Tesla s China Deliveries Rebound in August on Price Cuts Caixin Global

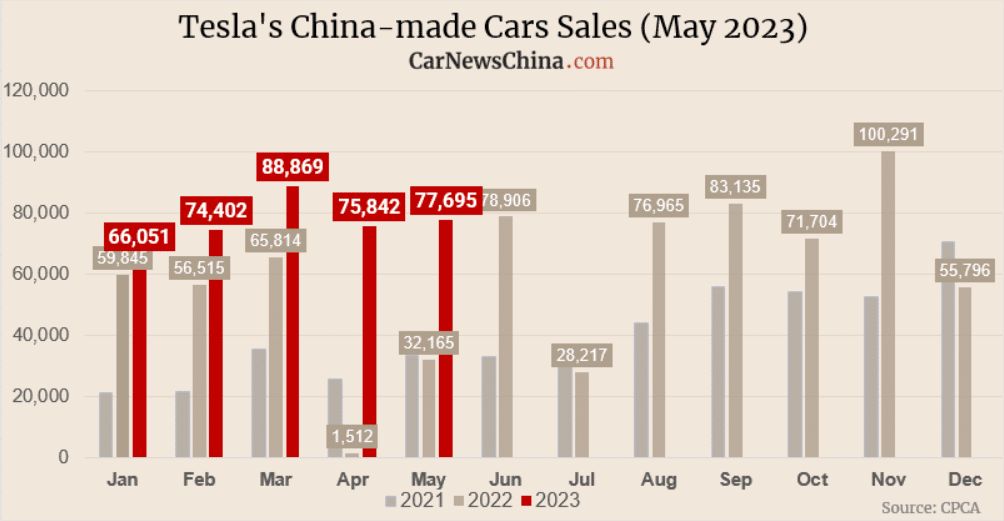

Tesla Records Modest Recovery in China Sales After Huge Price Cuts as

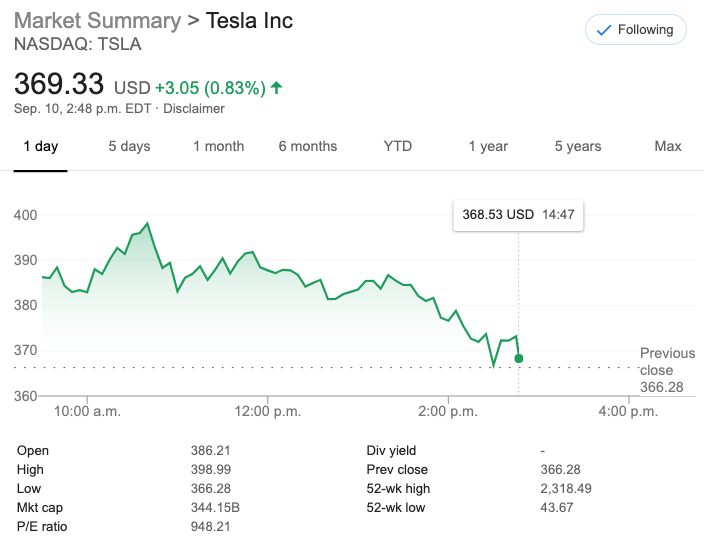

Can Tesla Stock Rebound To 1 000 Levels Again NASDAQ TSLA Seeking

Tesla shares rebound after selloff briefly took valuation below 1

Indonesia s Sustainable Modest Fashion Show helps designers rebound

Tesla Model S China Sales Robust Electric Car Waiting List Long Analyst

Watch Leaked Tesla Email China Numbers Rebound Production Report

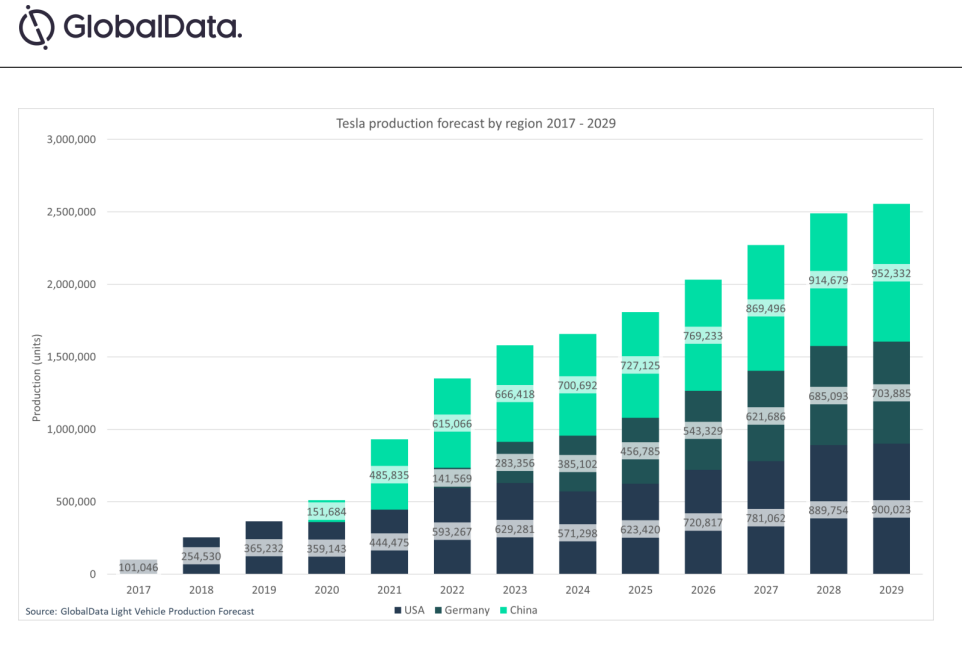

Tesla Sales Revenue amp Production 2023 Complete Statistics

Tesla s stock is headed for its worst month quarter year on record

