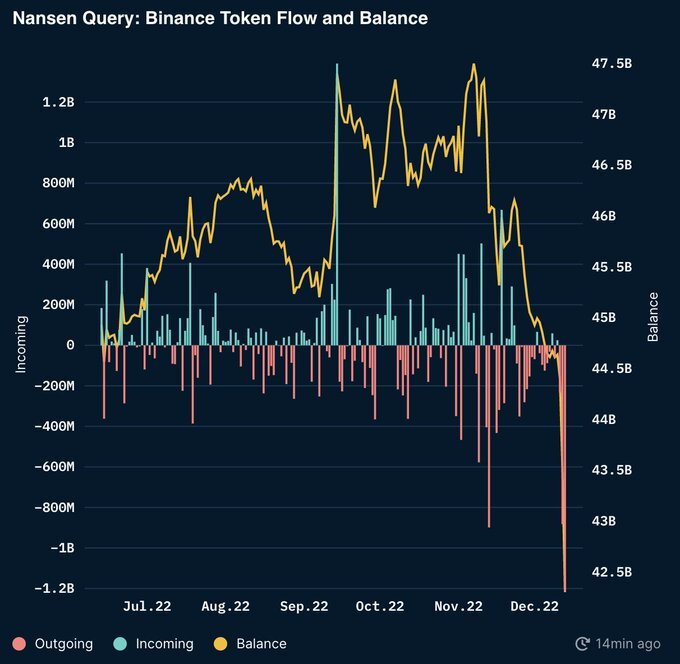

Binance Experiences Its Largest Ever Outflow of Stablecoins as the

Binance Records Largest Ever Bitcoin Outflow Over 162 000 BTC Worth 4

Binance to stop supporting USDC the second largest stablecoin

Binance Observes Largest Stablecoin Net Outflow In History Financial

Cyrpto exchange Binance to discontinue its stablecoin BGPB

Binance to convert users USDC into its own stablecoin The Straits Times

Binance Implements Mandatory Identity Verification For All Users

Binance Receives NYDFS Approval to Launch BUSD Stablecoin

Binance Observes Largest Stablecoin Net Outflow In History Financial

Binance will stop supporting USDC the second largest stablecoin WAYA

Binance Alami Arus Keluar Stablecoin Tertinggi Sepanjang Sejarah

Binance the fastest growing cryptocurrency exchange Cryptocurrency

Binance Experiences Market Share Decline Post Regulatory Clampdown

Binance Reveals All New Stablecoin Initiative The Chain Bulletin

Binance USD BUSD Fully Backed and Regulated Stablecoin

Coinbase vs Binance Which Cryptocurrency Exchange Is Best PixelMining

The Inaugural Binance Stablecoin Completes Quantstamp Audit

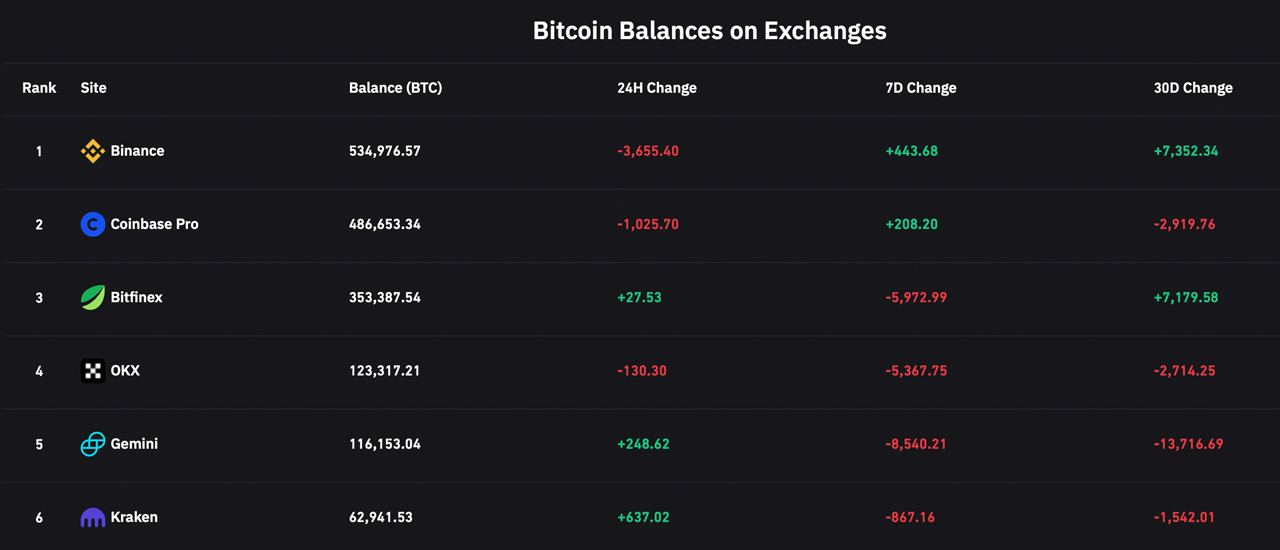

Assessing Binance Reserves And Liabilities Bitcoin Magazine Bitcoin

Binance Review The Largest Cryptocurrency Exchange

Binance Experiences Its Largest Ever Outflow of Stablecoins as the

Binance Observes Largest Stablecoin Net Outflow In History Financial

Cyrpto exchange Binance to discontinue its stablecoin BGPB

Binance suspends SEPA euro deposits as CZ calls compliance a journey

USD COIN EVERYTHING YOU SHOULD KNOW ABOUT THE SECOND LARGEST

Binance Implements Mandatory Identity Verification For All Users

