Election results Republicans keep Senate majority Vox

Midterm Elections Results Latest Updates Show Democrats Blue Wave

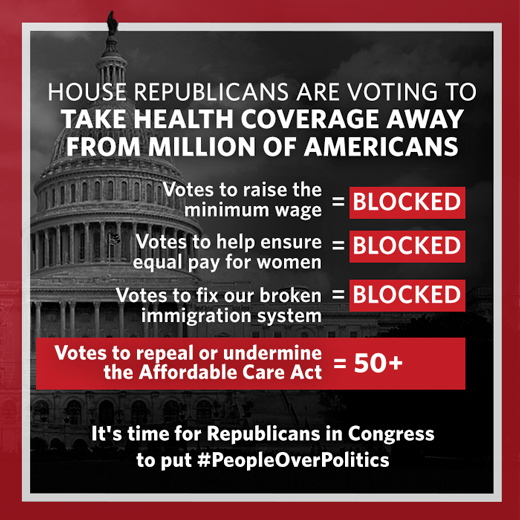

House Republicans Win Battle In Major Legal Challenge To Obamacare

Ex GOP Congressman Slams Republicans Illiterate Defense of Trump

House Republicans Win Anti Semitism Vote on Education Bill 162

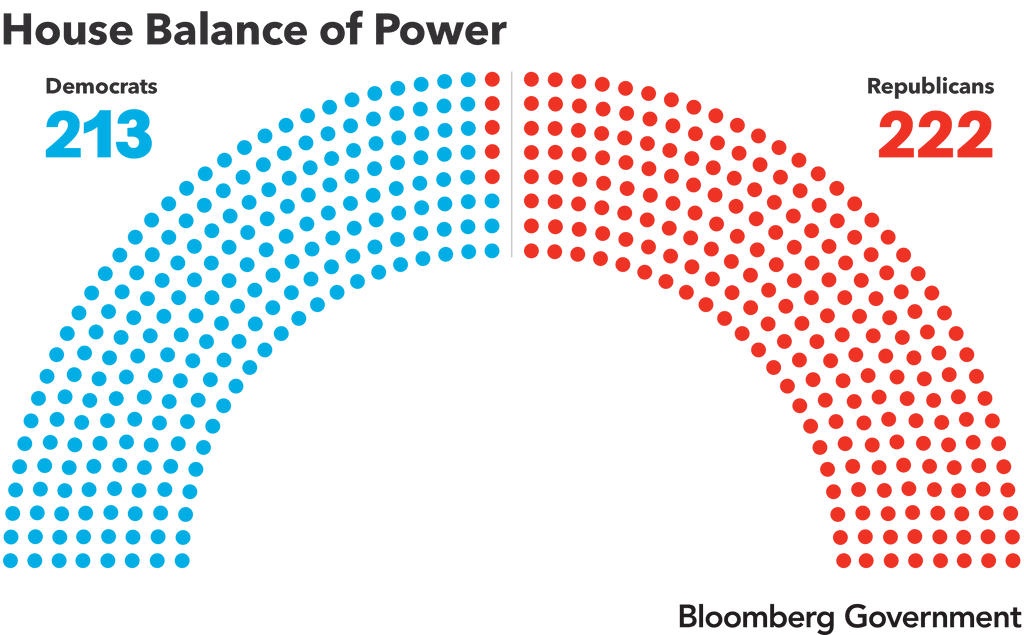

Republicans win 2 more years of House control

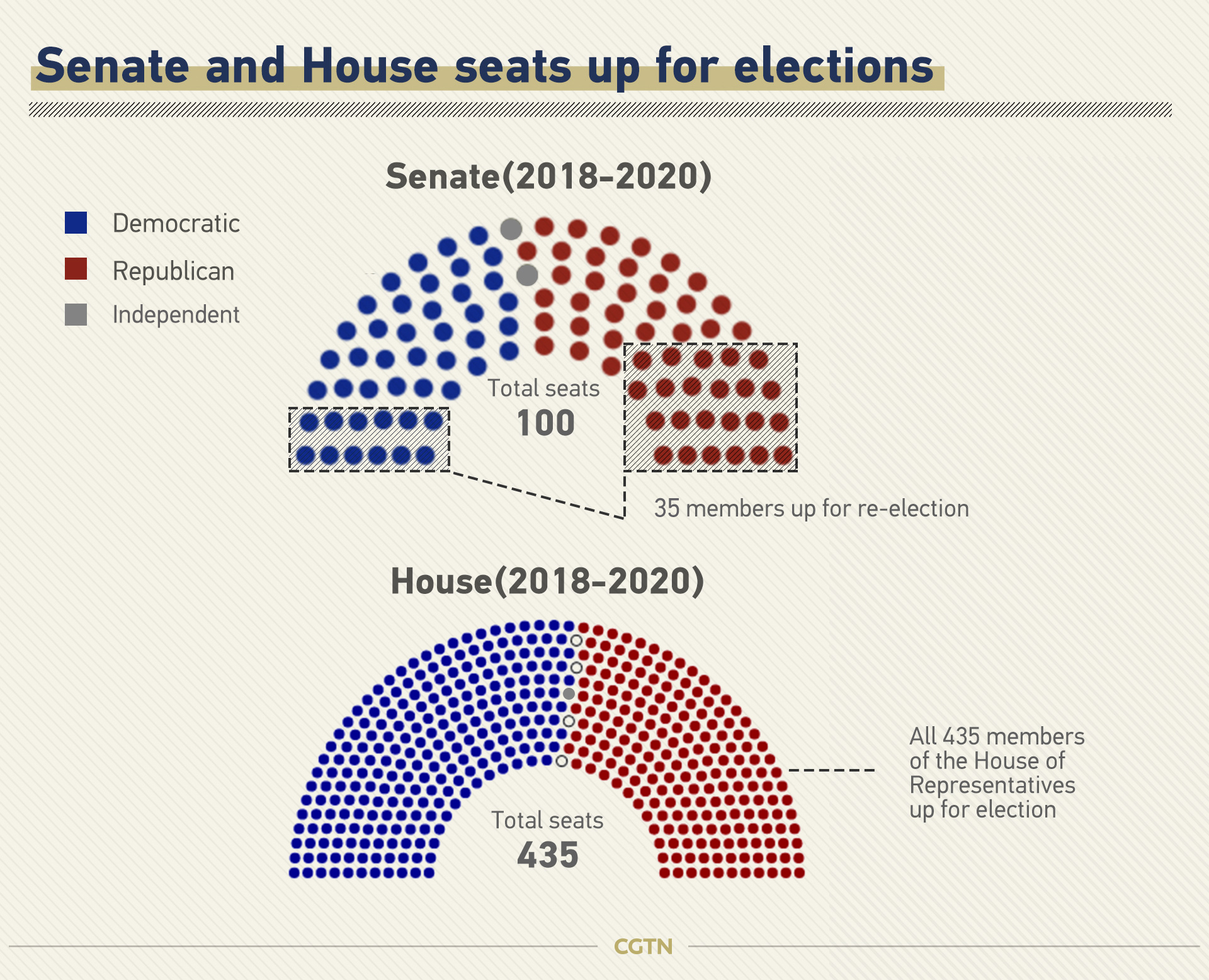

US Democrats win House Republicans keep Senate World News

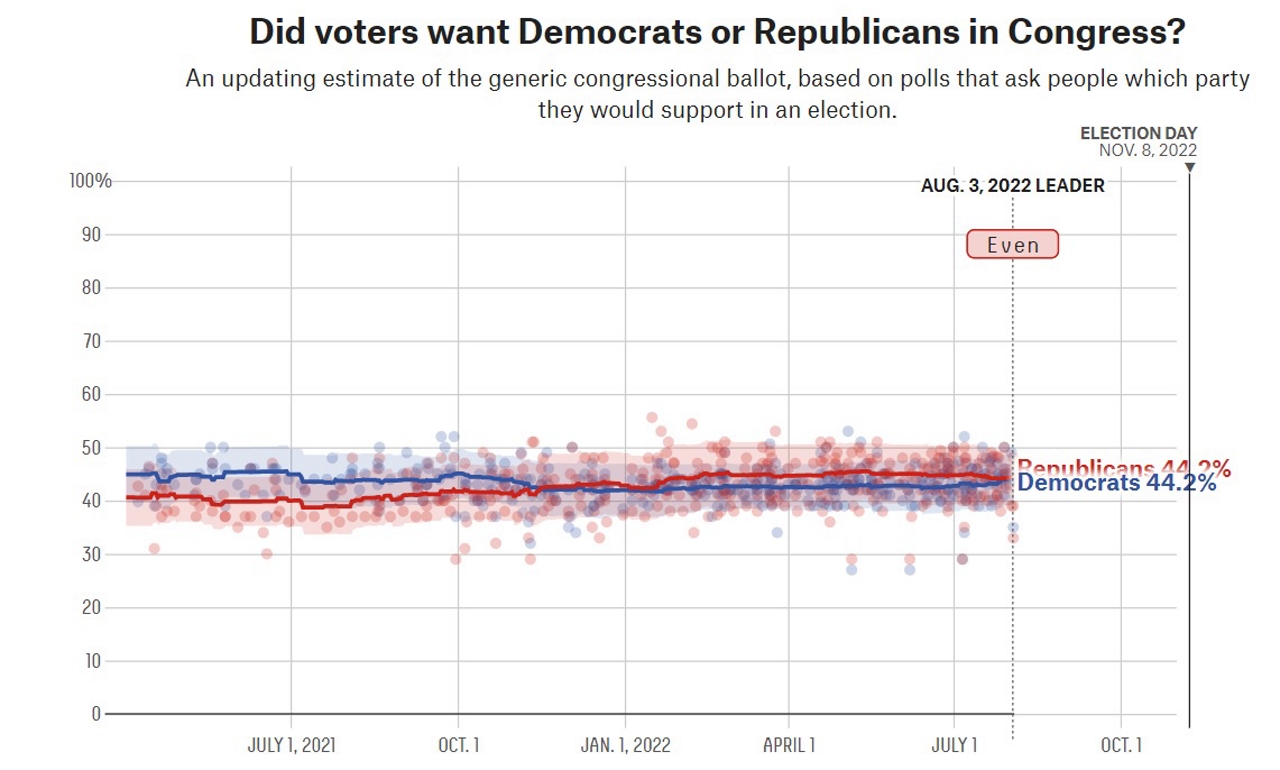

Final Forecast Republicans Are Favored To Win The House FiveThirtyEight

How Many Seats Did Republicans Gain In The House

