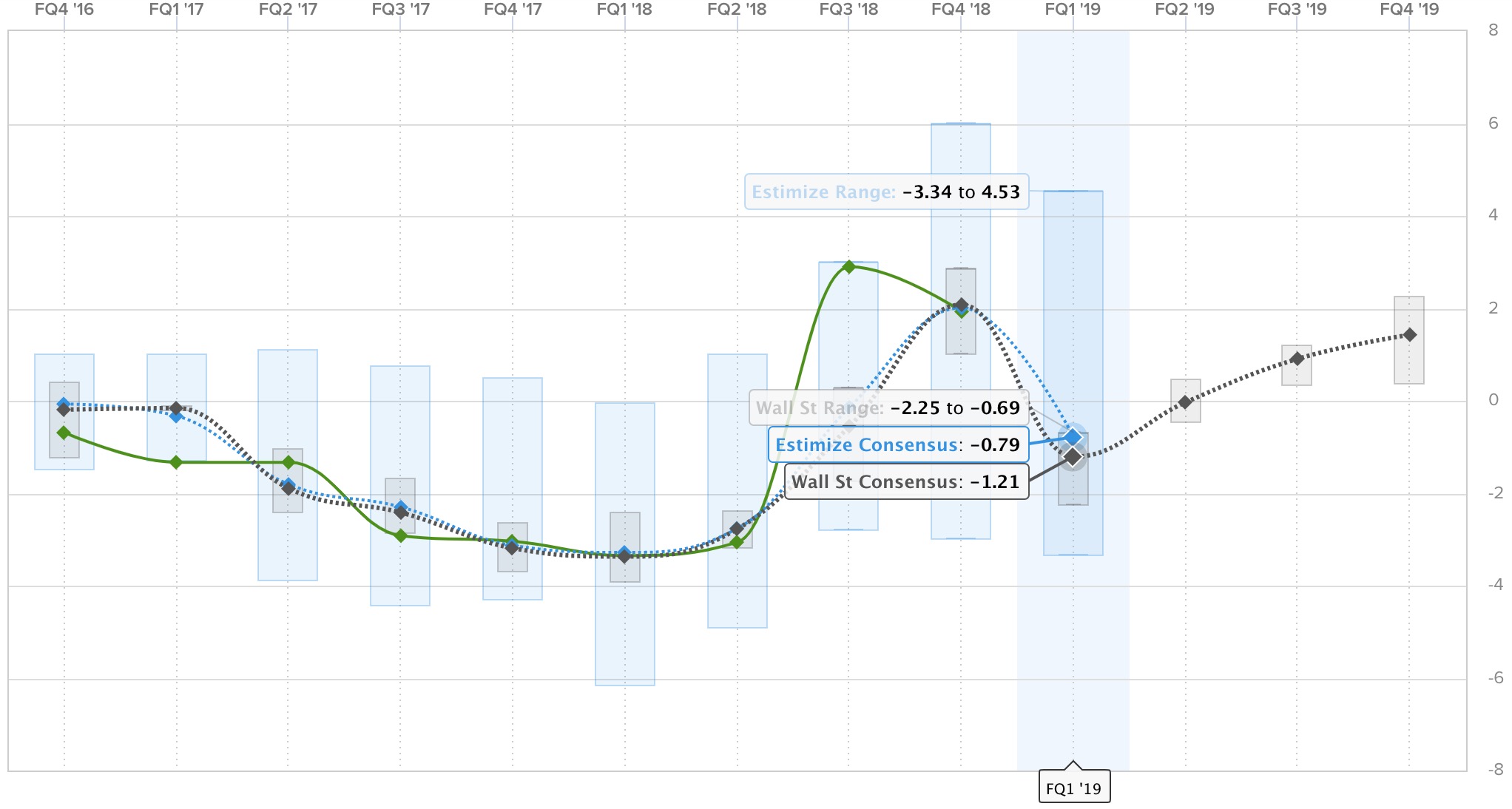

Tesla TSLA is about to release Q1 earnings here s what to expect

Earnings Reaction No Concerns With Tesla TSLA Automotive Margins

Tesla Inc TSLA Equity Research Report Sayers Research

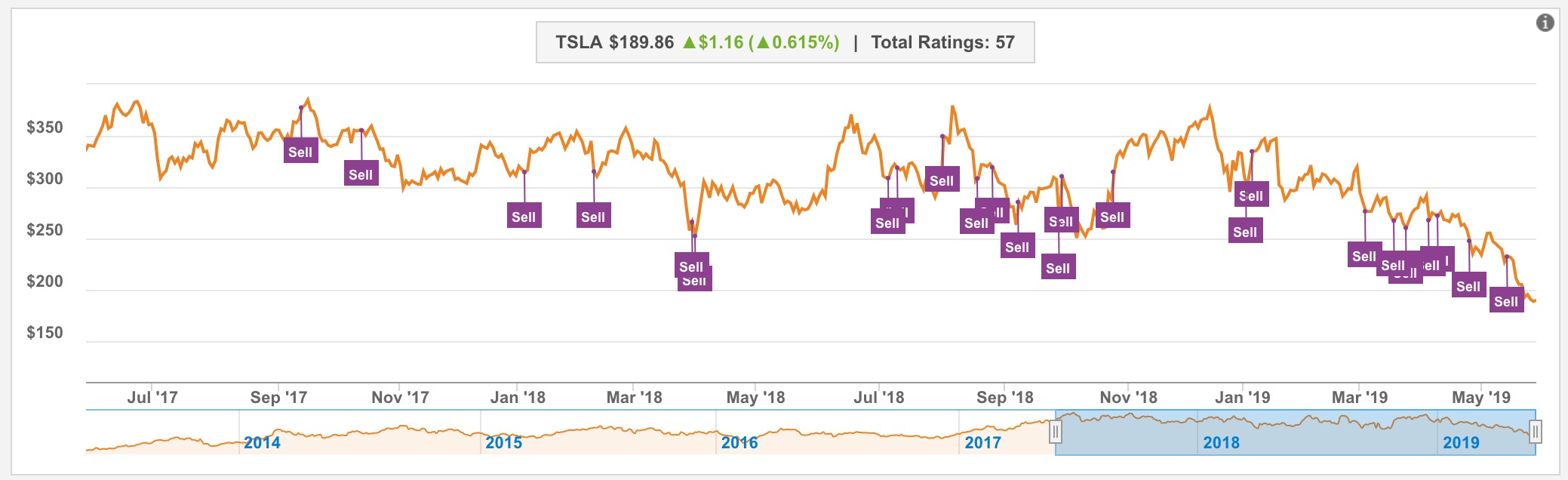

Tesla TSLA can t catch a break Barclays reduces price target and

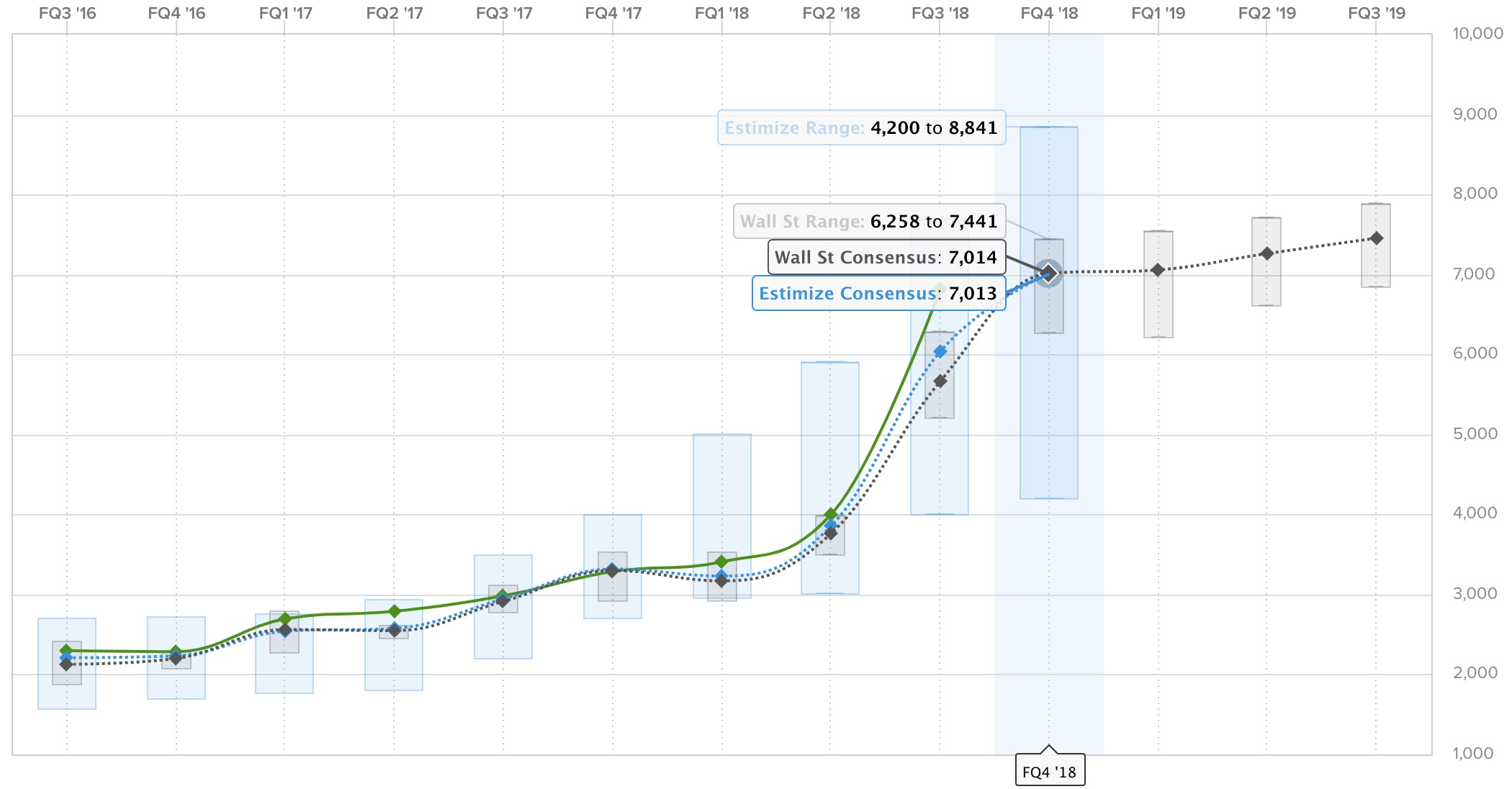

