how did elon musk set up tesla Elon musk says tesla s battery day in

10 Fascinating Facts About Tesla And Elon Musk

Here s what seven experts had to say about the future of Tesla and Elon

How Elon Musk put the sex into Tesla and conquered America

Elon Musk Tesla Model Y best seller 2023 Drive

Elon Musk Unveils Tesla s Latest Vehicle Cybertruck

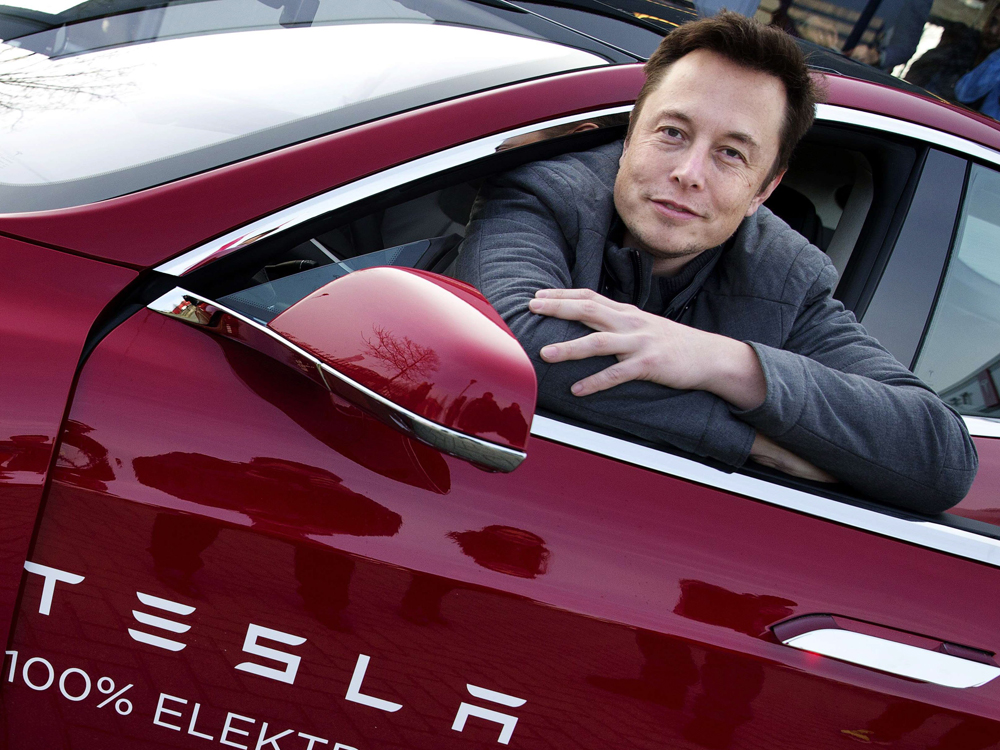

Tesla Model Y elektri ni kri anec Elona Muska City Magazine

Elon Musk promises Tesla India launch yet again The AUTO Kraft

elon musk tesla Jim Heath TV

Elon Musk Thinks He Can Grow Tesla s Value by 400 in Just 4 Years

Reality of Elon Musk s relationship with Tesla will decide quot entire

Elon Musk s Tesla Inc was founded by others and he was credited as co

18 Elon Musk Tesla Roadster 2 PNG DOSODO

Elon Musk comprar 225 17 3 millones en acciones de Tesla

Elon Musk admits Tesla has quality problems CNN

Elon Musk thinks this Toyota tech would make Tesla s yoke steering

Elon Musk reveals why Tesla is going through a production hell with

Tesla Elon Musk Tesla And Spacex Can Elon Musk Run Both Barron S

Why People Will Still Buy Teslas No Matter What They Think of Elon Musk

The 2021 Ford Mustang Mach E Is a Carbon Copy of the Tesla Model Y But

Elon Musk Patent Post Business Insider

Why did Elon Musk just release all of Tesla s patents

Elon Musk Releases Long Awaited Tesla Model Y But Is it Coming Too Late

Tesla CEO Elon Musk Said 7 Years Ago The TSLA Stock Price Seemed A Bit

Elon Musk thinks Tesla is under attack by the fossil fuel industry

Elon Musk Delivers Last Teslas of an Era YouTube

Elon Musk Is Taking Tesla Beyond Rivals Long Term Big Picture Thinking

Elon Musk Announces the Tesla Model 3 the Company s New 35 000 Car

First look at Elon Musk s personal Tesla Model S with prototype color

To check out how Elon Musk impacted and resurrected the history of

Elon Musk explains why auto industry hasn t caught up with Tesla says

How Elon Musk Created Tesla Full Documentary YouTube

Elon Musk Says Tesla Cars Will Soon Be Able to Steer and Parallel Park

The Wall Street Journal Interviews Elon Musk About Tesla amp Timelines

Tesla overtakes Volkswagen for No 2 spot among world s most valuable

Why Elon Musk Doesn t Need to Be Tesla s CEO

Elon Musk admits relying too much on robots a mistake of Tesla

169 entrepreneur com Elon musk Tesla Car buying

Seven Experts Debate The Future Of Tesla And Elon Musk YouTube

Tesla Innovation 12 Lessons You Can Learn From Elon Musk