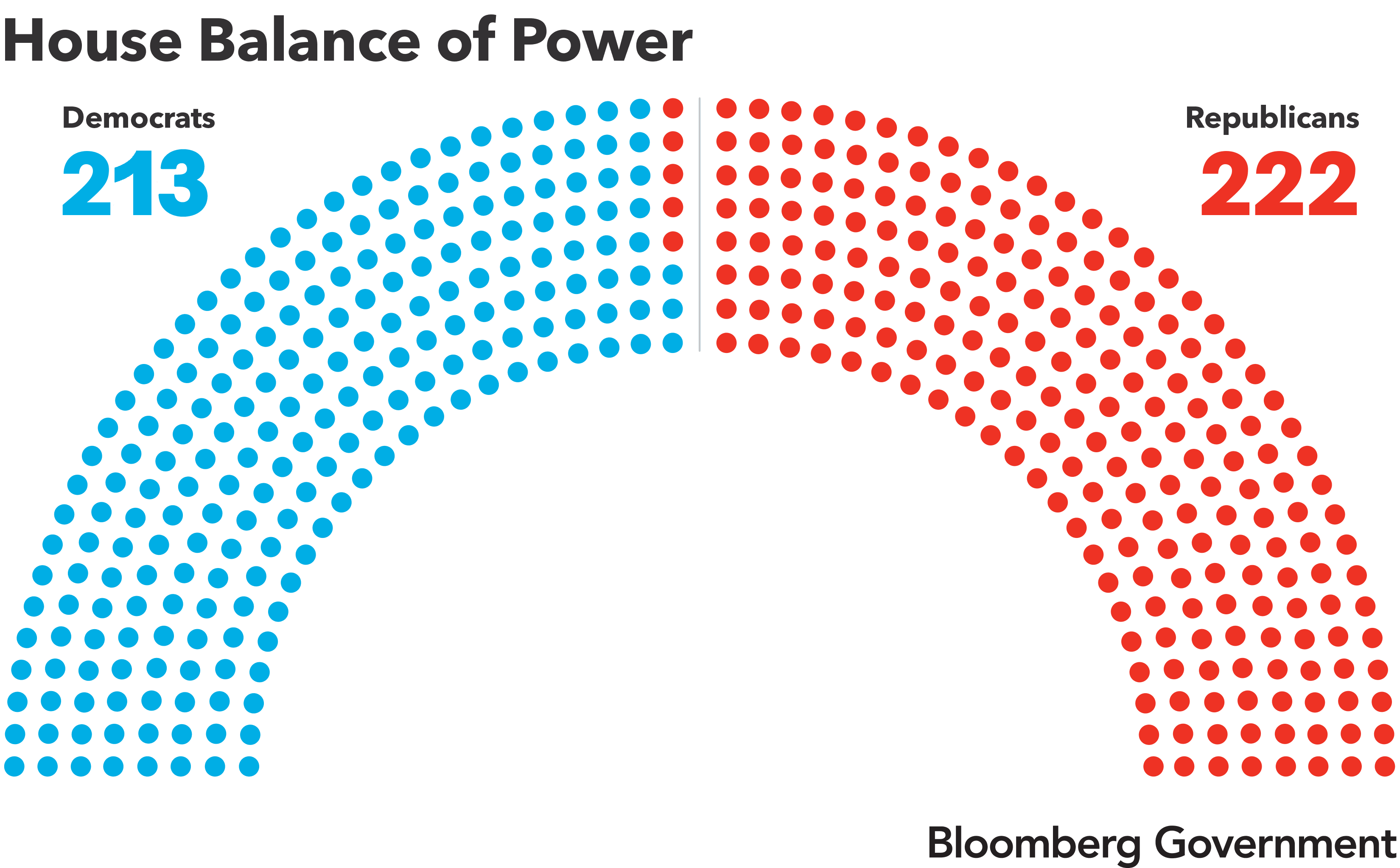

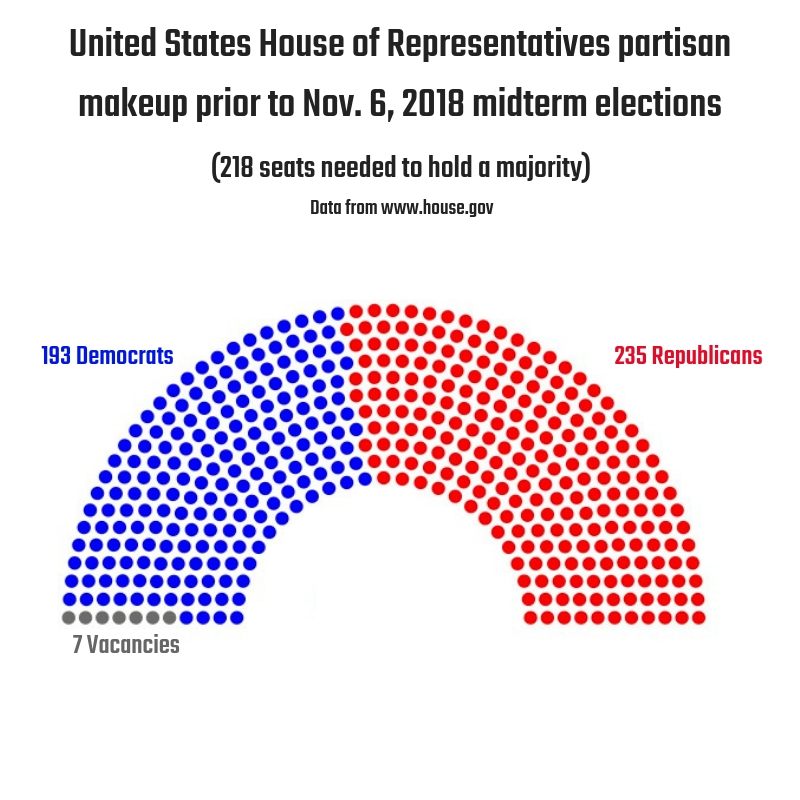

Congressional Balance of Power Republican Majority the House

US Midterms Republican Party Win Majority in House of Representatives

House Republicans threaten to push U S into default unless health care

US Republicans win House gain in Senate

Republicans say they can win state House MPR News

Why Did House Republicans Storm an Impeachment Hearing Rolling Stone

House Republicans should ask themselves Was it worth it Business

The Caucus Blog of the Illinois House Republicans Dems Reject

Republicans expand majority in Kentucky s House Senate

DEAD HEAT Democrats Tie GOP in 538 Congressional Average