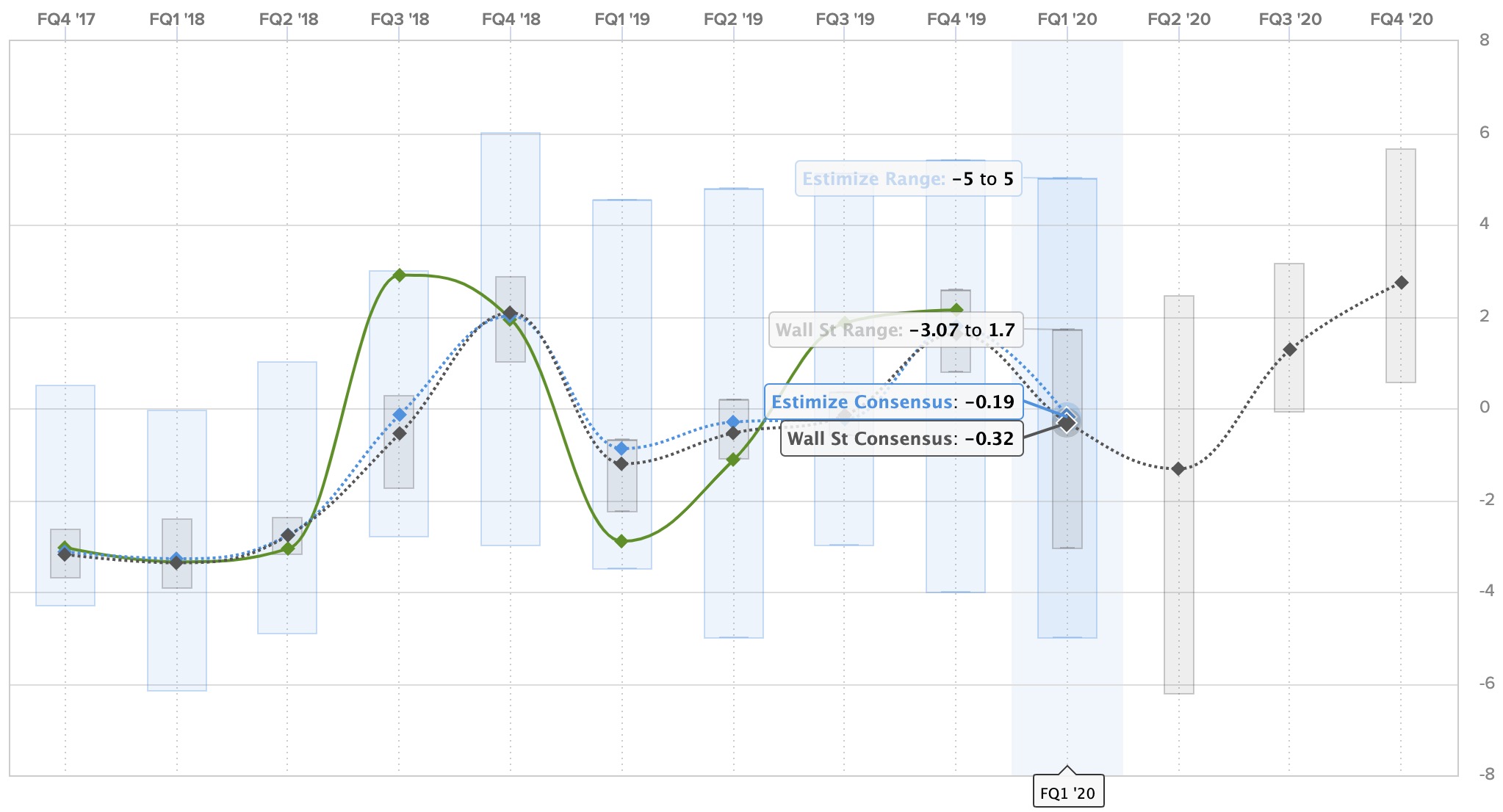

Tesla TSLA is about to release its Q4 earnings here s what to

TESLA STOCK PREDICTIONS What if TSLA drops more YouTube

Tesla TSLA Price Prediction Tesla Missed Earnings Do This NOW

Tesla Inc CDR Quote TSLA ADVFN

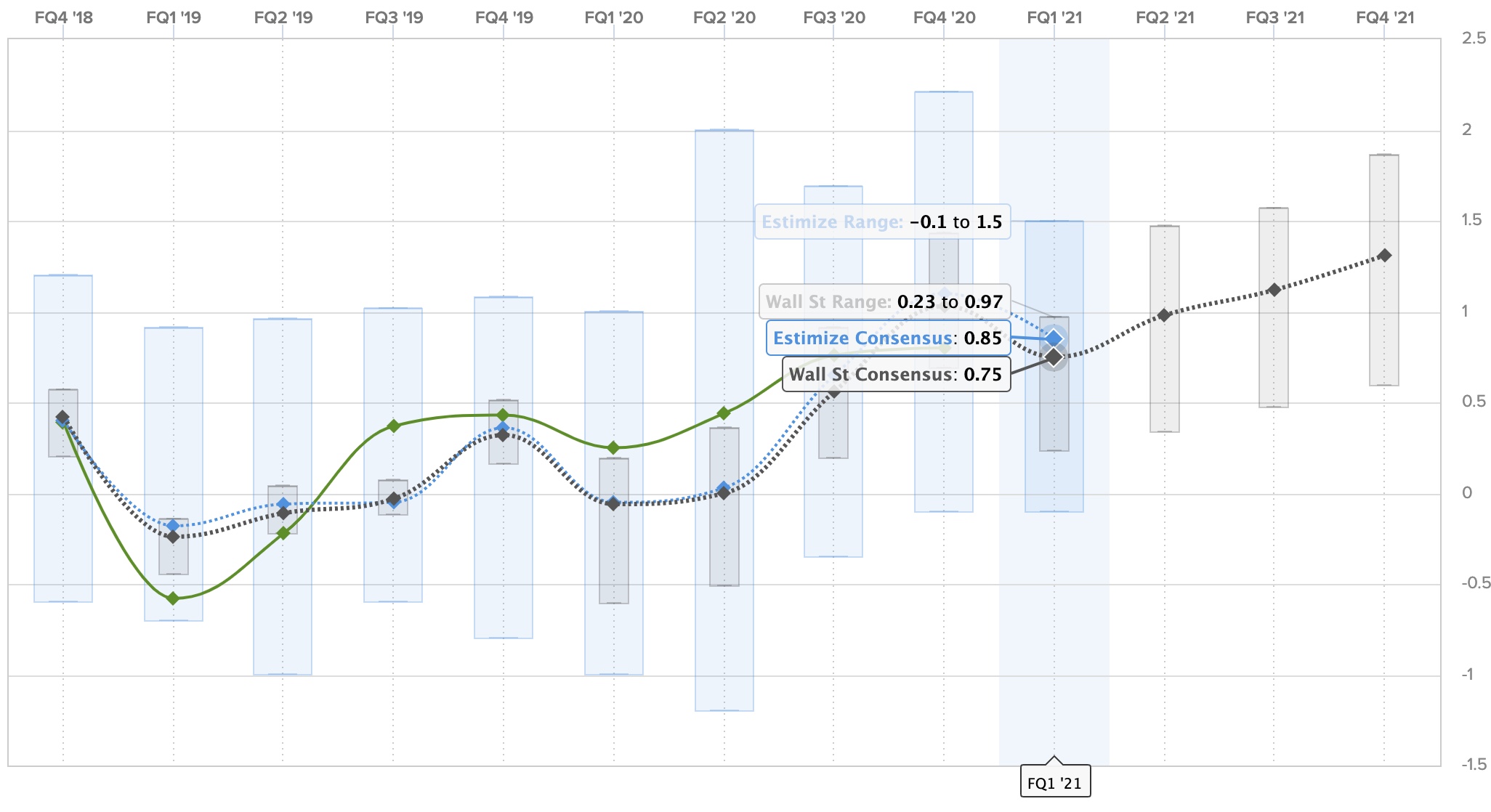

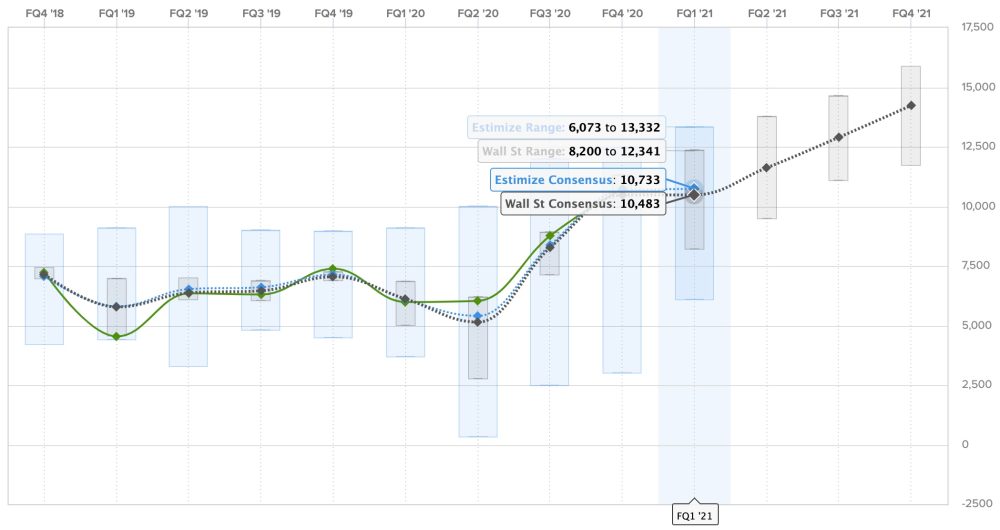

Tesla TSLA Q1 2021 earnings preview Here s what people are expecting