China property sales rebound 13 1pc in November amid easing measures

Tesla China sales reach 35 478 units in March up 94 from February

Tesla Shares Rebound Over the Past Two Days Winning Back Some Gains

Retail industry sees modest rebound

Tesla amp The Minions China EV Sales Report

Tesla stock climbs into record territory on rebound in Chinese sales

Tesla Stock REBOUND COMING TSLA STOCK price prediction SPY TSLA

Tesla Stock Rebound amp Media Manipulation Byton M Byte Interior Final

Tesla TSLA Stock Up 12 58 amid United States Tech Rebound

Analysts predict Tesla Model 3 sales in China to hit 150 000 in 2020

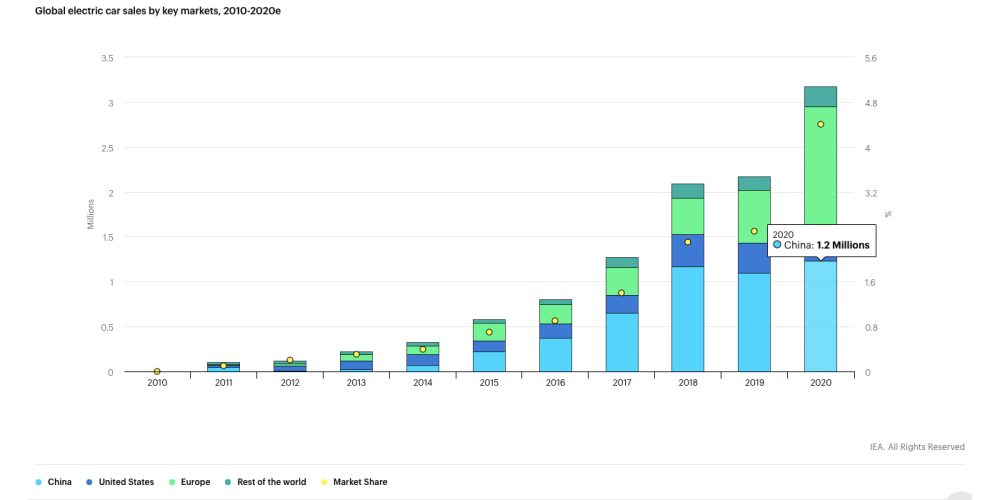

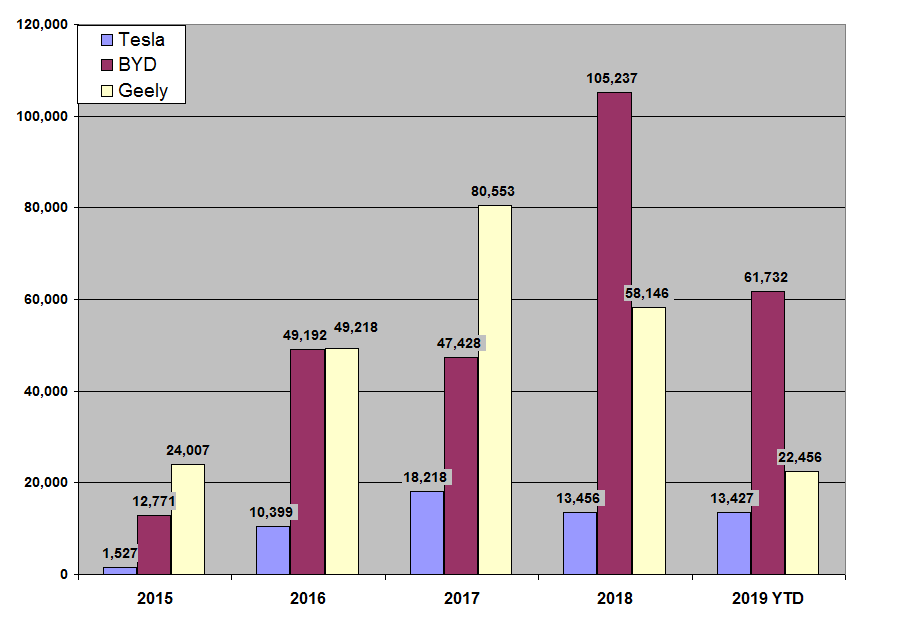

Tesla competitors growing in China NIO Xpeng and more Electrek