What do Republicans have against secure elections The Washington Post

The Caucus Blog of the Illinois House Republicans Dems Reject

Republicans expand majority in Kentucky s House Senate

Will 2022 Be A Good Year For Republicans FiveThirtyEight

Congressional Balance of Power Republican Majority the House

DEAD HEAT Democrats Tie GOP in 538 Congressional Average

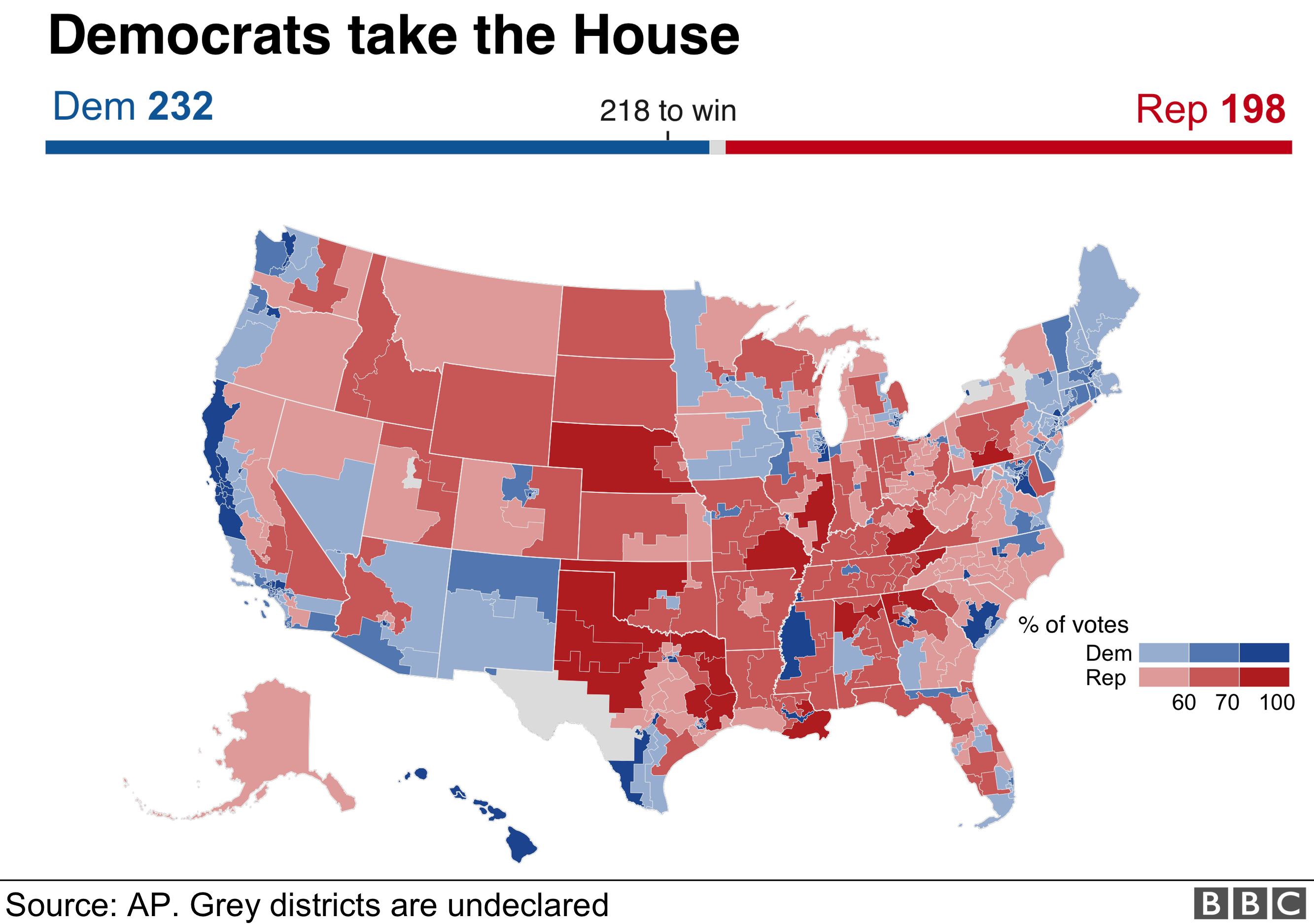

Democrats Win Control Of U S House Republicans Gain Seats In Senate

What do Republicans have against secure elections The Washington Post

Average IQ Of Democrats Vs Republicans Best Guide

Election Results Balance of Power Shifts as Republicans Seize Senate

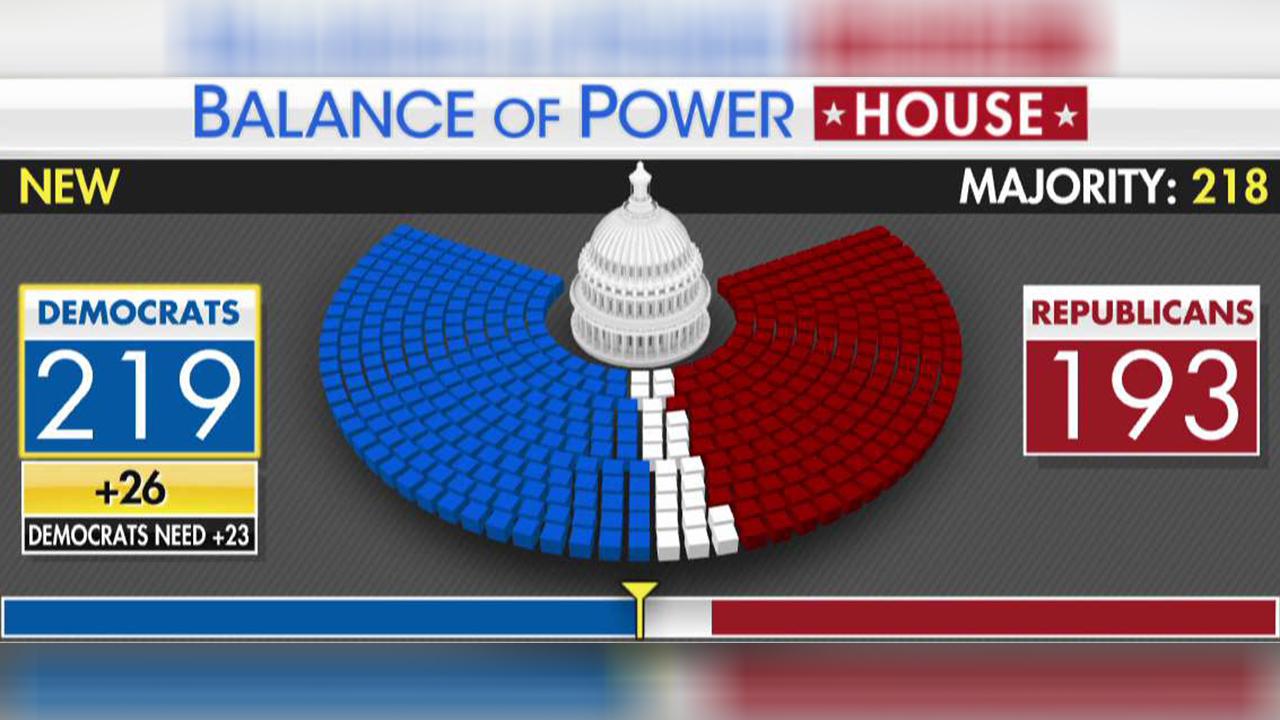

Fox News Voter Analysis Democrats win the House Republicans gain