TESLA STOCK PREDICTIONS What to expect if TSLA drops YouTube

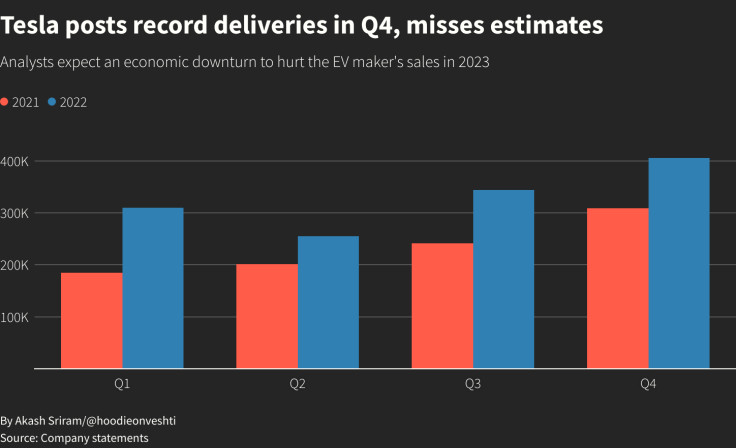

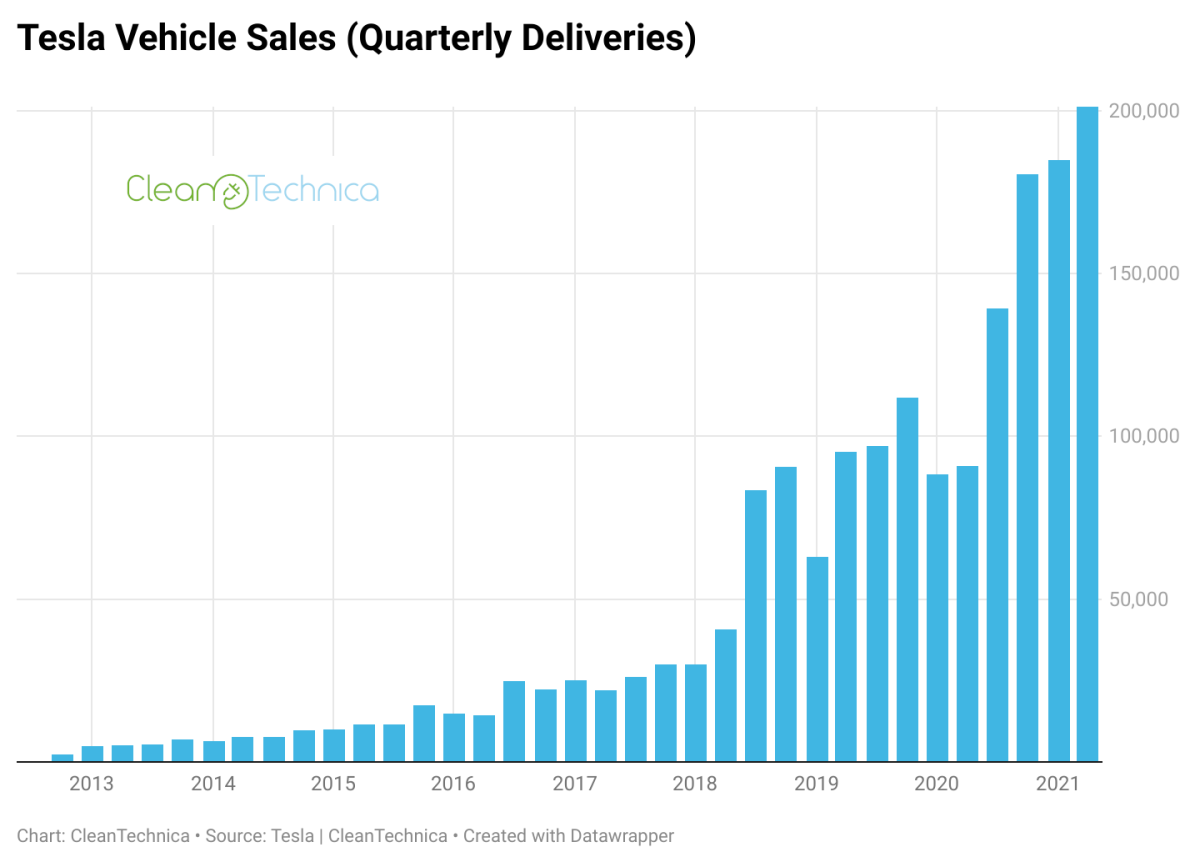

Tesla reports record quarterly deliveries but misses estimates

Tesla TSLA Stock Technical Analysis May 13th 2021 Tesla is bouncing

Tesla clocks record 4 05 lakh EV delivery in Q3 yet misses target HT

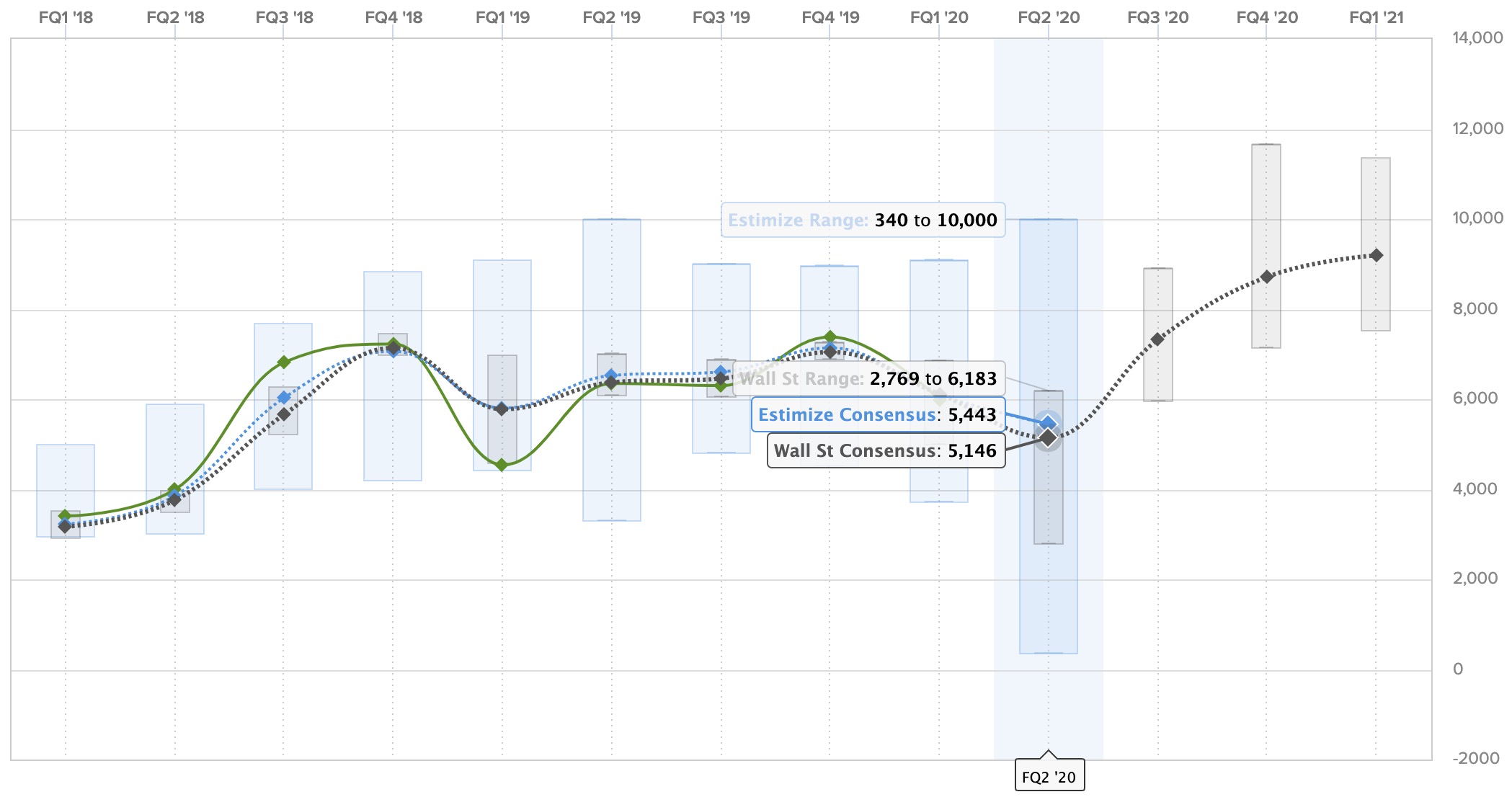