Tesla Posts Massive First Quarter Loss After Self Driving Car Absconds

Tesla Model 3 Shines In Disrupted Market China EV Sales Report

Pin on Economic Perceptions of China

Global finance leaders hopeful for modest rebound in 2020 CityNews

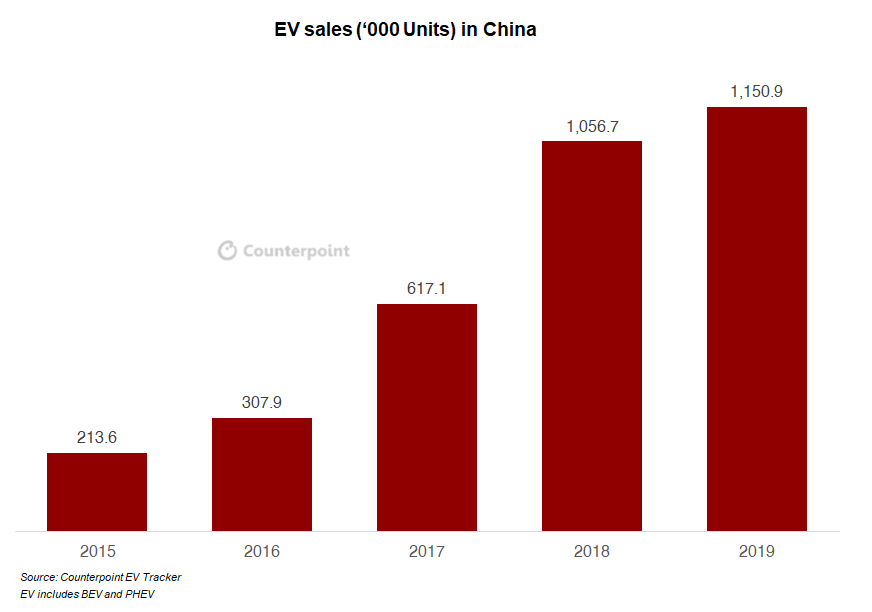

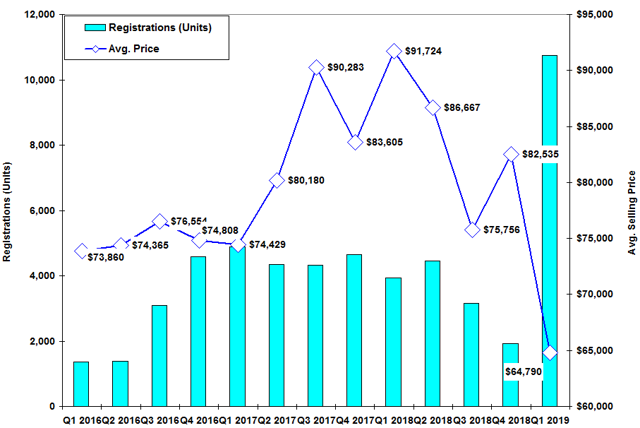

EV sales in post lockdown rebound

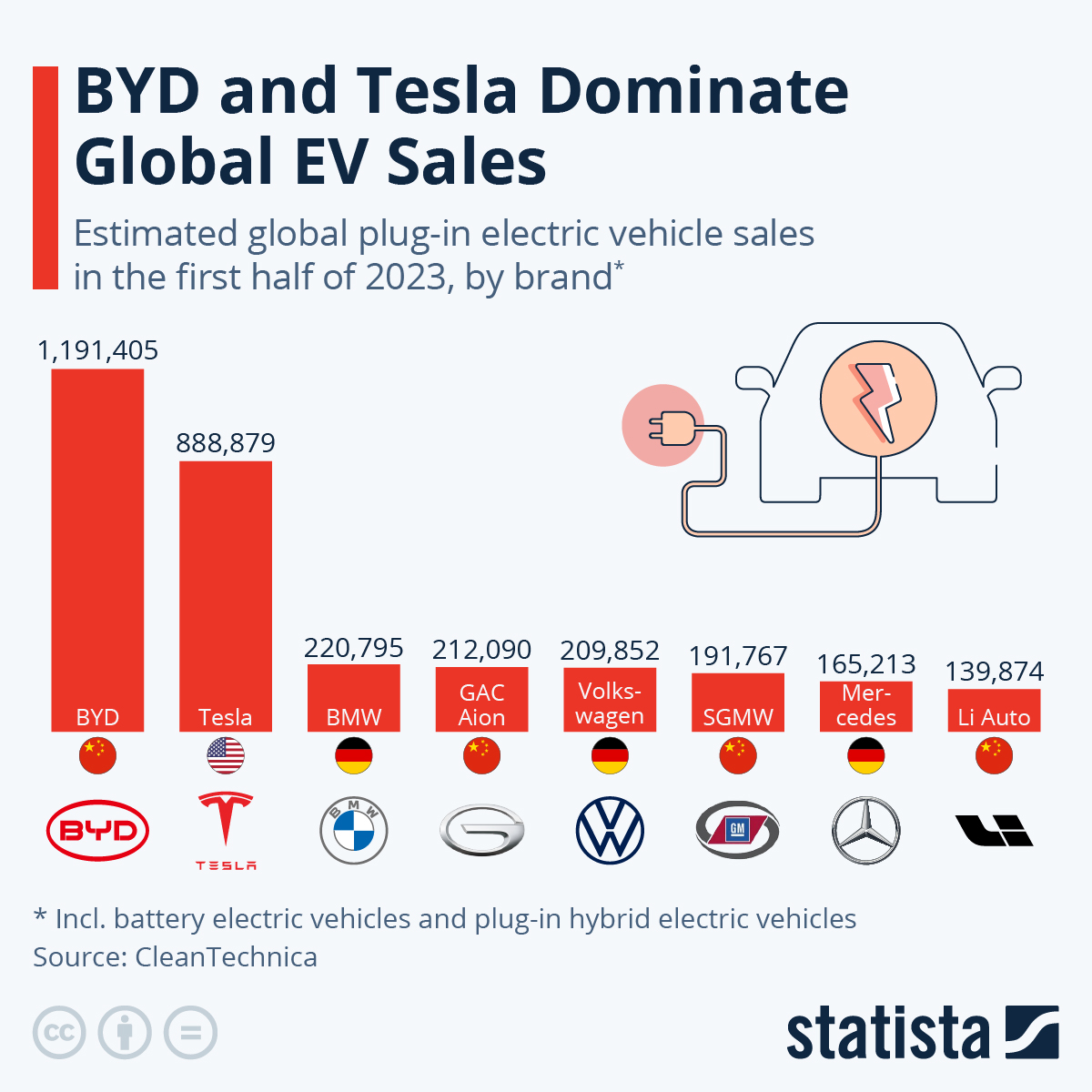

BYD and Tesla Rule The EV Roost

Tesla Why China Poses High Risks Tesla Inc NASDAQ TSLA Seeking

China auto sales rebound in June after weak first half Taipei Times

Trading Tesla as China Sales Plunge

China units modest 6 financial progress goal amid COVID rebound

Tesla Why China Poses High Risks Tesla Inc NASDAQ TSLA Seeking