Senate races How Democrats can win a majority from the Republicans

Pollster says Republicans Democrats did not do effective job laying

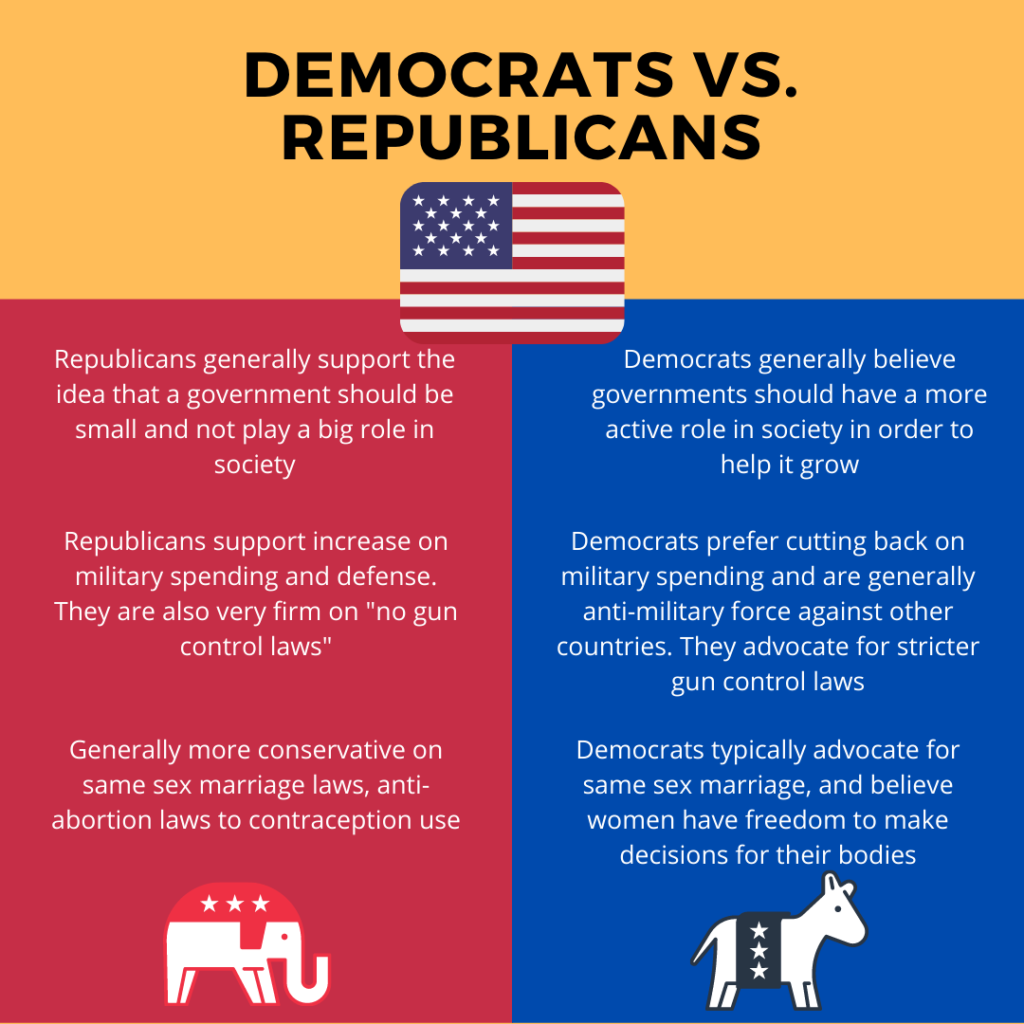

Democrats vs Republicans Explained In 5 Minutes US Politics Summary

House Republicans Elect Leaders for the 116th Congress C SPAN org

10 reasons why the Republicans will struggle to win the White House CapX

Republicans vs Democrats When It Comes To VA Scandals Do You Think

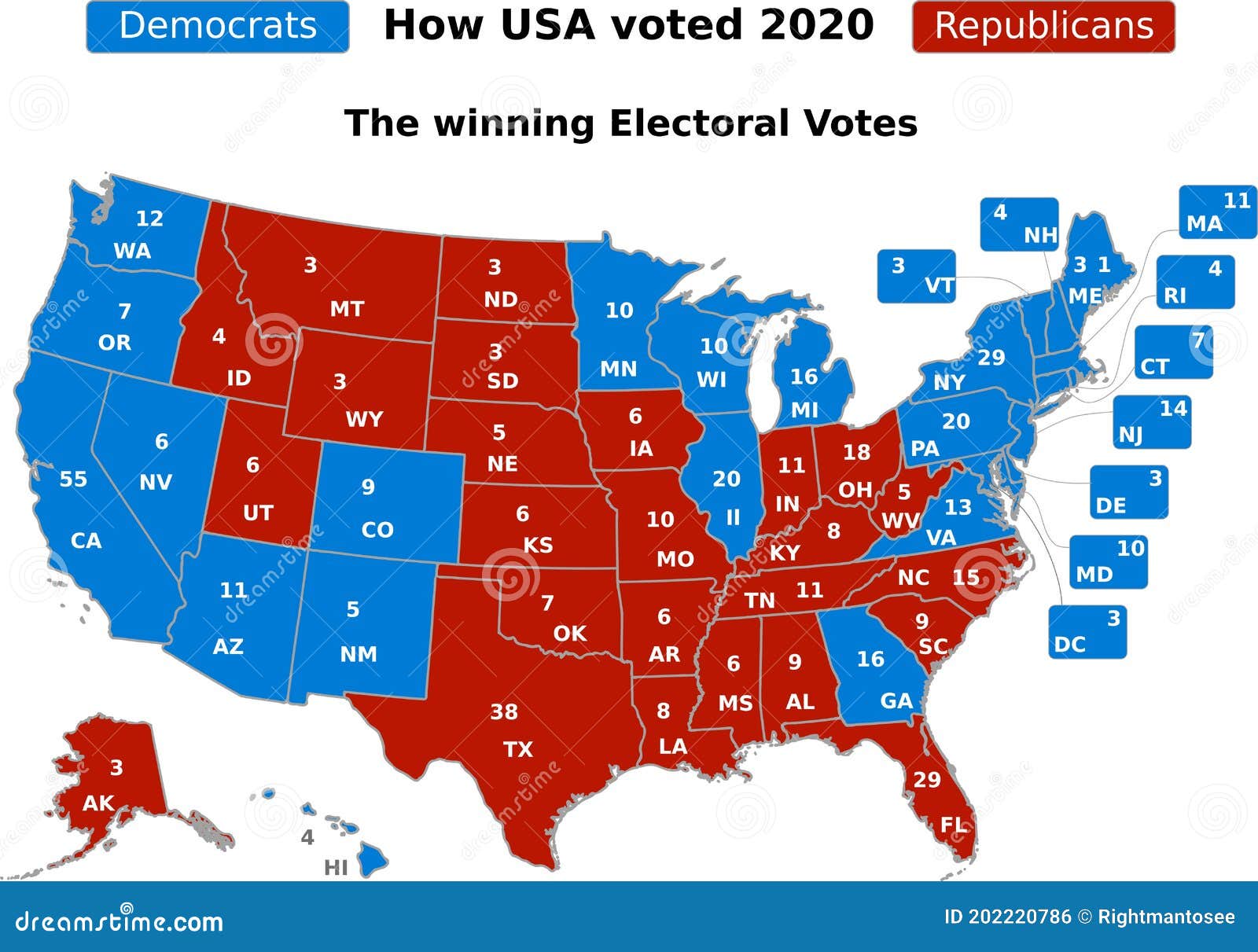

Bitesize Guide The People amp The Political Parties in the 2020 US

More Insanity Do Nothing Republicans Expected To Gain Seats in House

Fox News Voter Analysis Democrats win the House Republicans gain