Tesla TSLA Q3 2020 earnings preview Expectations are high Electrek

TSLA Stock Tesla Poised to Surprise in Q2 Tesla Daily

TSLA Stock Tesla Poised to Surprise in Q2 Tesla Daily

Tesla Inc TSLA Stock Price News Quote amp History Yahoo Finance

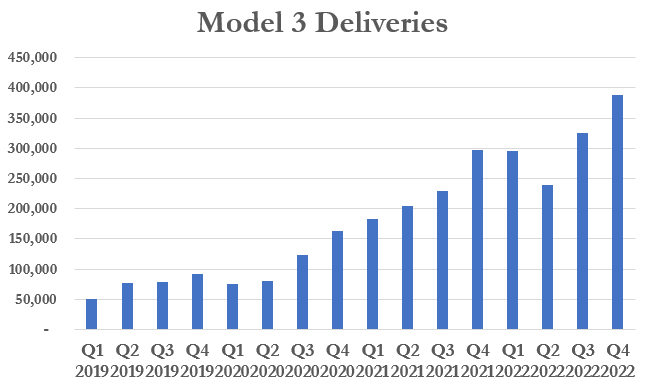

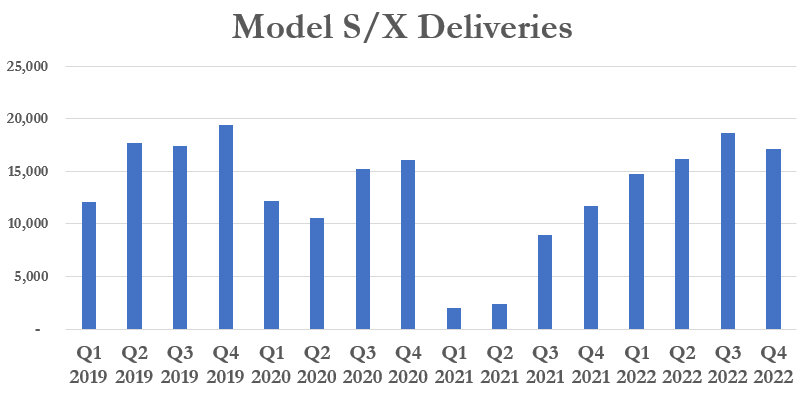

Tesla Delivers Record 405 278 Vehicles In Q4 2022 But Misses Wall

Tesla Misses and Melts Down Tsla Calls Options I Sold YouTube

TSLA TESLA May 26 Update Technical Analysis Chart YouTube

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla TSLA Stock Technical Analysis May 14th 2021 Tesla is resting

Tesla TSLA is about to release Q1 earnings here s what to expect

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla TSLA jumps after hours reports profit in Q3 2019 earnings