Binance Receives NYDFS Approval to Launch BUSD Stablecoin

Binance Observes Largest Stablecoin Net Outflow In History Financial

Stablecoin da Binance tem seus primeiros pares de negocia 231 227 o listados

Terra s UST flips BUSD to become third largest stablecoin

Binance will stop supporting USDC the second largest stablecoin WAYA

Binance Alami Arus Keluar Stablecoin Tertinggi Sepanjang Sejarah

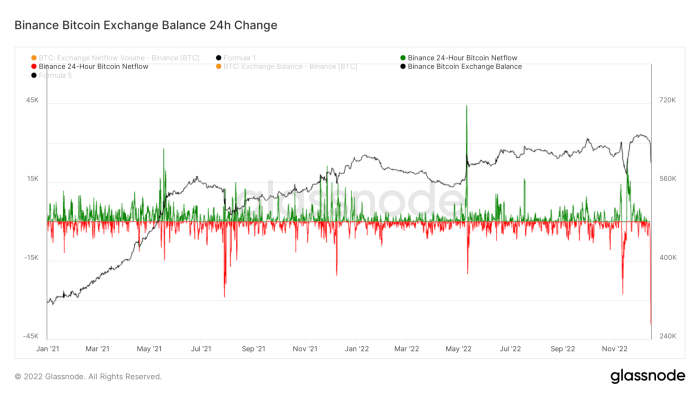

Binance Experiences Significant BTC ETH and Stablecoin Withdrawals

Binance Experiences Market Share Decline Post Regulatory Clampdown

Binance to stop supporting USDC the second largest stablecoin

Binance Reveals All New Stablecoin Initiative The Chain Bulletin

Binance USD BUSD Fully Backed and Regulated Stablecoin

Binance Launches Its Own Stablecoin News ihodl com

Binance CEO CZ Unveils New Stablecoin Development

The Inaugural Binance Stablecoin Completes Quantstamp Audit

Assessing Binance Reserves And Liabilities Bitcoin Magazine Bitcoin

Binance BUSD Suffers 500M Outflow Crypto Daily TV 29 3 2023

Binance Review The Largest Cryptocurrency Exchange

Regulator orders crypto firm Paxos to stop issuing Binance stablecoin

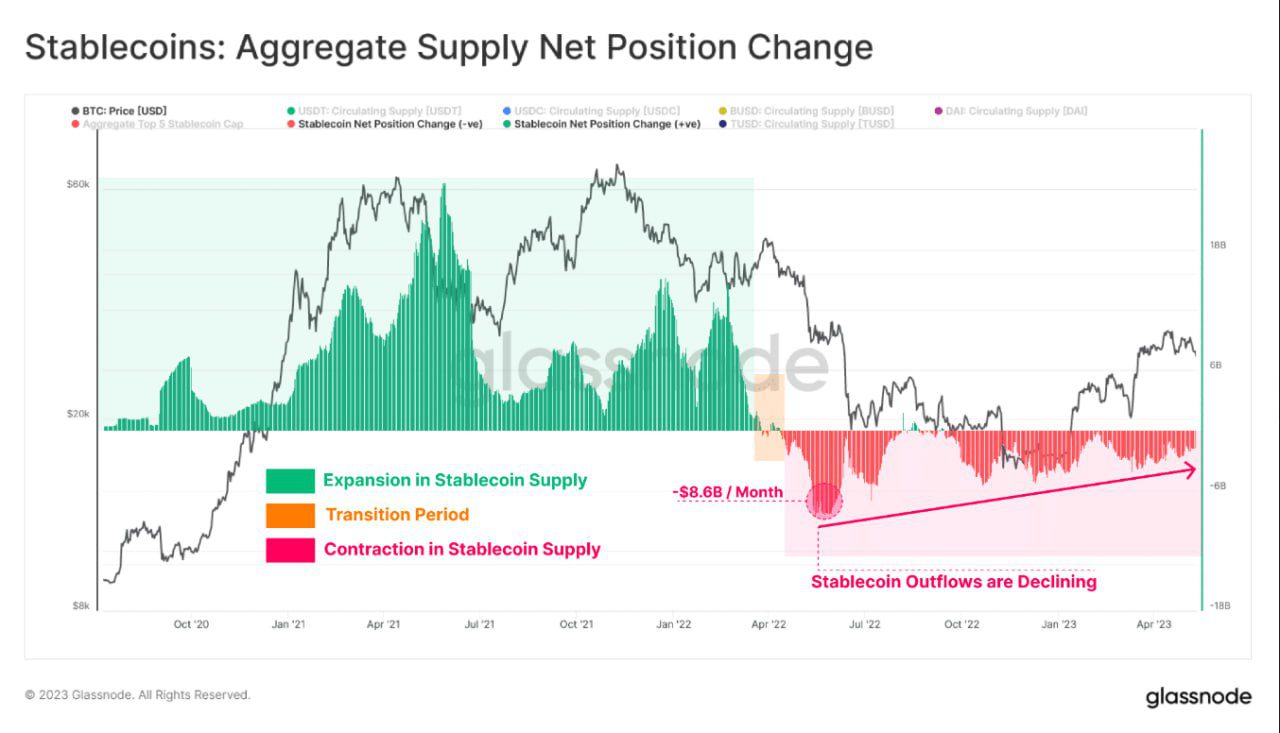

CryptoQuant Big stablecoin outflow happen ahead of big

Binance Binance Watchdog Clamps Down On Cryptocurrency Exchange Bbc

Krypto B 246 rse Binance erlebt gr 246 223 ten Abfluss von Stablecoins

Binance Review The Largest Cryptocurrency Exchange

Binance BUSD Suffers 500M Outflow Crypto Daily TV 29 3 2023

Dijegal Regulator AS Binance Alami Outflow Stablecoin Terbesar dalam

Binance Review The Largest Cryptocurrency Exchange

Regulator orders crypto firm Paxos to stop issuing Binance stablecoin