Republicans maintain control of both houses of Congress VICE News

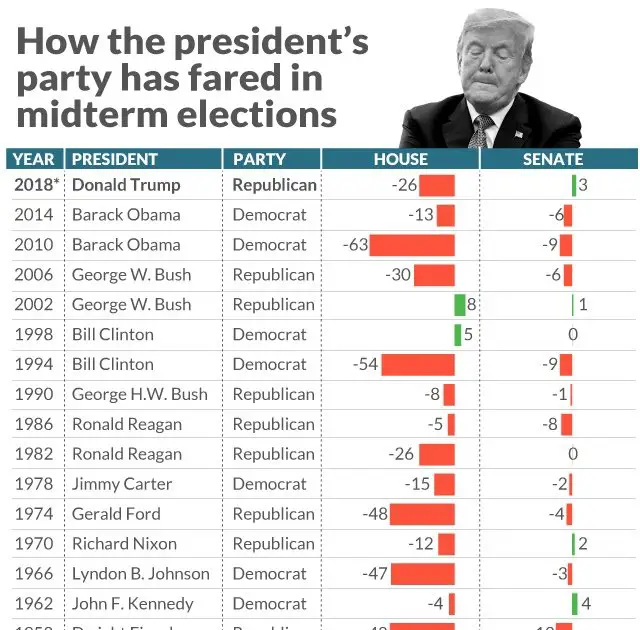

US mid term election results 2018 Maps charts and analysis BBC News

Just How Bad an Election Night Was It for California Republicans The

US Elections 2022 US House results The Economist

Republicans gain control of U S Senate CTV News

Republicans gain seats in Assembly win special Senate election in

Why Republicans likely won t take back the House YouTube

Republicans Win Big in 2014 Midterm Elections HMH In The News

Democrats keep House majority but Republicans defied the odds ABC News

Republicans Win Big in 2014 Midterm Elections HMH In The News