Musk Tesla could be trillion dollar company and other predictions

Top 30 Successes amp Failures Of Elon Musk

Elon Musk s affordable Tesla Model 3 specifications leaked online

Nice Try But Elon Musk Isn t Going to Get You Out of that DUI in Your

Tesla Elon Musk Is Unexpected Ally to Donald Trump on Key Issue

Tesla s Elon Musk introduces Model Y crossover SUV

Elon Musk hints at tomorrow s Tesla D reveal update new Model S with

Elon Musk s affordable Tesla Model 3 specifications leaked online

Nice Try But Elon Musk Isn t Going to Get You Out of that DUI in Your

Tesla Elon Musk Is Unexpected Ally to Donald Trump on Key Issue

Tesla s Elon Musk introduces Model Y crossover SUV

Elon Musk hints at tomorrow s Tesla D reveal update new Model S with

Tesla s Elon Musk Goes Broke TheDetroitBureau com

Tesla Model 3 Build Video Shows Why Elon Musk Thinks Humans Are Underrated

Elon Musk Tesla is 2 years away from a fully self driving car

Stephen Colbert thinks Tesla CEO Elon Musk should run for president

Elon Musk and the Tesla 3 Green Energy Futures

Should Elon Musk merge Tesla and SpaceX

Elon Musk says Tesla will make fully autonomous models by 2018

Elon Musk And Tesla Possibly Under SEC Investigation After Bitcoin

It s time for Elon Musk to stop making Tesla promises he can t keep

So you want to invest in Tesla Don t

Tesla Owners Help Elon Musk Deliver Model 3 Cars YouTube

Why Elon Musk Still Does Not Produce Tesla Roadster YouTube

Teslas can now be bought for bitcoin Elon Musk says Reuters

Elon Musk in Search of Profit Cuts Tesla s Work Force The New York

quot I m An Idiot quot Says Elon Musk Taking Responsibility For Tesla s Model

Tesla CEO Elon Musk Just Got a Position in Donald Trump s

Elon Musk Announces quot Unexpected Tesla Product Unveiling quot for October 17

Tesla sues oil exec for allegedly impersonating Elon Musk to get trade

Elon Musk says Tesla can build 1M robotaxis in the next year

Flipboard Why Tesla is Not a Car Company and What You Can Learn From

Elon Musk admits Tesla has quality problems CNN

Tesla Model 3 Could Put Elon Musk Out of Business Hedge Fund Warns

Elon Musk personally cancels blogger s Tesla order after rude post

Elon Musk Thinks The Tesla Model Y Is Being Penalized In The Us For Being Too Efficient - The pictures related to be able to Elon Musk Thinks The Tesla Model Y Is Being Penalized In The Us For Being Too Efficient in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DNV7PO45BJPUJPPAQZUN5WNCA4.jpg)