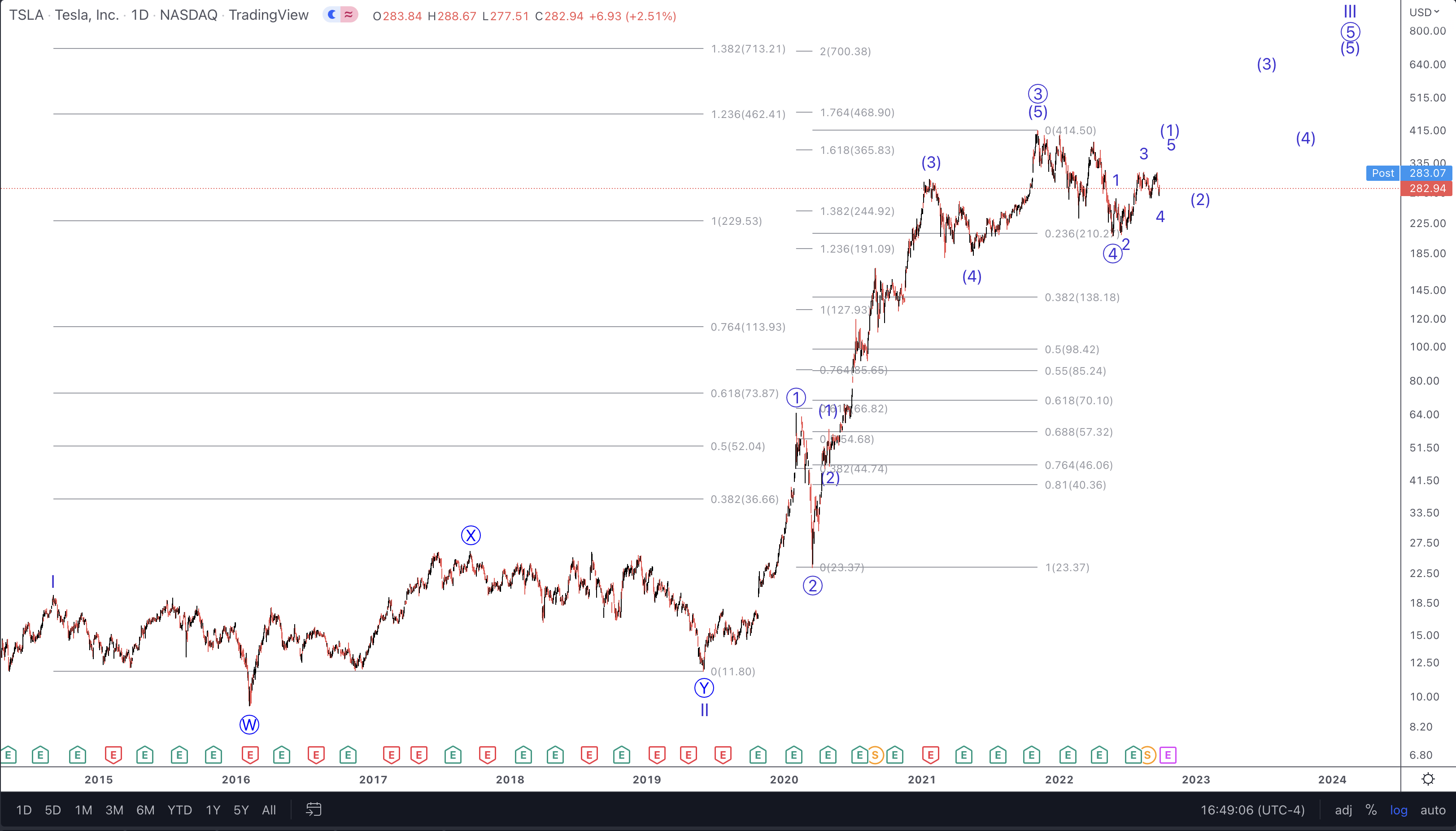

Tesla Inc TSLA Technical Analysis Bullish Trend Update Very

Tesla TSLA Analysis 02 03 2020 Will it stop YouTube

Tesla TSLA Q1 2021 earnings preview Here s what people are expecting

Tesla tops expectations but misses deliveries recap The Tell

Tesla reports record quarterly deliveries but misses estimates IBTimes UK

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla TSLA Q2 2020 earnings preview Electrek