Democrats keep House majority but Republicans defied the odds ABC News

What Would Happen If House Republicans Actually Repealed the Affordable

Opinion Forum 187 What If the Republicans Win Control of Congress

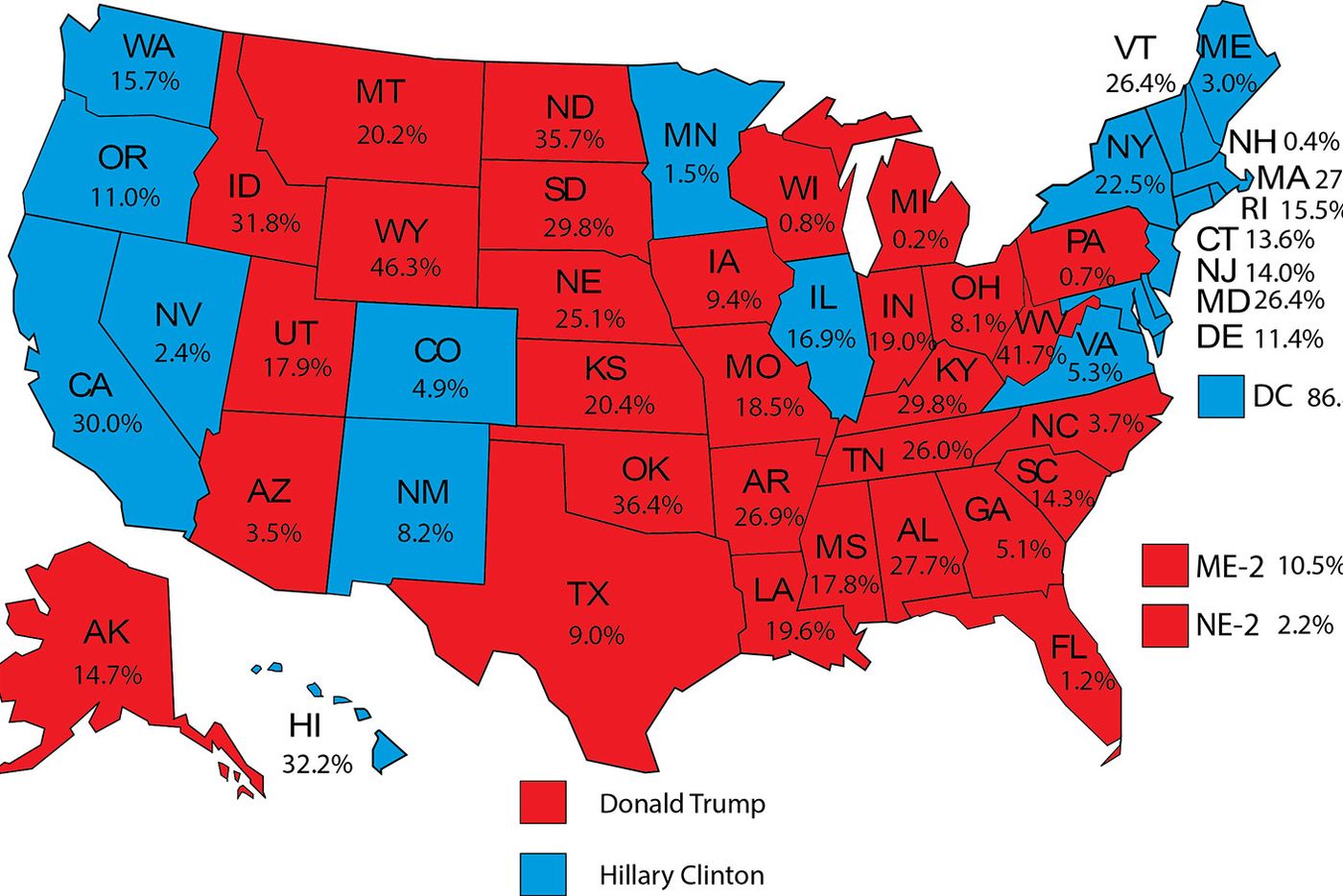

This is How USA Voted in the 2020 Presidential Election Showing the

Ken Padgett Democrats vs Republicans by the Numbers

Can Republicans Gain from Job Growth The New Yorker

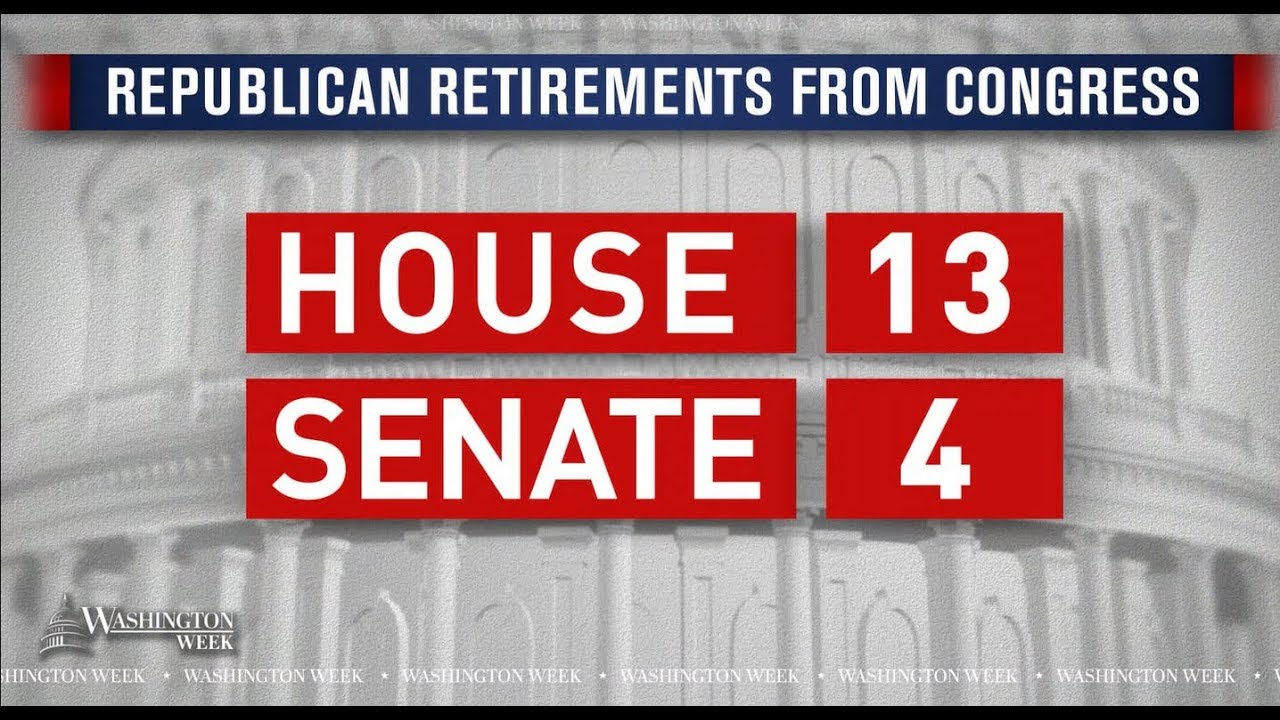

WashWeekPBS Why are so many House Republicans retiring from Congress

Bitesize Guide The People amp The Political Parties in the 2020 US

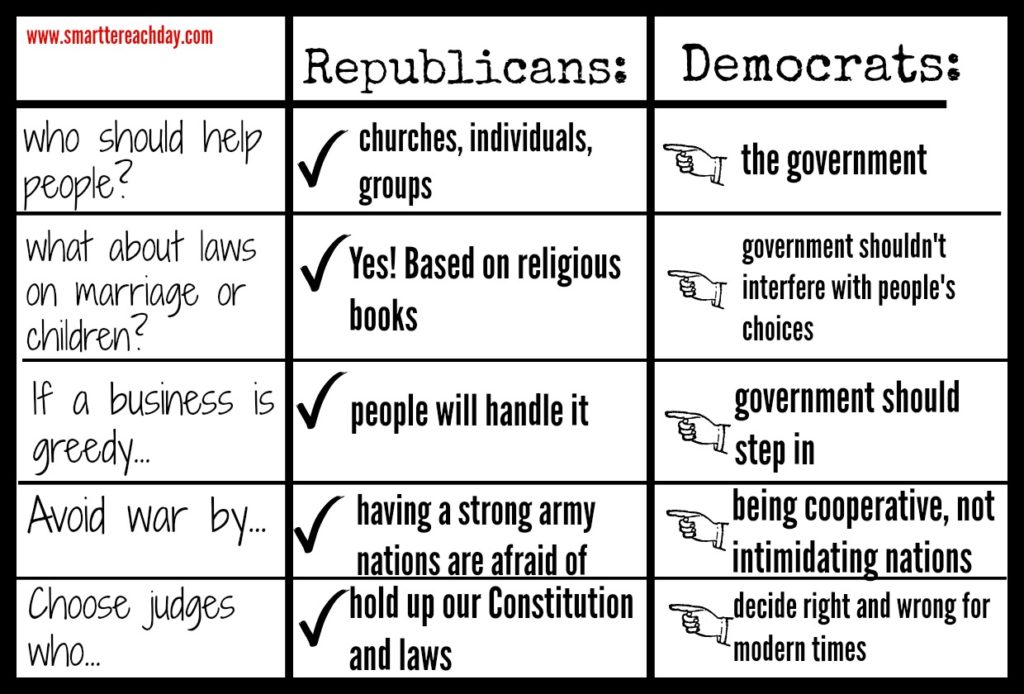

Republicans amp Democrats Comparing amp Contrasting US Political Parties