Tesla posts net profit for fifth straight quarter

May could be Tesla s Rebound Month YouTube

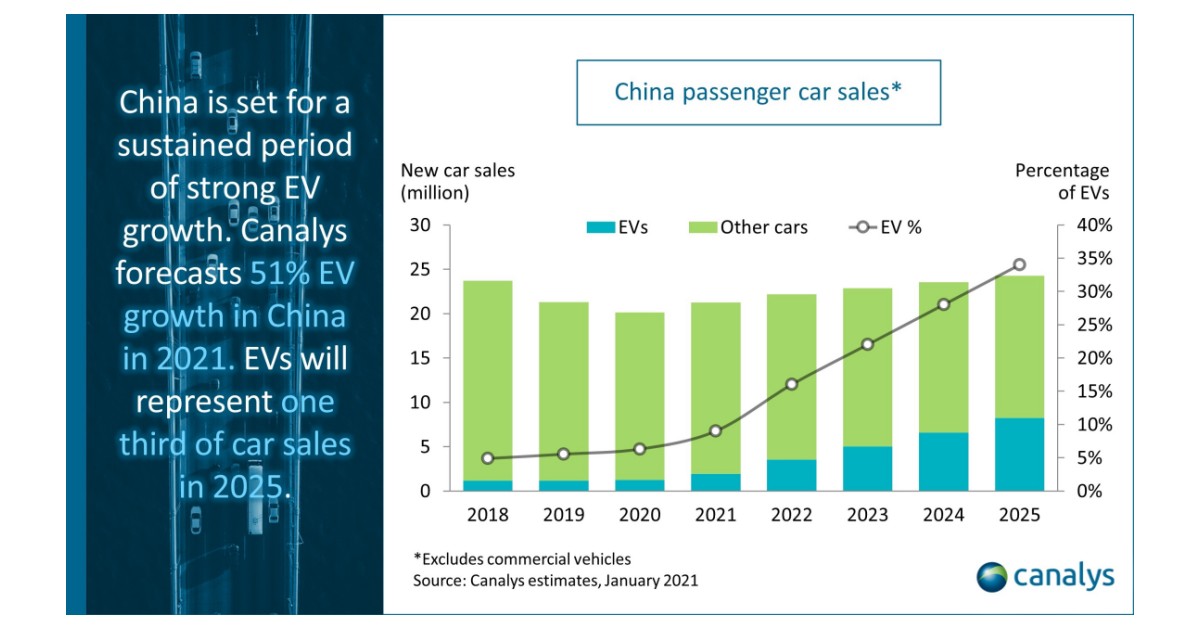

Canalys China s electric vehicle sales to grow by more than 50 in

When Will Tesla Stock Rebound YouTube

Top All Electric Car OEMs In Q2 2022 BYD Approaches Tesla

NAB tweaks rates outlook as business conditions book modest rebound but

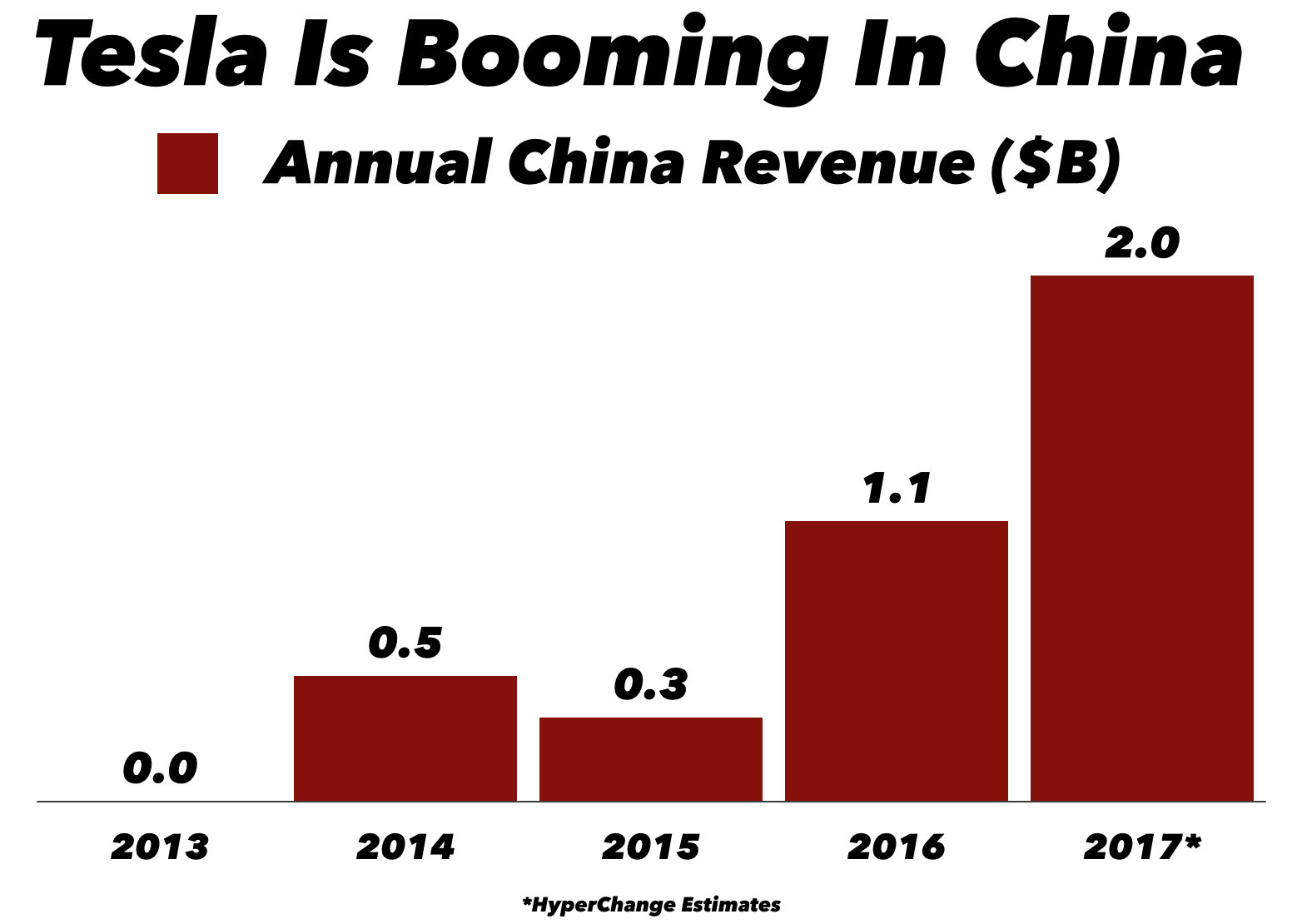

Tesla In China A Mega Opportunity Tesla Inc NASDAQ TSLA

Tesla sales expected to increase in China WattEV2Buy

Tesla Stock REBOUND BUY NOW Robinhood Investing Tesla Stock

Global finance leaders hopeful for modest rebound in 2020

Rebound Schmidt Rebound Hammer Test with Engineering Plastics Case Standard

Proceq Rebound Hammer Digital at Rs 220000 Schmidt Hammer in New