Tesla misses 2022 Q4 target share price drops further Ars Technica

TSLA Stock Hits All Time High as S amp P 500 Expectations Rise Tesla Daily

Tesla reports record quarterly deliveries but misses estimates Mint

Why We Expect Tesla TSLA to Deliver Q4 Earnings Beat

Tesla Opens Door to Merge with Large Manufacturer TSLA

22Q4 Tesla delivery numbers are lower than expected Missed 2022

TSLA Price Predictions Tesla Stock Analysis for Thursday September

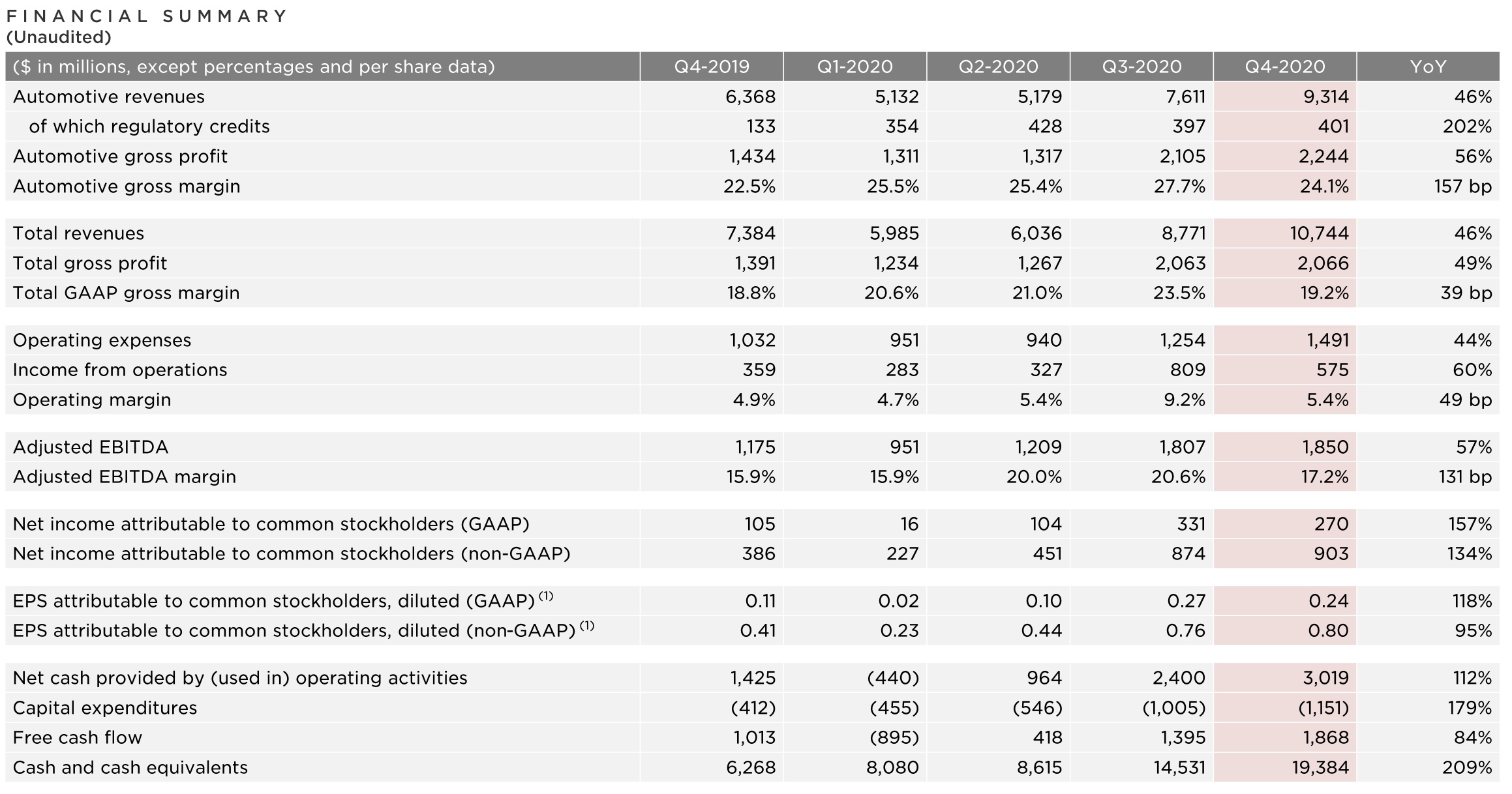

Tesla TSLA releases Q4 2020 results record revenue of 10 7 billion

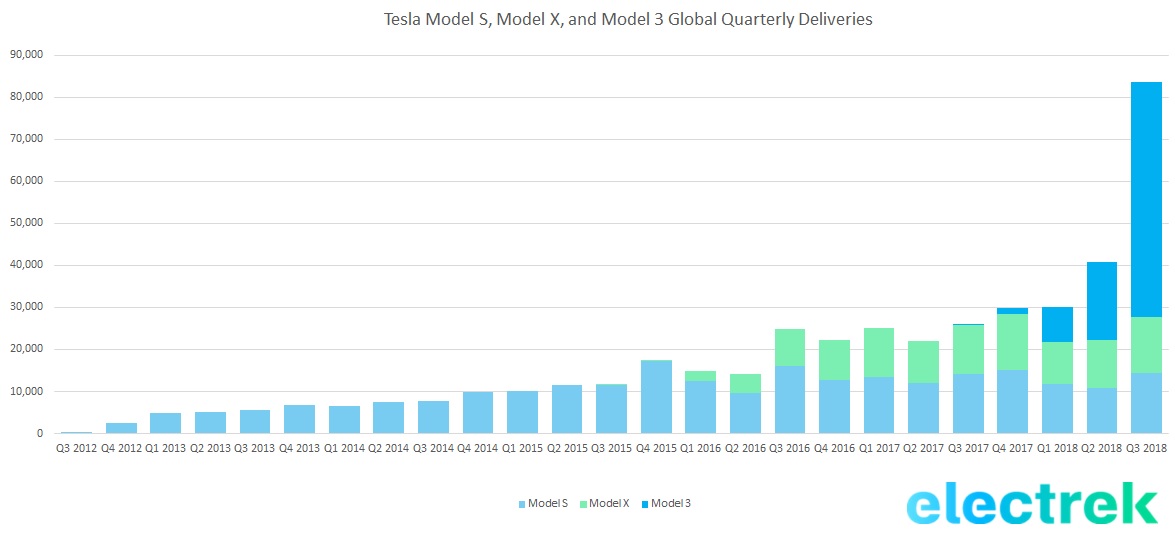

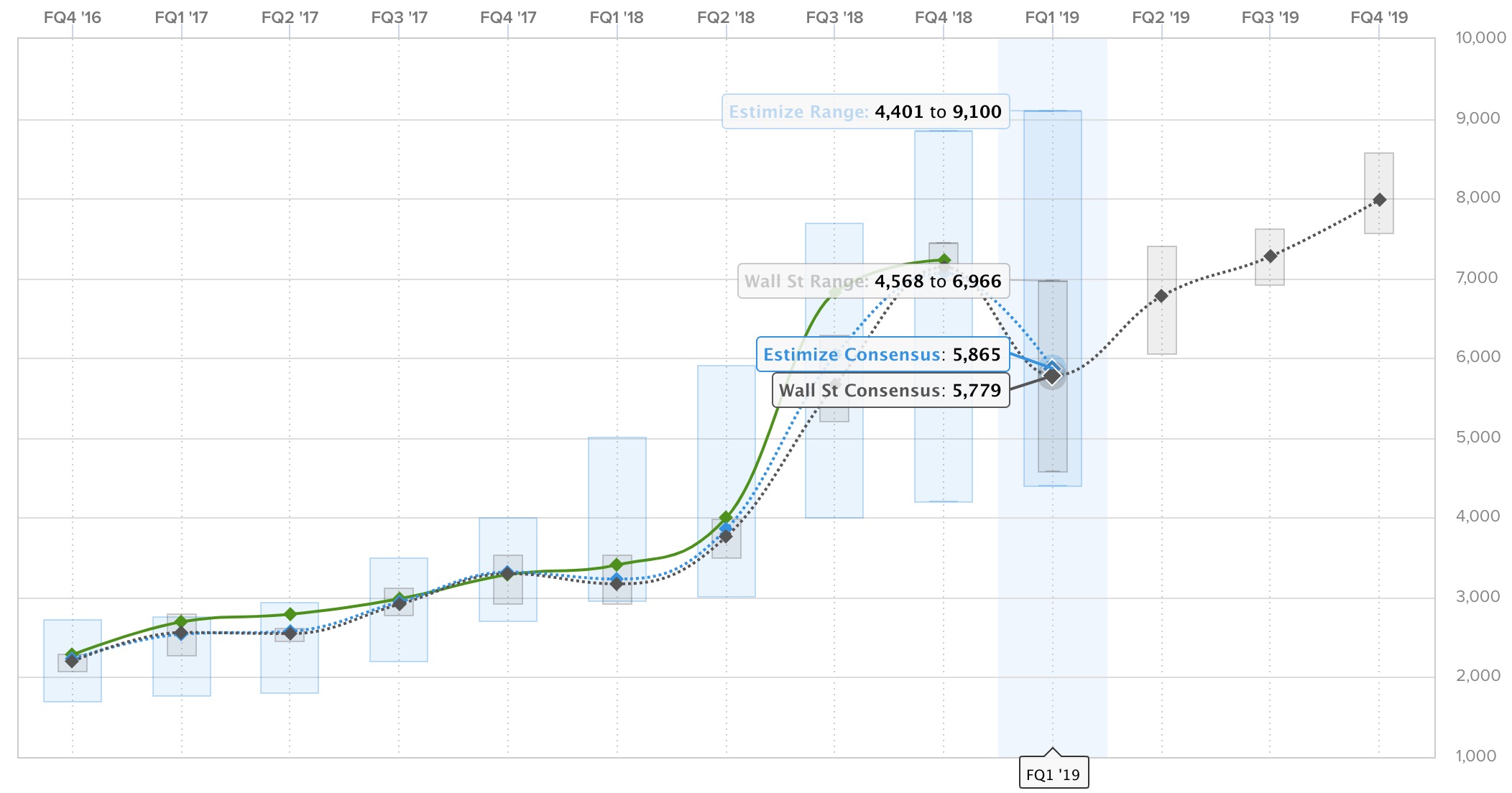

Tesla TSLA is about to release its third quarter 2018 results here

Tesla TSLA is about to release its Q1 earnings here s what to

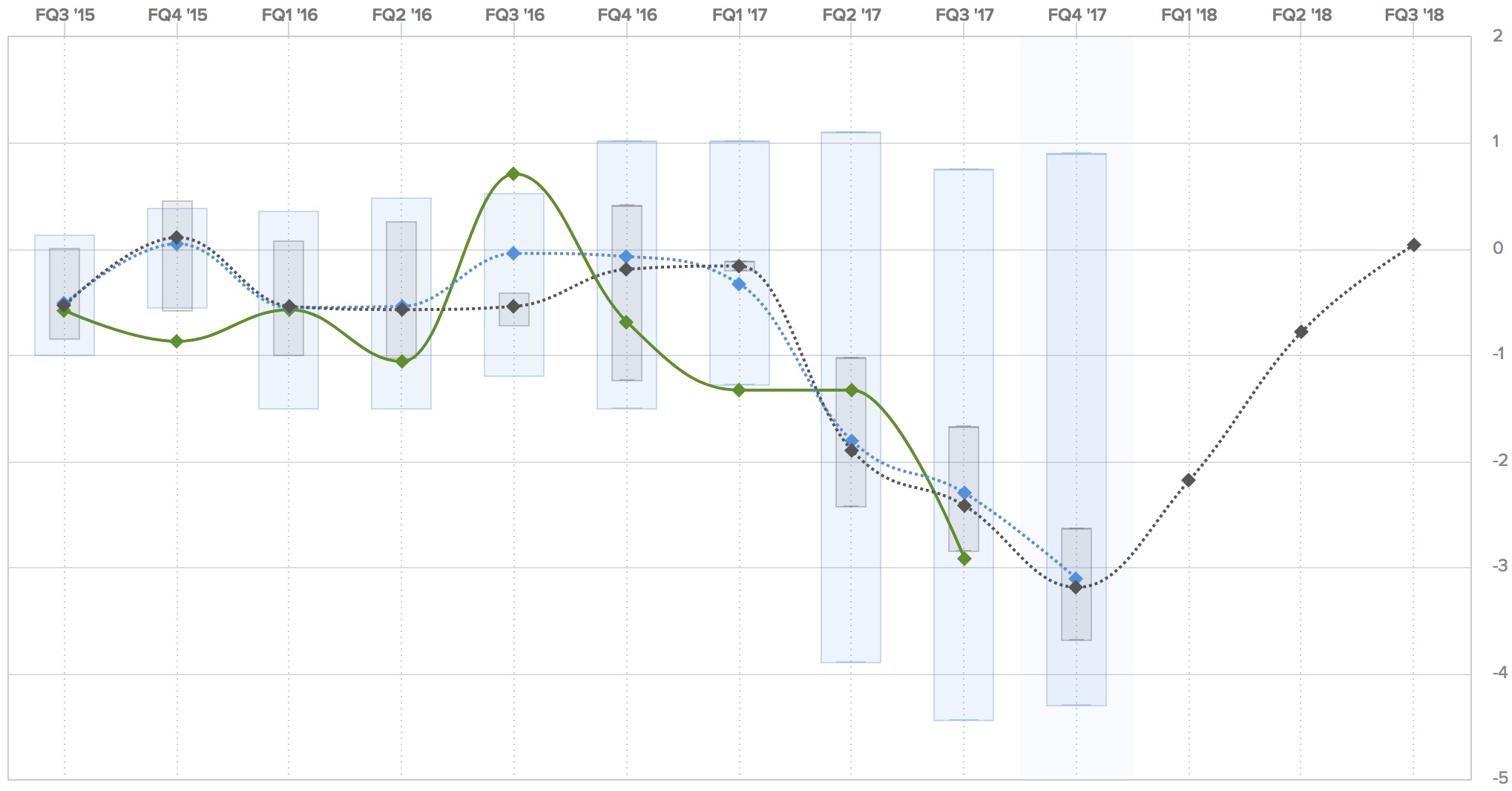

Tesla Q4 Consensus amp Expectations Updated TSLA Short Interest

Tesla TSLA releases Q4 2020 results record revenue of 10 7 billion

Tesla TSLA is about to release its third quarter 2018 results here

Tesla TSLA is about to release Q1 earnings here s what to expect

TESLA TSLA May 14 Update Technical Analysis Chart YouTube

Tesla TSLA is about to release its Q1 earnings here s what to

Tesla Q4 Consensus amp Expectations Updated TSLA Short Interest

Tesla Delivers Record 405 278 Vehicles In Q4 2022 But Misses Wall

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla Delivers Record 405 278 Vehicles In Q4 2022 But Misses Wall

Tesla Catch Me If You Can NASDAQ TSLA Seeking Alpha

Tesla Stock Analysis Why TSLA Is Dominating The Competition YouTube