Registering By Party Where the Democrats and Republicans Are Ahead

ARRA News Service How Trump amp GOP Could Win Back the House amp Keep the

What Happens If Republicans Keep Control Of The House And Senate

Democrats vs Republicans Useful Differences between Republicans vs

Republicans Gain Control of Congress and More

Does the average age of Republicans and Democrats differ Quora

Does the average age of Republicans and Democrats differ Quora

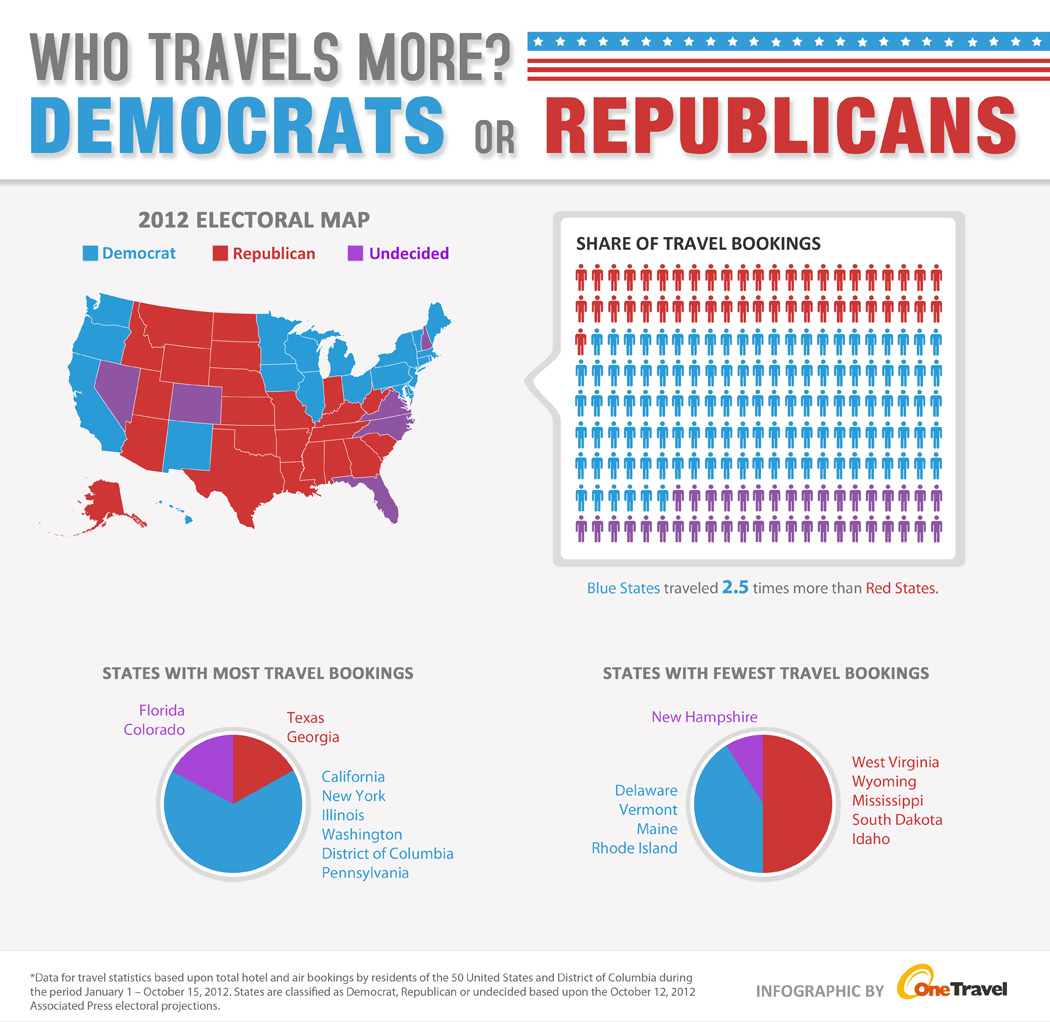

Do Democrats or Republicans Travel More Going Places

Republicans and Democrats fight for Senate majority in midterm election

If Republicans Win The Senate Business Insider

Republicans Are On Track To Take Back The House In 2022 Republican