CryptoQuant Big stablecoin outflow happen ahead of big

Binance Binance Watchdog Clamps Down On Cryptocurrency Exchange Bbc

Krypto B 246 rse Binance erlebt gr 246 223 ten Abfluss von Stablecoins

Binance Review The Largest Cryptocurrency Exchange

Binance s Stablecoin is now Approved by the NYDFS Blockonews

Stablecoin da Binance tem seus primeiros pares de negocia 231 227 o listados

Binance CEO Changpeng Zhao Addresses Concerns over Billions in Exchange

USDC Stablecoin Creator Circle Raises 440M in Largest Crypto

Binance CEO Boosting the Super Exchange Ecosystem With the Possibility

Stablecoin Regulation We Are Innovation

USDC to surpass USDT as largest stablecoin This report could be key

How to Buy VeChain on Binance

Stablecoin Popularity Investment or Fractional Reserve Banking More

Binance Outflows Tops 3 Billion CZ Says the Exchange Will Survive Any

Binance Coin Overtakes Tether For Third Ranked Crypto Asset MarsMasters

Binance to stop supporting USDC the second largest stablecoin

STABLECOIN DA BINANCE YouTube

The Largest Exchange Outflow 55k Bitcoin Or Over 1 1 Billion Leave

glassnode on Twitter quot For stablecoins there has been around 3 2B in

glassnode on Twitter quot Aggregate stablecoin supplies have declined by a

Binance received approval for stablecoin BUSD CRYPTO MINING BLOG

L ng Stablecoin Outflow h 236 nh th 224 nh xu h ng gi m d n

Binance Experiences Largest Stablecoin Outflow Ever As Crisis Of Confidence Around The Exchange Deepens - The pictures related to be able to Binance Experiences Largest Stablecoin Outflow Ever As Crisis Of Confidence Around The Exchange Deepens in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.