Is Tesla TSLA Stock A Buy My Tesla Thesis amp Why I m So Heavily

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla TSLA Stock Review of a Leader Aug 29 2013 YouTube

Tesla TSLA is about to release its Q1 earnings here s what to

Tesla delivers 405 000 cars in Q4 but still falls short of expectations

Tesla Earnings Smashes Wall Street Expectations Gigafactory 3 Is

Tesla TSLA is about to release its fourth quarter 2017 results here

Tesla TSLA amp the Investment World the Perpetual Investors Roundtable

Tesla Exec In Employee Email Daily Model 3 Production Well Into The

Tesla tops expectations but misses deliveries recap The Tell

Tesla Is it Still a Buy Capital 19

How to short Tesla with options TSLA YouTube

Tesla Announces Q2 Earnings Date Tesla Daily

Valuation of the Week 1 A Tesla Motors Inc TSLA Test Insider Monkey

TSLA Weekly Analysis Tesla Stock YouTube

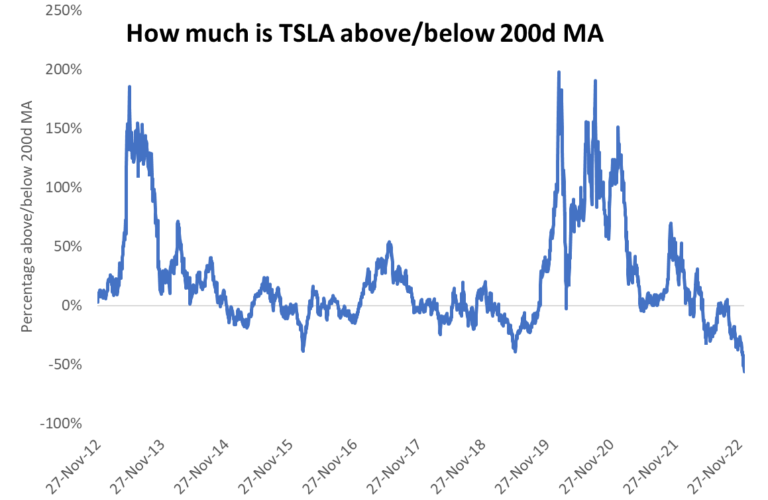

News Flash Big Advances Deserve Big Corrections and Proper Perspective

Tesla tops expectations but misses deliveries recap The Tell

Tesla Tsla Misses Consensus Expectations With 405278 Units Delivered In Q4 2022 Upcoming Catalysts Could Pave The Way For Troubled Inventory Recovery - The pictures related to be able to Tesla Tsla Misses Consensus Expectations With 405278 Units Delivered In Q4 2022 Upcoming Catalysts Could Pave The Way For Troubled Inventory Recovery in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cdn.vox-cdn.com/uploads/chorus_image/image/69274037/GettyImages_1232815520.0.jpg)