Democratic party takes control of the House of Representatives

Republicans keep control of Senate CBS News

What a GOP Senate would mean for the Jewish communal agenda Jewish

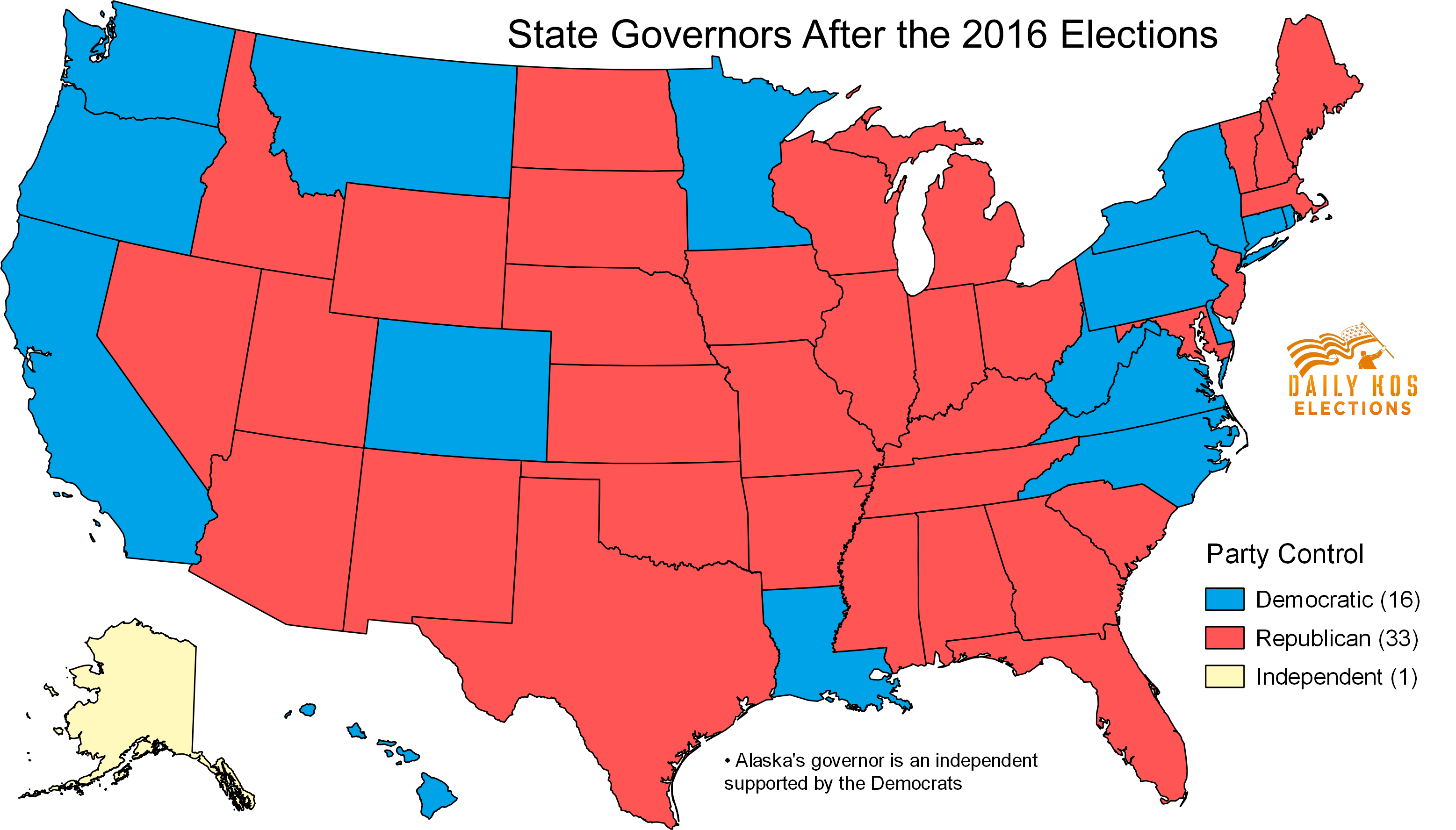

Republicans now dominate state government with 32 legislatures and 33

What Is A Republican amp What Is A Democrat For Kids quot Smartter quot Each Day

House Republicans Win An Average Gain Of 0 4 Percent Versus A Loss Of 1 76 Percent For Democrats - The pictures related to be able to House Republicans Win An Average Gain Of 0 4 Percent Versus A Loss Of 1 76 Percent For Democrats in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cdn.vox-cdn.com/uploads/chorus_image/image/62215339/GOP_KEEP_SENATE.0.jpg)