Is The Modest Rebound In Commercial Lending Sustainable The Capital

after a historic drop in demand a modest rebound expected in 2021

Further Reading Owners explain why they chose HiPhi China s highest

U S Sales Record Modest Rebound in May WardsAuto

U S Sales Record Modest Rebound in May WardsAuto

JD com Delivers Strong Topline Results Hong Kong listed Internet

GM China sales decline again in 2020

Proceq Rebound Hammer Digital Schmidt Hammer Swiss Hammer

2021 Estimating Tesla Sales In China MaxedOutMama Seeking Alpha

Jobless claims goods orders signal modest rebound oregonlive com

Tesla posts 700M Q1 loss Equity Insider

Stocks Post Modest Rebound on August 26 Here s Why It May Continue

Smartphone sales see modest rebound after two year slump Arab News

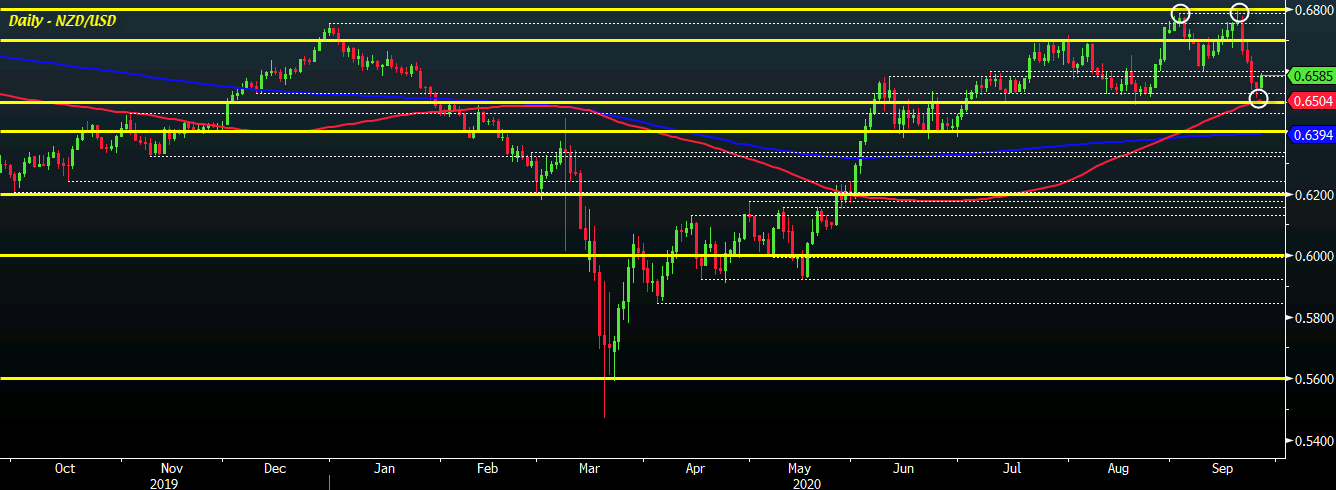

NZD USD extends modest rebound from overnight trading what s next

Tesla Rebound Softbank Kehilangan USD 12 Miliar

Tesla Posts First Full Year Profit Will Pursue Increase in Output

UK house prices experience modest rebound in July Financial Times

US Housing Starts Posts Modest Rebound In September IBTimes

Rebound Hammer For Industrial Rs 12500 piece Instrumentation ID

Good prospects for China economy

Schmidt Concrete Testing Rebound Hammer Schmidt Concrete Testing

Schmidt Concrete Testing Rebound Hammer Schmidt Concrete Testing

China s factory rebound eases one big fear about global outlook Moneyweb

BMW Daimler look to rebound from China sales slide Automotive News

Chinese rebound plods on MacroBusiness

How China Rebound from Covid 19 Crisis

Competition hollows out US supply base in race to bottom

Chinese rebound plods on MacroBusiness

A Historic Rebound for the Housing Market

China s Car Sales Log Second Month of Nearly 40 Rebound CPCA Says

ONLINE CIVIL ENGINEERING SCHMIDT REBOUND HAMMER TEST

House building recovery after snow disruption underpins modest

Tesla Posts Modest Rebound In China Sales After Massive Price Cuts As Elon Musks Secured Financing Trial Begins - The pictures related to be able to Tesla Posts Modest Rebound In China Sales After Massive Price Cuts As Elon Musks Secured Financing Trial Begins in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/34H5H2PUQFIWRHA3BHYFHBHUDM.JPG)